Codere SPAC Presentation Deck

Transaction Overview

Key Transaction Terms

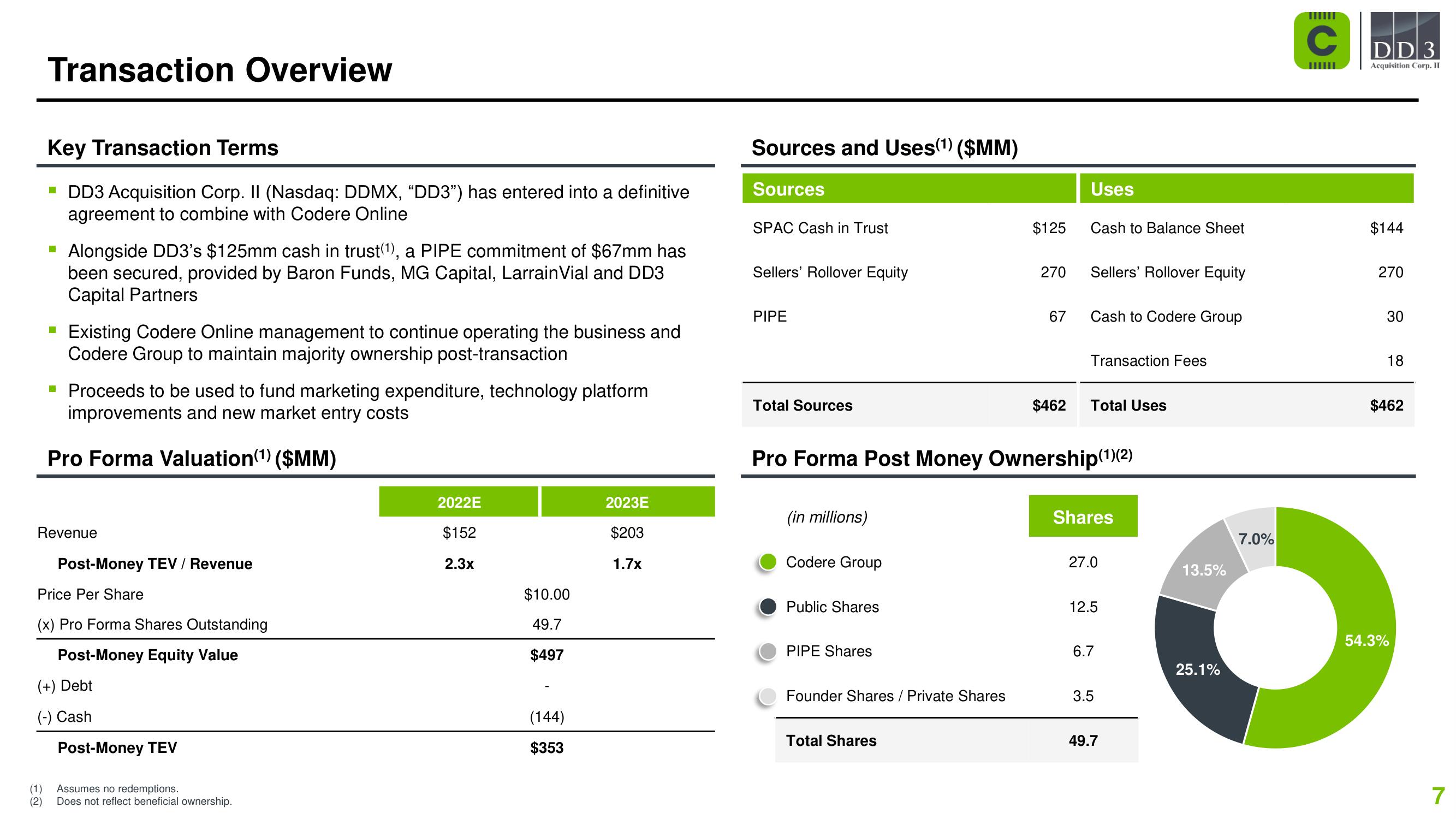

▪ DD3 Acquisition Corp. II (Nasdaq: DDMX, “DD3") has entered into a definitive

agreement to combine with Codere Online

■ Alongside DD3's $125mm cash in trust(¹), a PIPE commitment of $67mm has

been secured, provided by Baron Funds, MG Capital, LarrainVial and DD3

Capital Partners

Existing Codere Online management to continue operating the business and

Codere Group to maintain majority ownership post-transaction

▪ Proceeds to be used to fund marketing expenditure, technology platform

improvements and new market entry costs

Pro Forma Valuation (¹) ($MM)

Revenue

Post-Money TEV / Revenue

Price Per Share

(x) Pro Forma Shares Outstanding

Post-Money Equity Value

(+) Debt

(-) Cash

Post-Money TEV

(1) Assumes no redemptions.

(2) Does not reflect beneficial ownership.

2022E

$152

2.3x

$10.00

49.7

$497

(144)

$353

2023E

$203

1.7x

Sources and Uses(¹) ($MM)

Sources

SPAC Cash in Trust

Sellers' Rollover Equity

PIPE

Total Sources

(in millions)

Codere Group

Public Shares

PIPE Shares

Founder Shares / Private Shares

$125

Total Shares

270

67

$462

Uses

Pro Forma Post Money Ownership(¹)(2)

Cash to Balance Sheet

Sellers' Rollover Equity

Cash to Codere Group

Transaction Fees

Total Uses

Shares

27.0

12.5

6.7

3.5

49.7

13.5%

25.1%

7.0%

с

DD 3

Acquisition Corp. II

$144

270

30

18

$462

54.3%

7View entire presentation