NextNav SPAC Presentation Deck

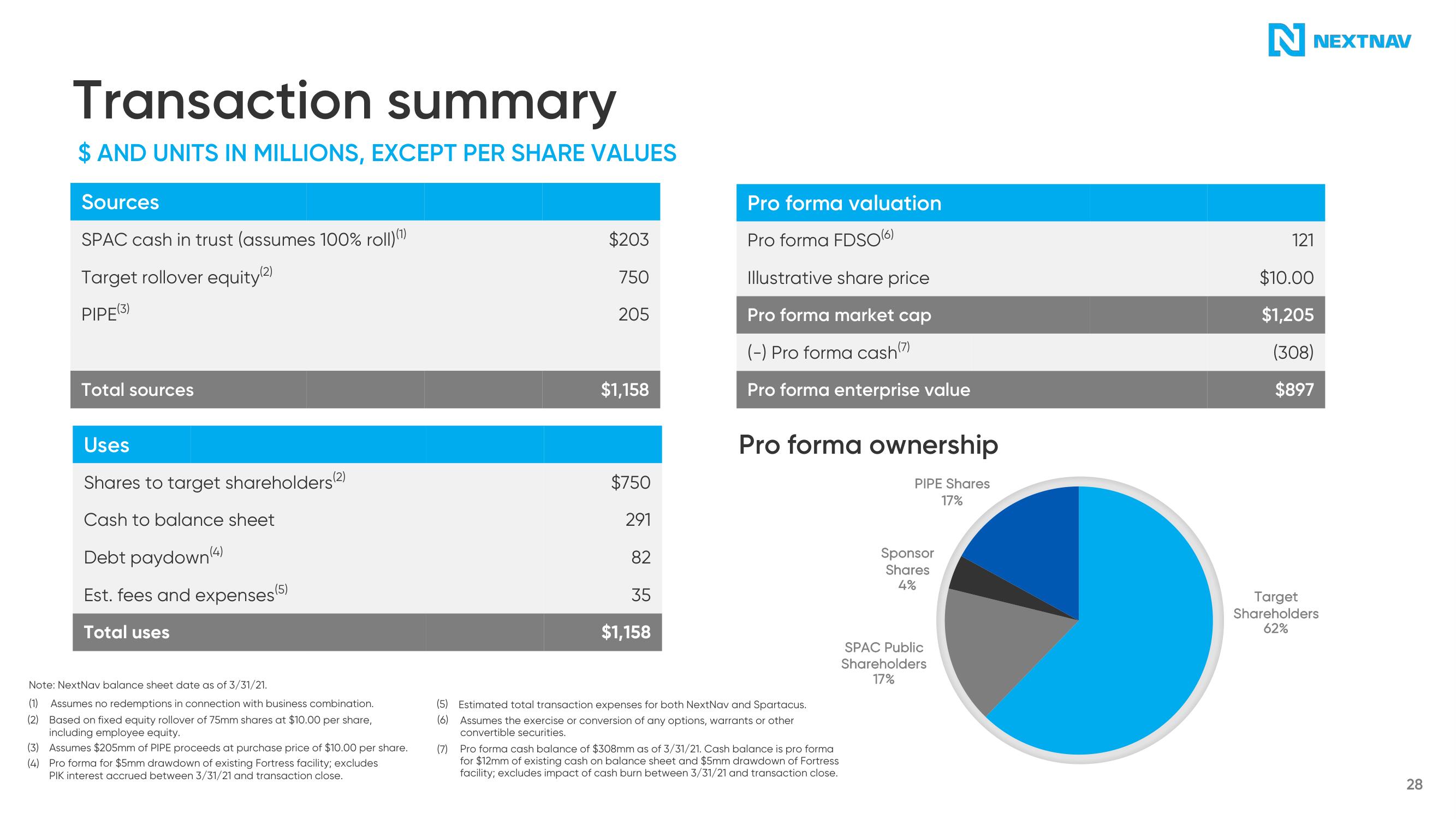

Transaction summary

$ AND UNITS IN MILLIONS, EXCEPT PER SHARE VALUES

Sources

SPAC cash in trust (assumes 100% roll)(¹)

Target rollover equity(2)

PIPE (3)

Total sources

Uses

Shares to target shareholders(2)

Cash to balance sheet

Debt paydown(4)

Est. fees and expenses(5

Total uses

Note: NextNav balance sheet date as of 3/31/21.

(1)

Assumes no redemptions in connection with business combination.

(2) Based on fixed equity rollover of 75mm shares at $10.00 per share,

including employee equity.

(3) Assumes $205mm of PIPE proceeds at purchase price of $10.00 per share.

(4) Pro forma for $5mm drawdown of existing Fortress facility; excludes

PIK interest accrued between 3/31/21 and transaction close.

(5)

(6)

$203

750

205

$1,158

$750

291

82

35

$1,158

Pro forma valuation

Pro forma FDSO(6)

Illustrative share price

Pro forma market cap

(-) Pro forma cash (7)

Pro forma enterprise value

Pro forma ownership

Estimated total transaction expenses for both NextNav and Spartacus.

Assumes the exercise or conversion of any options, warrants or other

convertible securities.

(7)

Pro forma cash balance of $308mm as of 3/31/21. Cash balance is pro forma

for $12mm of existing cash on balance sheet and $5mm drawdown of Fortress

facility; excludes impact of cash burn between 3/31/21 and transaction close.

PIPE Shares

17%

Sponsor

Shares

4%

SPAC Public

Shareholders

17%

N NEXTNAV

121

$10.00

$1,205

(308)

$897

Target

Shareholders

62%

28View entire presentation