Melrose Results Presentation Deck

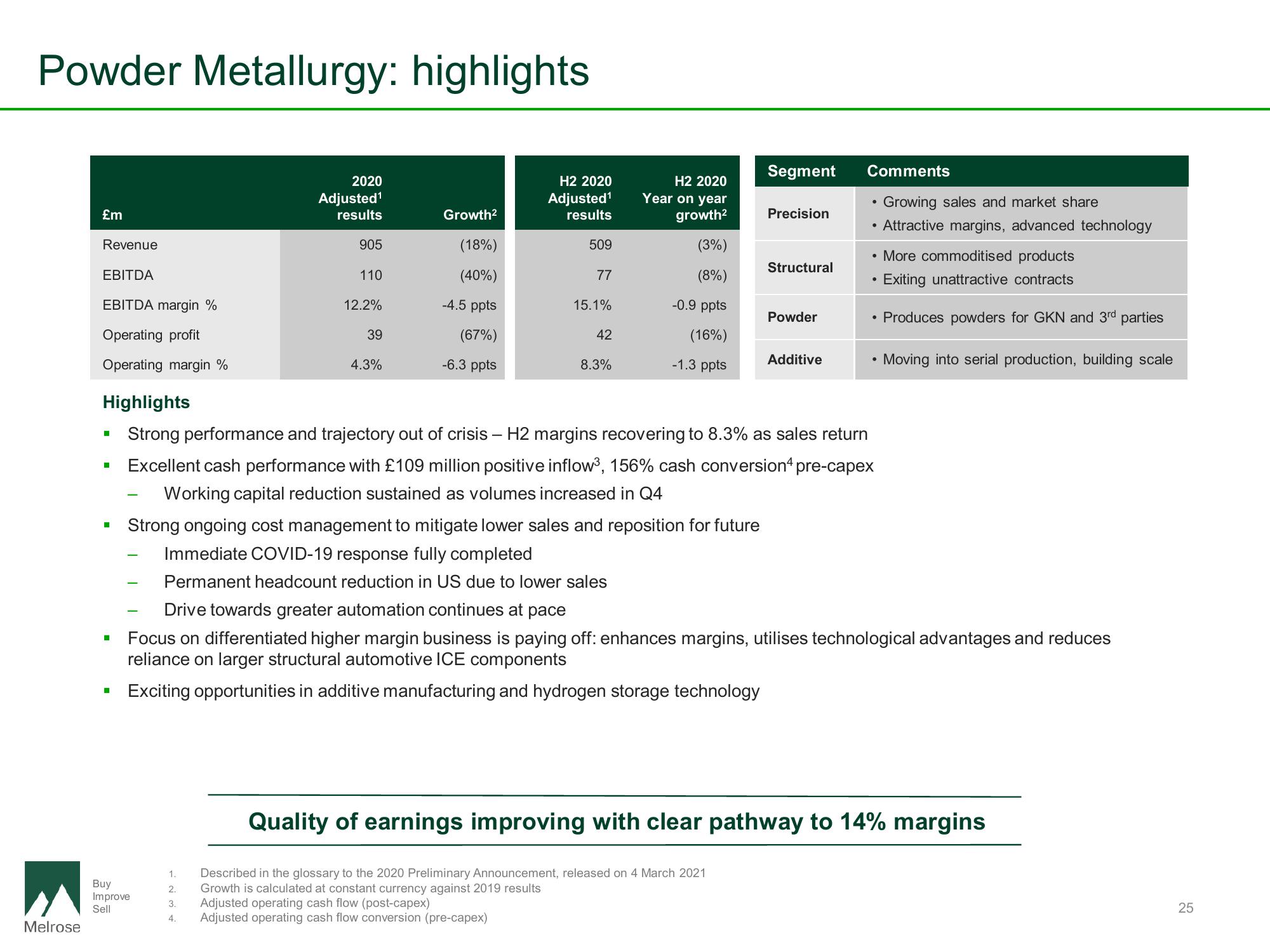

Powder Metallurgy: highlights

Melrose

£m

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

I

I

■

■

2020

Adjusted¹

results

905

110

12.2%

39

Buy

Improve

Sell

4.3%

1.

2.

3.

4.

Growth²

(18%)

(40%)

-4.5 ppts

(67%)

-6.3 ppts

H2 2020

Adjusted¹

results

509

77

15.1%

42

8.3%

H2 2020

Year on year

growth²

(3%)

(8%)

-0.9 ppts

(16%)

-1.3 ppts

Strong ongoing cost management to mitigate lower sales and reposition for future

Immediate COVID-19 response fully completed

Permanent headcount reduction in US due to lower sales

Segment

Highlights

Strong performance and trajectory out of crisis - H2 margins recovering to 8.3% as sales return

Excellent cash performance with £109 million positive inflow³, 156% cash conversion4 pre-capex

Working capital reduction sustained as volumes increased in Q4

Precision

Structural

Described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

Growth is calculated at constant currency against 2019 results

Adjusted operating cash flow (post-capex)

Adjusted operating cash flow conversion (pre-capex)

Powder

Additive

Comments

Growing sales and market share

• Attractive margins, advanced technology

• More commoditised products

• Exiting unattractive contracts

• Produces powders for GKN and 3rd parties

Drive towards greater automation continues at pace

Focus on differentiated higher margin business is paying off: enhances margins, utilises technological advantages and reduces

reliance on larger structural automotive ICE components

Exciting opportunities in additive manufacturing and hydrogen storage technology

• Moving into serial production, building scale

Quality of earnings improving with clear pathway to 14% margins

25View entire presentation