Faraday Future SPAC Presentation Deck

Profitability

Key commentary

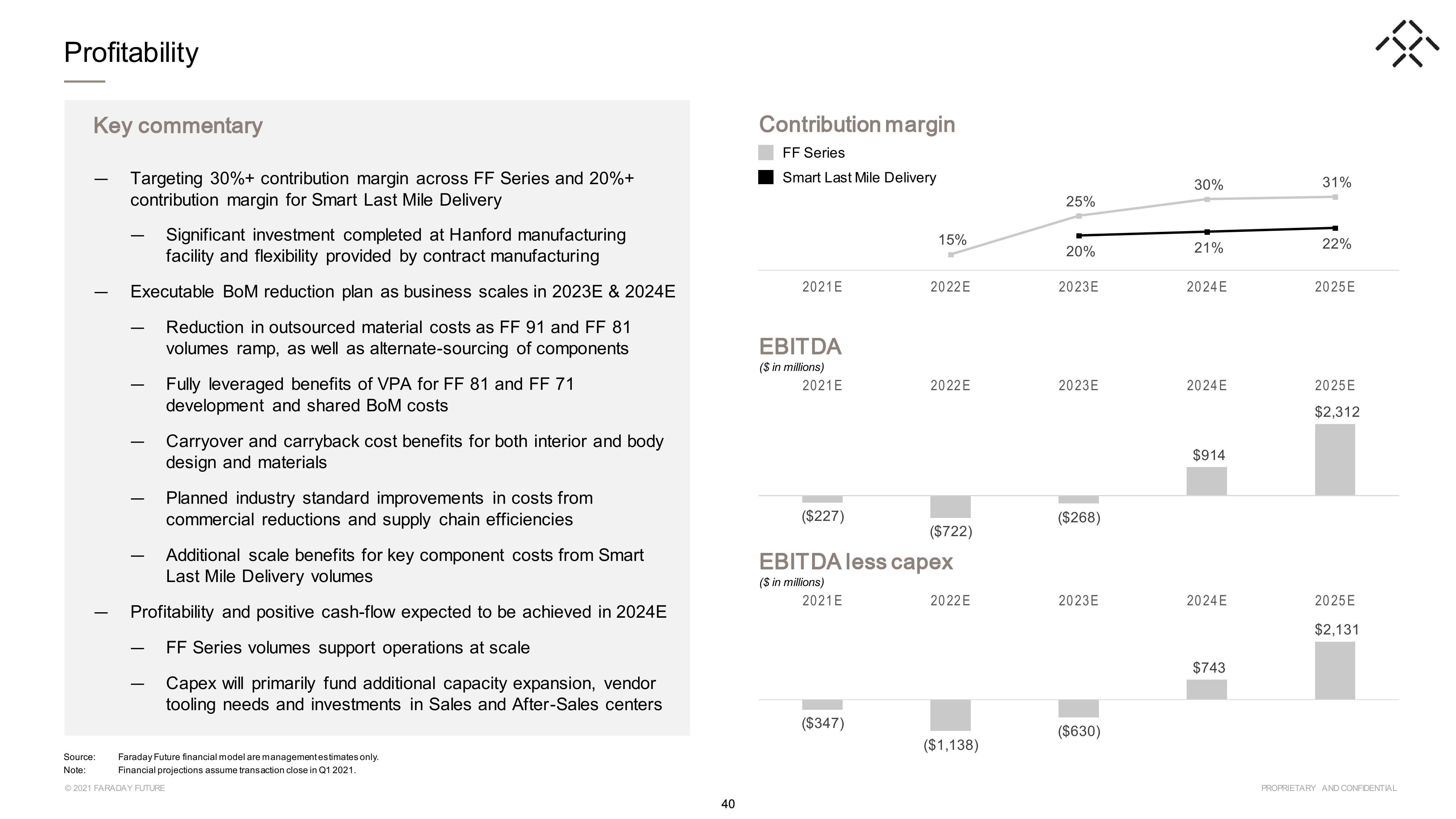

Targeting 30%+ contribution margin across FF Series and 20%+

contribution margin for Smart Last Mile Delivery

Significant investment completed at Hanford manufacturing

facility and flexibility provided by contract manufacturing

Executable BoM reduction plan as business scales in 2023E & 2024E

Reduction in outsourced material costs as FF 91 and FF 81

volumes ramp, as well as alternate-sourcing of components

-

-

-

-

-

-

Additional scale benefits for key component costs from Smart

Last Mile Delivery volumes

Profitability and positive cash-flow expected to be achieved in 2024E

FF Series volumes support operations at scale

Capex will primarily fund additional capacity expansion, vendor

tooling needs and investments in Sales and After-Sales centers

-

Fully leveraged benefits of VPA for FF 81 and FF 71

development and shared BoM costs

Source:

Note:

Ⓒ2021 FARADAY FUTURE

Carryover and carryback cost benefits for both interior and body

design and materials

Planned industry standard improvements in costs from

commercial reductions and supply chain efficiencies

Faraday Future financial model are management estimates only.

Financial projections assume transaction close in Q1 2021.

40

Contribution margin

FF Series

Smart Last Mile Delivery

2021 E

EBITDA

($ in millions)

2021 E

($227)

2021 E

15%

($347)

2022E

2022E

EBITDA less capex

($ in millions)

($722)

2022E

($1,138)

25%

20%

2023E

2023E

($268)

2023E

($630)

30%

21%

2024E

2024E

$914

2024E

$743

31%

22%

2025E

2025E

$2,312

2025E

$2,131

38

PROPRIETARY AND CONFIDENTIALView entire presentation