SoftBank Results Presentation Deck

LATAM

PROGRESS & HIGHLIGHTS

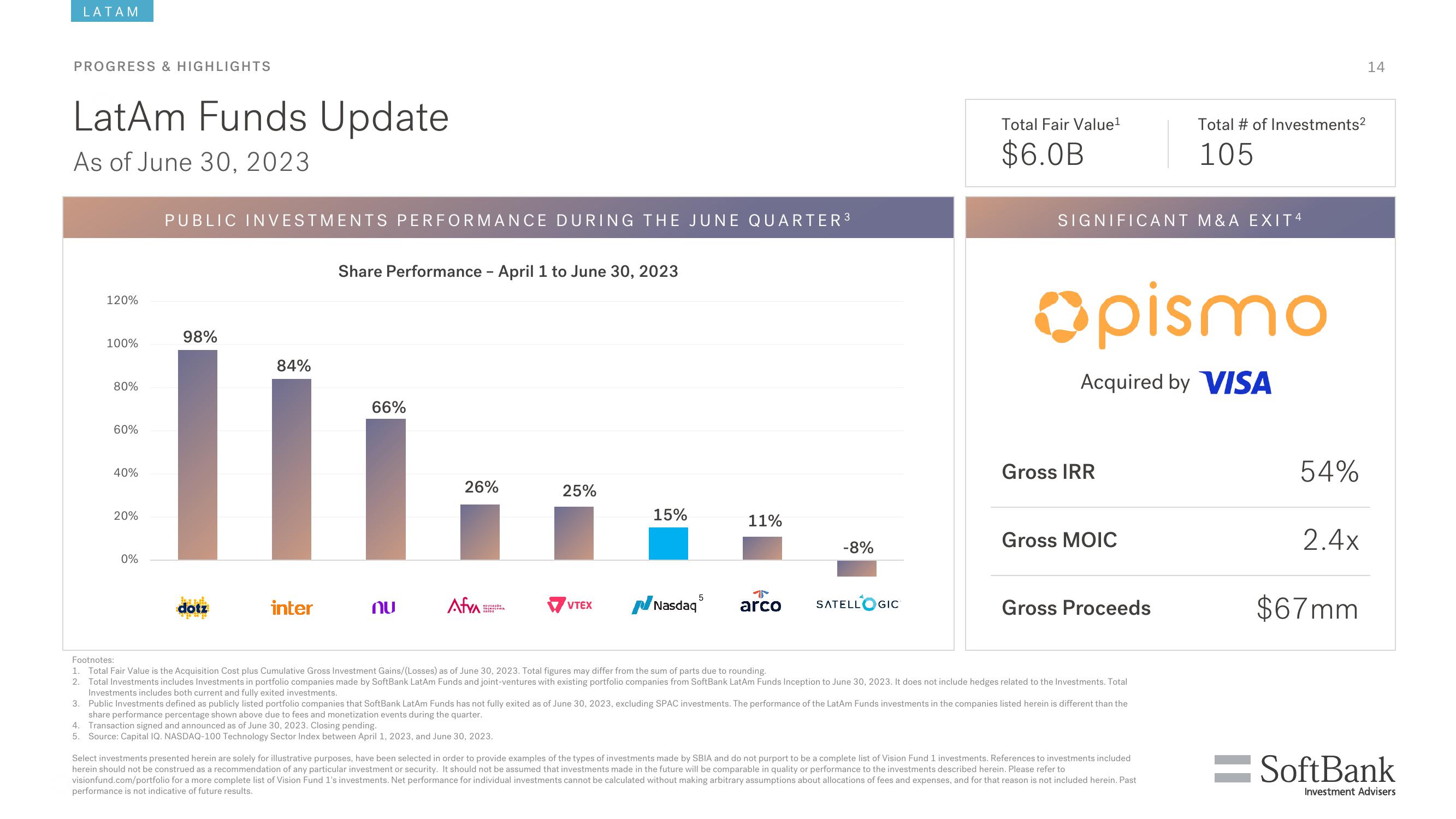

LatAm Funds Update

As of June 30, 2023

120%

100%

80%

60%

40%

20%

0%

PUBLIC INVESTMENTS PERFORMANCE DURING THE JUNE QUARTER 3

98%

84%

66%

III.

dotz

ega tege

Share Performance - April 1 to June 30, 2023

inter

nu

26%

Afva

EDUCAÇÃ

25%

4. Transaction signed and announced as of June 30, 2023. Closing pending.

5. Source: Capital IQ. NASDAQ-100 Technology Sector Index between April 1, 2023, and June 30, 2023.

VTEX

15%

Nasdaq

5

11%

T

arco

-8%

SATELL

GIC

Total Fair Value¹

$6.0B

SIGNIFICANT M&A EXIT4

Opismo

Acquired by VISA

Gross IRR

Gross MOIC

Gross Proceeds

Footnotes:

1. Total Fair Value is the Acquisition Cost plus Cumulative Gross Investment Gains/(Losses) as of June 30, 2023. Total figures may differ from the sum of parts due to rounding.

2. Total Investments includes Investments in portfolio companies made by SoftBank LatAm Funds and joint-ventures with existing portfolio companies from SoftBank LatAm Funds Inception to June 30, 2023. It does not include hedges related to the Investments. Total

Investments includes both current and fully exited investments.

3. Public Investments defined as publicly listed portfolio companies that SoftBank LatAm Funds has not fully exited as of June 30, 2023, excluding SPAC investments. The performance of the LatAm Funds investments in the companies listed herein is different than the

share performance percentage shown above due to fees and monetization events during the quarter.

Total # of Investments²

105

Select investments presented herein are solely for illustrative purposes, have been selected in order to provide examples of the types of investments made by SBIA and do not purport to be a complete list of Vision Fund 1 investments. References to investments included

herein should not be construed as a recommendation of any particular investment or security. It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. Please refer to

visionfund.com/portfolio for a more complete list of Vision Fund 1's investments. Net performance for individual investments cannot be calculated without making arbitrary assumptions about allocations of fees and expenses, and for that reason is not included herein. Past

performance is not indicative of future results.

54%

2.4x

$67mm

14

=SoftBank

Investment AdvisersView entire presentation