BAT Results Presentation Deck

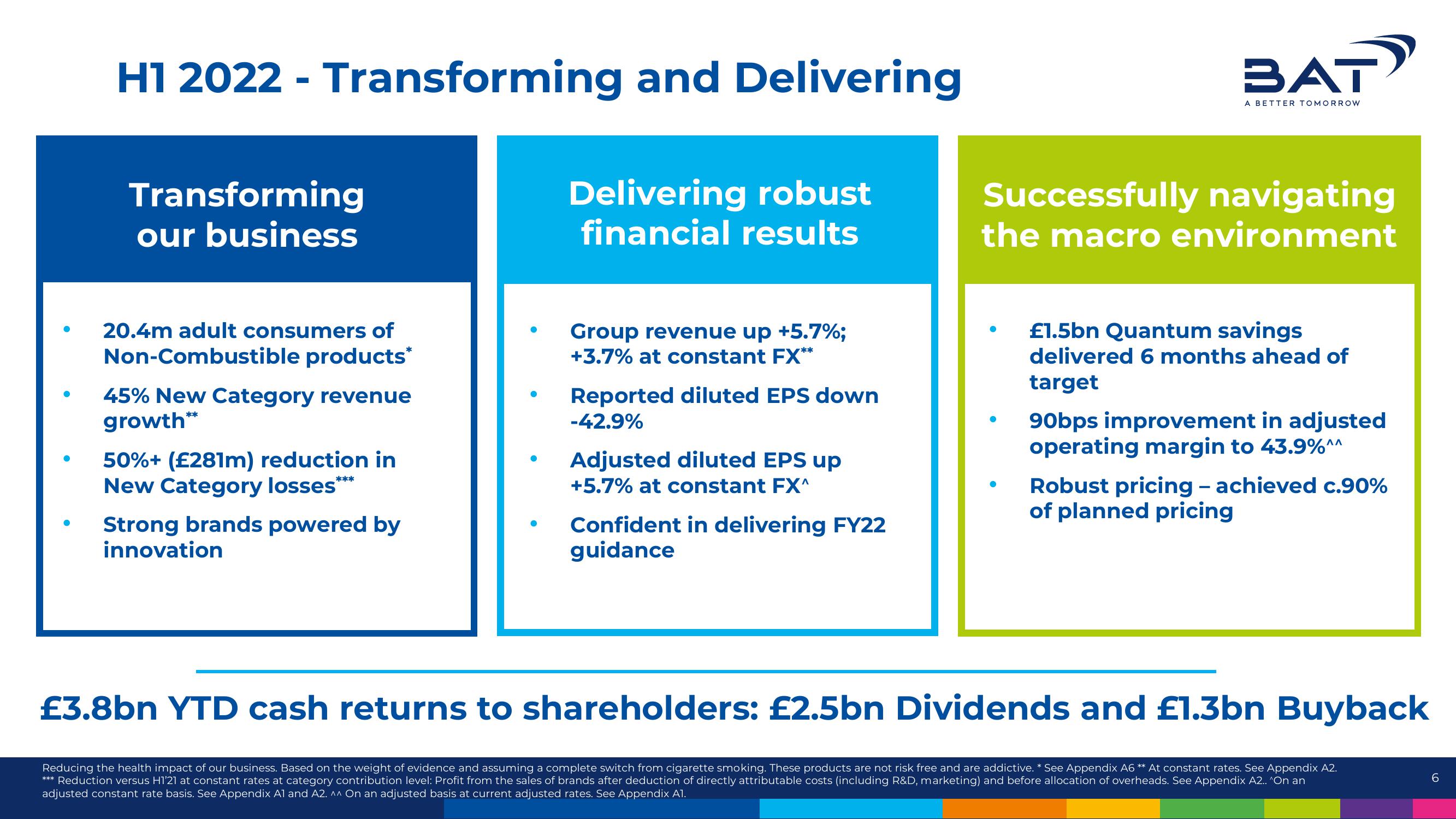

H1 2022 - Transforming and Delivering

Transforming

our business

Delivering robust

financial results

20.4m adult consumers of

Non-Combustible products*

45% New Category revenue

growth**

50%+ (£281m) reduction in

New Category losses***

Strong brands powered by

innovation

Group revenue up +5.7%;

+3.7% at constant FX**

Reported diluted EPS down

-42.9%

Adjusted diluted EPS up

+5.7% at constant FX^

Confident in delivering FY22

guidance

BAT

●

A BETTER TOMORROW

Successfully navigating

the macro environment

£1.5bn Quantum savings

delivered 6 months ahead of

target

90bps improvement in adjusted

operating margin to 43.9%^^

Robust pricing - achieved c.90%

of planned pricing

£3.8bn YTD cash returns to shareholders: £2.5bn Dividends and £1.3bn Buyback

Reducing the health impact of our business. Based on the weight of evidence and assuming a complete switch from cigarette smoking. These products are not risk free and are addictive. * See Appendix A6** At constant rates. See Appendix A2.

*** Reduction versus H1'21 at constant rates at category contribution level: Profit from the sales of brands after deduction of directly attributable costs (including R&D, marketing) and before allocation of overheads. See Appendix A2.. ^On an

adjusted constant rate basis. See Appendix A1 and A2. ^^ On an adjusted basis at current adjusted rates. See Appendix A1.

6View entire presentation