Bausch+Lomb Results Presentation Deck

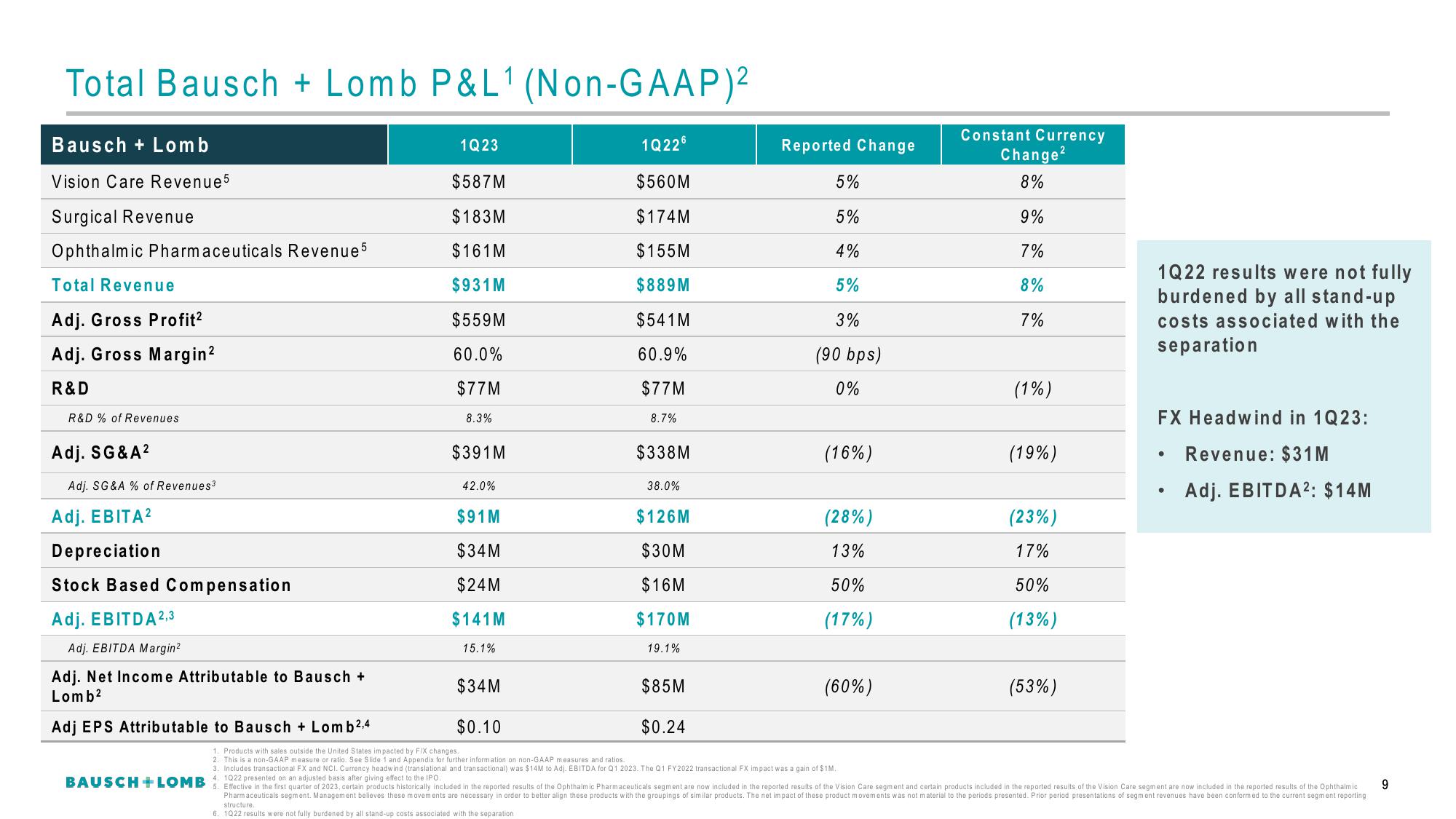

Total Bausch + Lomb P&L1 (Non-GAAP)²

Bausch + Lomb

Vision Care Revenue5

Surgical Revenue

Ophthalmic Pharmaceuticals Revenue 5

Total Revenue

Adj. Gross Profit²

Adj. Gross Margin²

R&D

R&D % of Revenues

Adj. SG&A²

Adj. SG&A % of Revenues³

Adj. EBITA²

Depreciation

Stock Based Compensation

Adj. EBITDA 2,3

Adj. EBITDA Margin²

Adj. Net Income Attributable to Bausch +

Lomb²

Adj EPS Attributable to Bausch + Lomb2,4

1Q23

$587M

$183M

$161 M

$931 M

$559M

60.0%

$77M

8.3%

$391M

42.0%

$91 M

$34M

$24M

$141M

15.1%

$34M

$0.10

1Q226

$560M

$174M

$155M

$889M

$541M

60.9%

$77M

8.7%

$338M

38.0%

$126M

$30M

$16M

$170M

19.1%

$85M

$0.24

Reported Change

5%

5%

4%

5%

3%

(90 bps)

0%

(16%)

(28%)

13%

50%

(17%)

(60%)

1. Products with sales outside the United States impacted by F/X changes.

2. This is a non-GAAP measure or ratio. See Slide 1 and Appendix for further information on non-GAAP measures and ratios.

3. Includes transactional FX and NCI. Currency headwind (translational and transactional) was $14M to Adj. EBITDA for Q1 2023. The Q1 FY2022 transactional FX impact was a gain of $1M.

Constant Currency

Change²

8%

9%

7%

8%

7%

(1%)

(19%)

(23%)

17%

50%

(13%)

(53%)

1Q22 results were not fully

burdened by all stand-up

costs associated with the

separation

FX Headwind in 1Q23:

Revenue: $31M

Adj. EBITDA²: $14M

●

●

4. on an basis after effect to the IPO.

BAUSCH + LOMB 5. Effective in the first quarter of 2023, certain products historically included in the reported results of the Ophthalmic Pharmaceuticals segment are now included in the reported results of the Vision Care segment and certain products included in the reported results of the Vision Care segment are now included in the reported results of the Ophthalmic

Pharmaceuticals segment. Management believes these movements are necessary in order to better align these products with the groupings of similar products. The net impact of these product movements was not material to the periods presented. Prior period presentations of segment revenues have been conformed to the current segment reporting.

6. 1022 results were not fully burdened by all stand-up costs associated with the separation.

structure.

9View entire presentation