Pershing Square Activist Presentation Deck

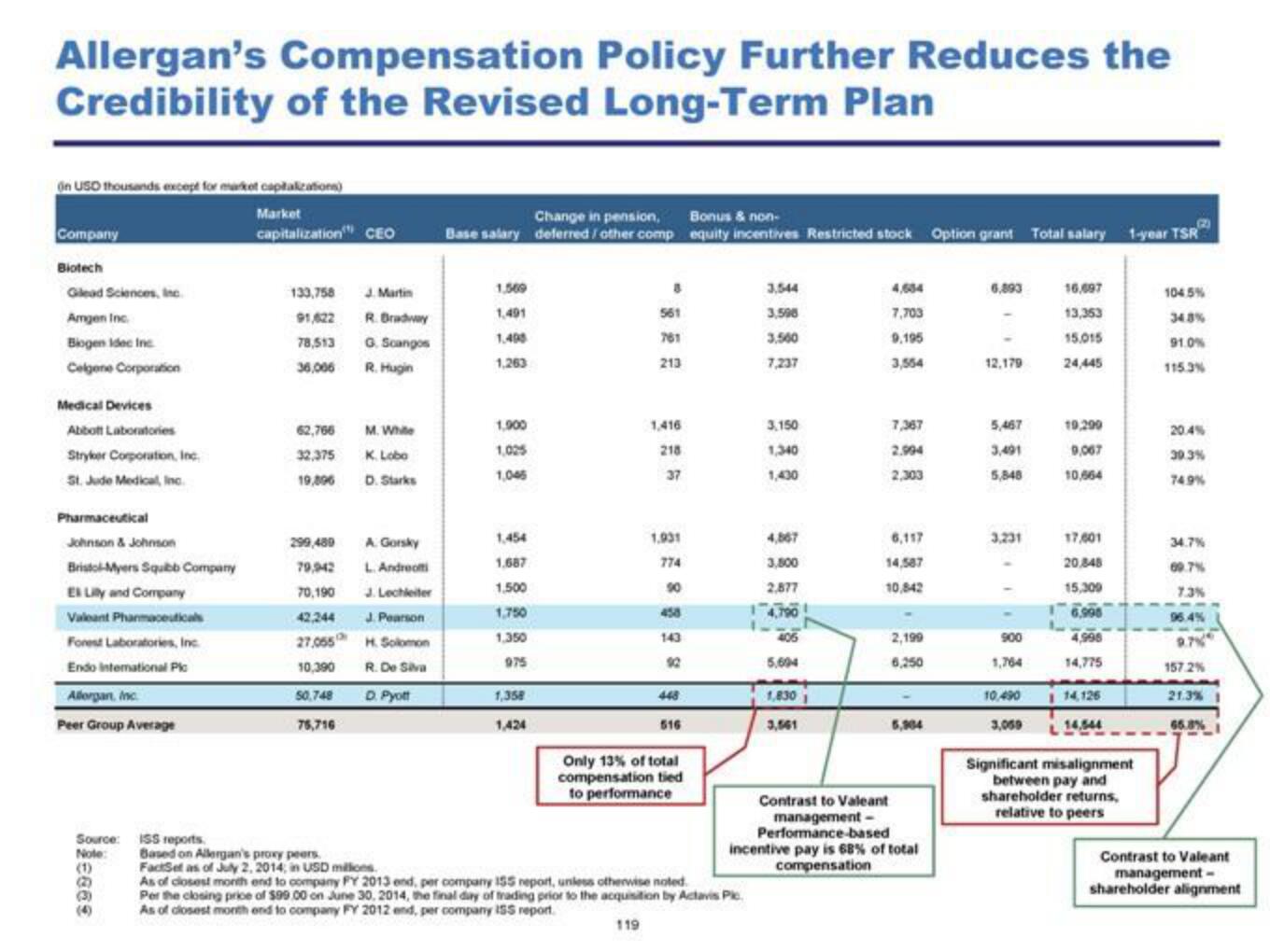

Allergan's Compensation Policy Further Reduces the

Credibility of the Revised Long-Term Plan

on USD thousands except for market capitalizations)

Market

capitalization CEO

Company

Biotech

Gilead Sciences, Inc.

Amgen Inc.

Biogen Idec Inc

Celgene Corporation

Medical Devices

Abbott Laboratories

Stryker Corporation, Inc.

St. Jude Medical, Inc.

Pharmaceutical

Johnson & Johnson

Bristol-Myers Squibb Company

El Lily and Company

valeant Pharmaceuticals

Forest Laboratories, Inc.

Endo international Pic

Allorgan, Inc.

Peer Group Average

Source: ISS reports.

leses

Note:

(3)

133,758

91,622

78,513

36,006

62,766

32,375

19,096

299,489

79,942

70,190

42,244

27,055

10,390

50,748

76,716

J. Martin

R.Bradway

G. Scangos

R. Hugin

M. While

K. Lobo

D. Starks

A Gorsky

L. Andreotti

J. Lechleiter

J. Pearson

H. Solomon

R. De Siva

D. Pyott

Based on Allergan's proxy peers.

FactSet as of July 2, 2014 in USD millions.

Change in pension,

Base salary deferred / other comp

1,569

1,491

1,490

1,263

1,900

1,025

1,045

1,454

1.687

1.500

1,750

1.350

975

1,358

1,424

561

761

213

1,416

218

37

1,931

774

90

458

143

92

448

516

Only 13% of total

compensation tied

to performance

Bonus & non-

B

equity incentives Restricted stock Option grant Total salary 1-year TSR

3,544

3,598

3,560

7,237

As of closest month end to company FY 2013 end, per company 155 report, unless otherwise noted.

Per the closing price of $99.00 on June 30, 2014, the final day of trading prior to the acquisition by Actavis Plc.

As of closest month end to company FY 2012 end, per company ISS report.

119

3,150

1,340

1,430

4,867

3,800

2,877

14,790

406

5,604

1,8301

3,561

4,604

7,703

9.195

3,554

7,367

2.994

2,303

6,117

14,587

10,842

2,199

6,250

Contrast to Valeant

management-

Performance-based

incentive pay is 68% of total

compensation

6,893

12,179

5,467

3,491

5,848

3,231

-

900

1,764

10,490

3,059

16,097

13,353

15.015

24,445

19,290

9,067

10,664

17,601

20,848

15,309

6.998

4,998

14,775

114,126

14,544

Significant misalignment

between pay and

shareholder returns,

relative to peers

104.5%

34.8%

91.0%

115.3%

20.4%

39.3%

74.9%

34.7%

69.7%

7.3%

96.4%

9.7%

157.2%

21.3%

66.8%

Contrast to Valeant

management -

shareholder alignmentView entire presentation