HBT Financial Results Presentation Deck

Securities Portfolio Overview

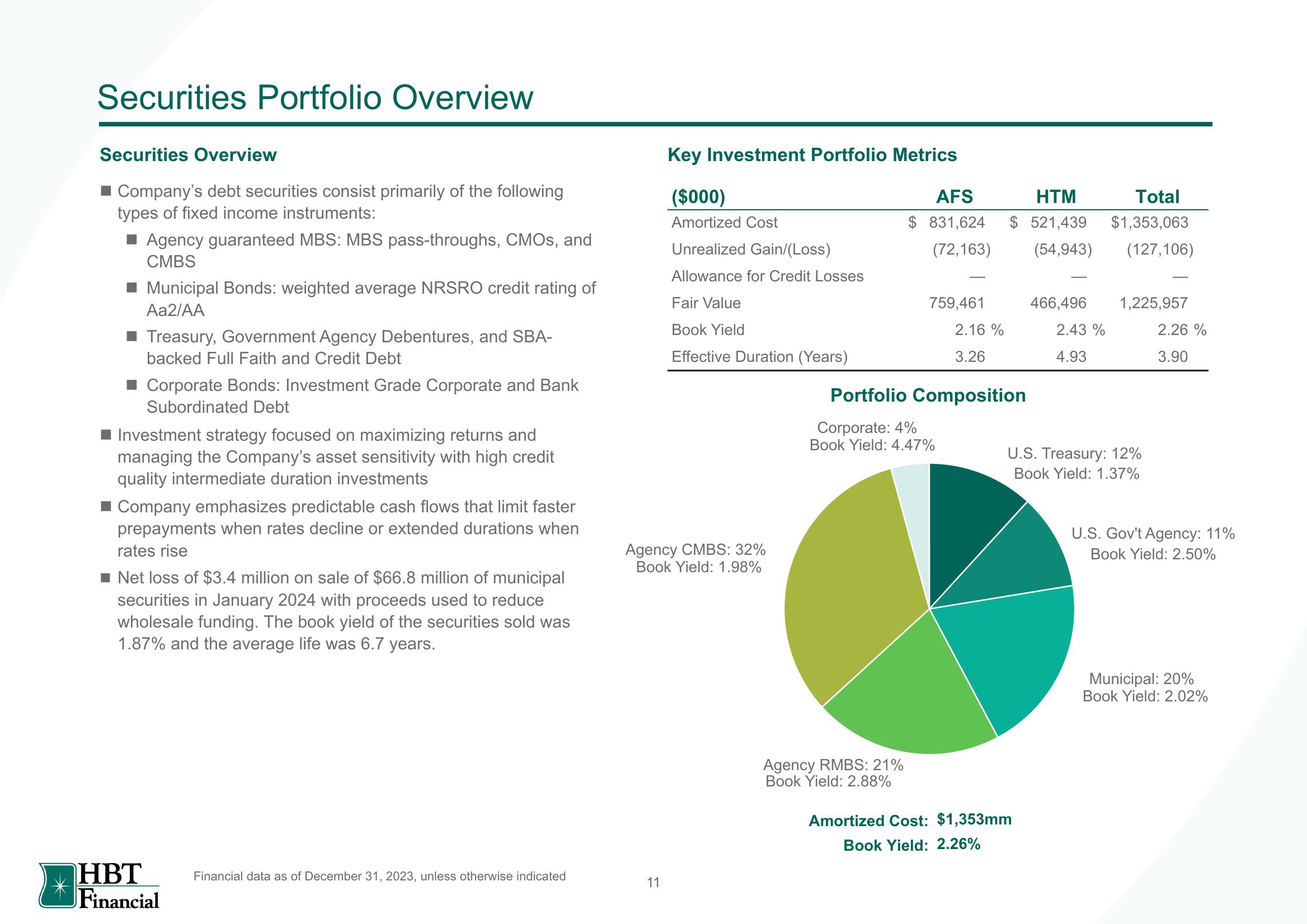

Securities Overview

■ Company's debt securities consist primarily of the following

types of fixed income instruments:

Agency guaranteed MBS: MBS pass-throughs, CMOS, and

CMBS

Municipal Bonds: weighted average NRSRO credit rating of

Aa2/AA

Treasury, Government Agency Debentures, and SBA-

backed Full Faith and Credit Debt

■ Corporate Bonds: Investment Grade Corporate and Bank

Subordinated Debt

Investment strategy focused on maximizing returns and

managing the Company's asset sensitivity with high credit

quality intermediate duration investments

■ Company emphasizes predictable cash flows that limit faster

prepayments when rates decline or extended durations when

rates rise

Net loss of $3.4 million on sale of $66.8 million of municipal

securities in January 2024 with proceeds used to reduce

wholesale funding. The book yield of the securities sold was

1.87% and the average life was 6.7 years.

HBT

Financial

Financial data as of December 31, 2023, unless otherwise indicated

Key Investment Portfolio Metrics

($000)

Amortized Cost

11

Unrealized Gain/(Loss)

Allowance for Credit Losses

Fair Value

Book Yield

Effective Duration (Years)

Agency CMBS: 32%

Book Yield: 1.98%

AFS

HTM

$ 831,624 $ 521,439

(72,163) (54,943)

Agency RMBS: 21%

Book Yield: 2.88%

759,461

2.16%

3.26

Portfolio Composition

Corporate: 4%

Book Yield: 4.47%

466,496

Amortized Cost: $1,353mm

Book Yield: 2.26%

2.43 %

4.93

Total

$1,353,063

(127,106)

1,225,957

U.S. Treasury: 12%

Book Yield: 1.37%

2.26%

3.90

U.S. Gov't Agency: 11%

Book Yield: 2.50%

Municipal: 20%

Book Yield: 2.02%View entire presentation