J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

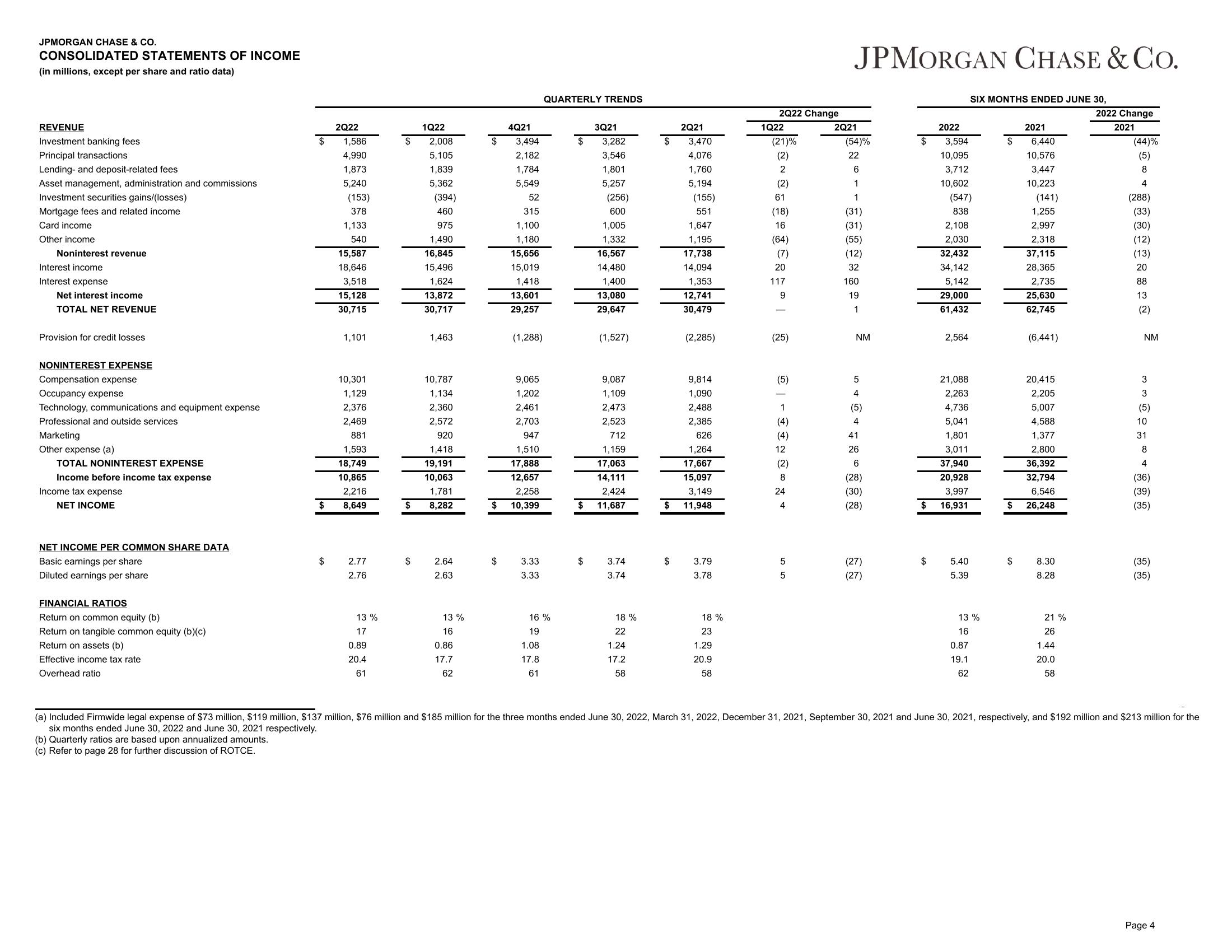

CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share and ratio data)

REVENUE

Investment banking fees

Principal transactions

Lending- and deposit-related fees

Asset management, administration and commissions

Investment securities gains/(losses)

Mortgage fees and related income

Card income

Other income

Noninterest revenue

Interest income

Interest expense

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Occupancy expense

Technology, communications and equipment expense

Professional and outside services

Marketing

Other expense (a)

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

NET INCOME PER COMMON SHARE DATA

Basic earnings per share

Diluted earnings per share

FINANCIAL RATIOS

Return on common equity (b)

Return on tangible common equity (b)(c)

Return on assets (b)

Effective income tax rate

Overhead ratio

$

$

2Q22

1,586

4,990

1,873

5,240

(153)

378

1,133

540

15,587

18,646

3,518

15,128

30,715

1,101

10,301

1,129

2,376

2,469

881

1,593

18,749

10,865

2,216

8,649

2.77

2.76

13 %

17

0.89

20.4

61

$

1Q22

$

2,008

5,105

1,839

5,362

(394)

460

975

1,490

16,845

15,496

1,624

13,872

30,717

1,463

10,787

1,134

2,360

2,572

920

1,418

19,191

10,063

1,781

$ 8,282

2.64

2.63

13 %

16

0.86

17.7

62

$

4Q21

3,494

2,182

1,784

5,549

$

52

315

1,100

1,180

15,656

15,019

1,418

13,601

29,257

(1,288)

9,065

1,202

2,461

2,703

947

1,510

17,888

12,657

2,258

$ 10,399

3.33

3.33

QUARTERLY TRENDS

16 %

19

1.08

17.8

61

$

$

$

3Q21

3,282

3,546

1,801

5,257

(256)

600

1,005

1,332

16,567

14,480

1,400

13,080

29,647

(1,527)

9,087

1,109

2,473

2,523

712

1,159

17,063

14,111

2,424

11,687

3.74

3.74

18%

22

1.24

17.2

58

$

$

$

2Q21

3,470

4,076

1,760

5,194

(155)

551

1,647

1,195

17,738

14,094

1,353

12,741

30,479

(2,285)

9,814

1,090

2,488

2,385

626

1,264

17,667

15,097

3,149

11,948

3.79

3.78

18%

23

1.29

20.9

58

2Q22 Change

1Q22

(21)%

(2)

2

(2)

61

(18)

16

(64)

(7)

20

117

9

(25)

(5)

A ∞ -

(4)

(4)

12

(2)

24

5

5

JPMORGAN CHASE & CO.

2Q21

(54)%

22

6

1

1

(31)

(31)

(55)

(12)

32

160

19

1

NM

5

4

(5)

4

41

26

6

(28)

(30)

(28)

(27)

(27)

$

$

2022

3,594

10,095

3,712

10,602

(547)

838

2,108

2,030

32,432

34,142

5,142

29,000

61,432

2,564

21,088

2,263

4,736

5,041

1,801

3,011

37,940

20,928

3,997

$ 16,931

SIX MONTHS ENDED JUNE 30,

5.40

5.39

13%

16

0.87

19.1

62

$

$

$

2021

6,440

10,576

3,447

10,223

(141)

1,255

2,997

2,318

37,115

28,365

2,735

25,630

62,745

(6,441)

20,415

2,205

5,007

4,588

1,377

2,800

36,392

32,794

6,546

26,248

8.30

8.28

21%

26

1.44

20.0

58

2022 Change

2021

(44)%

(5)

8

4

(288)

(33)

(30)

(12)

(13)

20

88

13

(2)

NM

3

3

(5)

10

31

8

4

(36)

(39)

(35)

(35)

(35)

(a) Included Firmwide legal expense of $73 million, $119 million, $137 million, $76 million and $185 million for the three months ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, respectively, and $192 million and $213 million for the

six months ended June 30, 2022 and June 30, 2021 respectively.

(b) Quarterly ratios are based upon annualized amounts.

(c) Refer to page 28 for further discussion of ROTCE.

Page 4View entire presentation