Marti Investor Presentation Deck

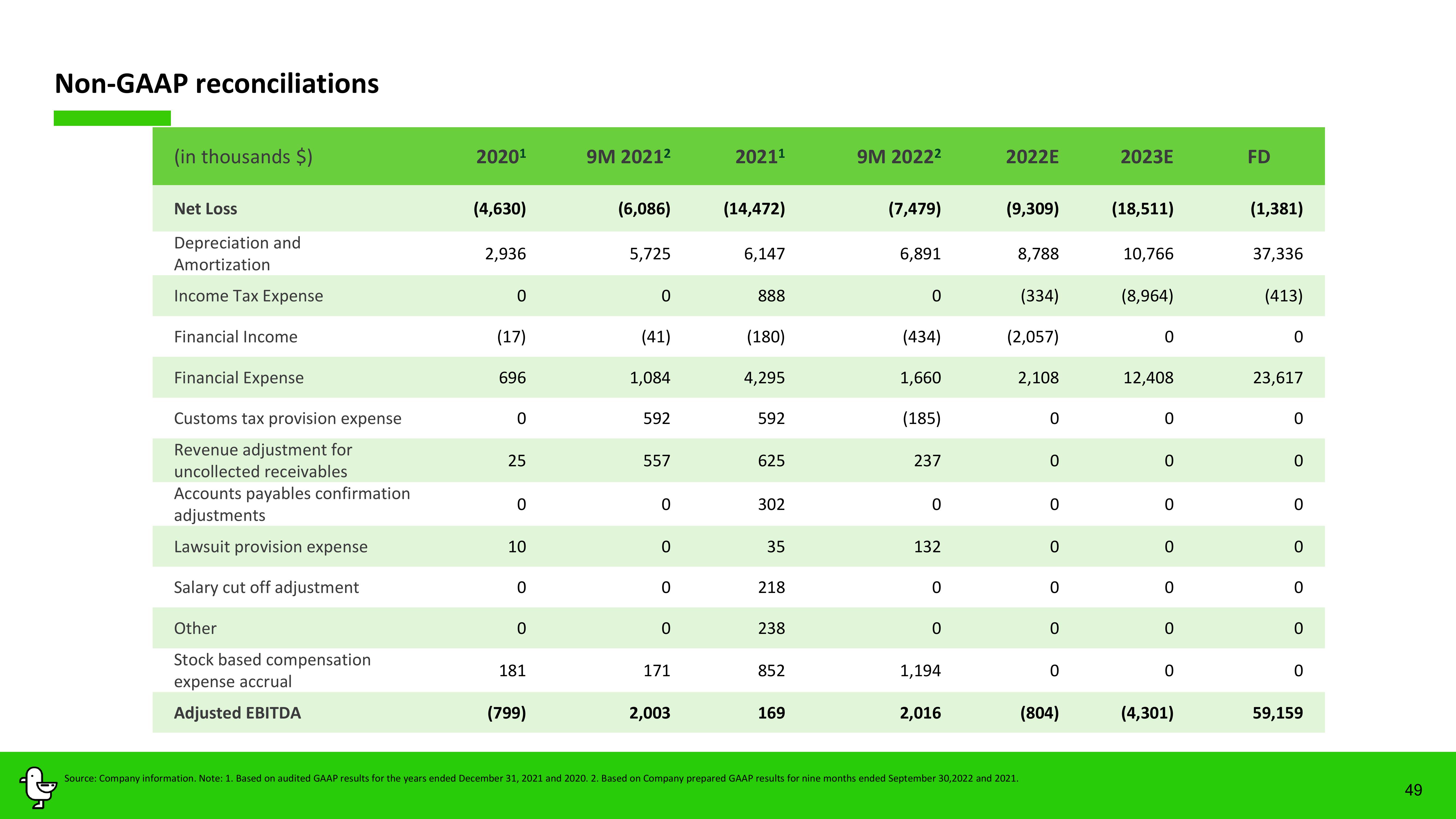

Non-GAAP reconciliations

(in thousands $)

Net Loss

Depreciation and

Amortization

Income Tax Expense

Financial Income

Financial Expense

Customs tax provision expense

Revenue adjustment for

uncollected receivables

Accounts payables confirmation

adjustments

Lawsuit provision expense

Salary cut off adjustment

Other

Stock based compensation

expense accrual

Adjusted EBITDA

2020¹

(4,630)

2,936

0

(17)

696

0

25

0

10

0

0

181

(799)

9M 2021²

(6,086)

5,725

0

(41)

1,084

592

557

0

0

0

0

171

2,003

2021¹

(14,472)

6,147

888

(180)

4,295

592

625

302

35

218

238

852

169

9M 2022²

(7,479)

6,891

0

(434)

1,660

(185)

237

0

132

0

0

1,194

2,016

2022E

(9,309)

8,788

(334)

(2,057)

2,108

Source: Company information. Note: 1. Based on audited GAAP results for the years ended December 31, 2021 and 2020. 2. Based on Company prepared GAAP results for nine months ended September 30,2022 and 2021.

0

0

0

0

0

0

0

(804)

2023E

(18,511)

10,766

(8,964)

0

12,408

0

0

0

0

0

0

0

(4,301)

FD

(1,381)

37,336

(413)

0

23,617

0

0

0

0

0

0

0

59,159

49View entire presentation