Bausch+Lomb Results Presentation Deck

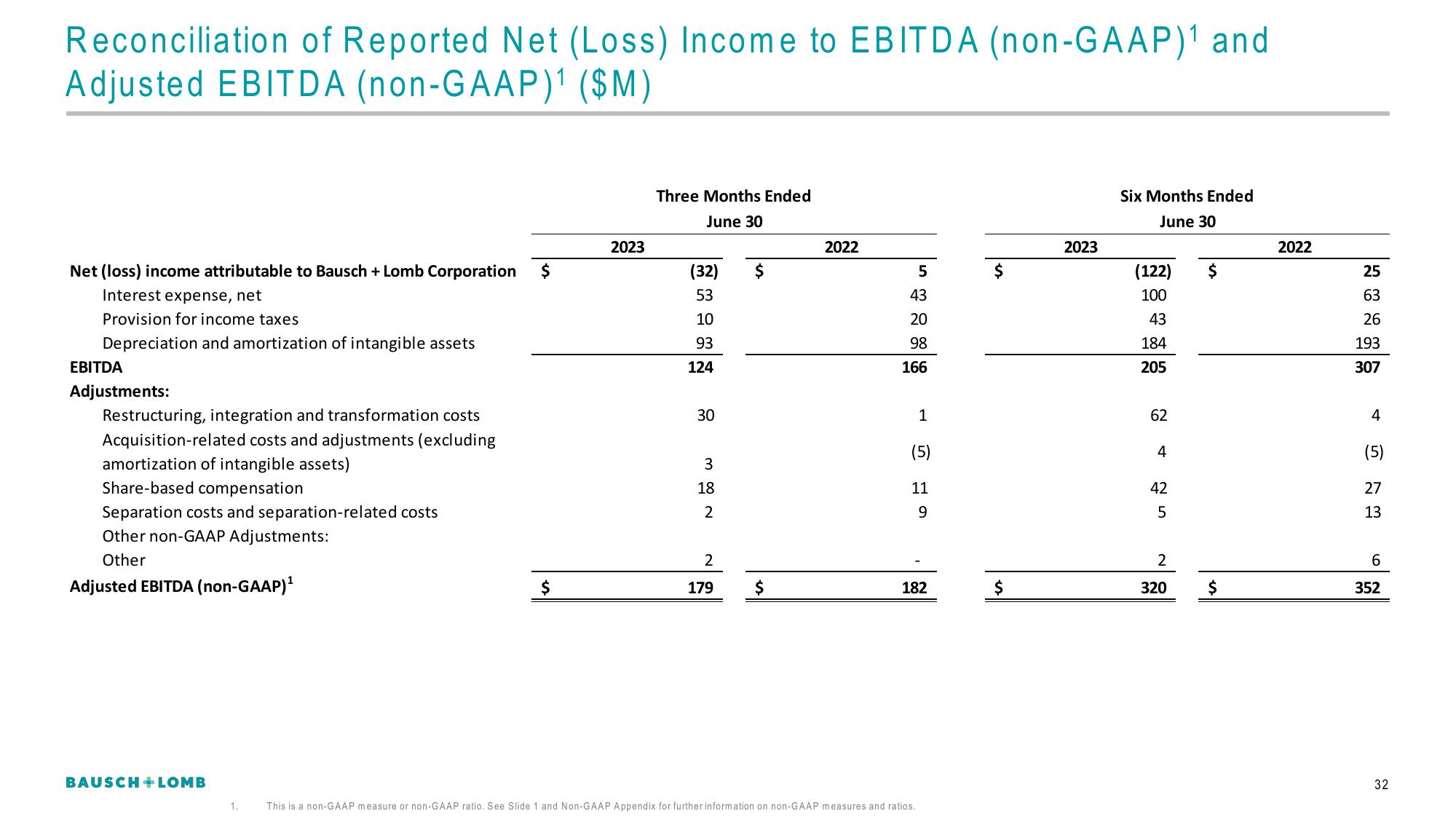

Reconciliation of Reported Net (Loss) Income to EBITDA (non-GAAP)¹ and

Adjusted EBITDA (non-GAAP)¹ ($M)

Net (loss) income attributable to Bausch + Lomb Corporation $

Interest expense, net

Provision for income taxes

Depreciation and amortization of intangible assets

EBITDA

Adjustments:

Restructuring, integration and transformation costs

Acquisition-related costs and adjustments (excluding

amortization of intangible assets)

Share-based compensation

Separation costs and separation-related costs

Other non-GAAP Adjustments:

Other

Adjusted EBITDA (non-GAAP) ¹

BAUSCH + LOMB

1.

$

2023

Three Months Ended

June 30

(32) $

53

10

93

124

30

3

18

2

2

179 $

2022

5

43

20

98

166

1

(5)

11

9

182

This is a non-GAAP measure or non-GAAP ratio. See Slide 1 and Non-GAAP Appendix for further information on non-GAAP measures and ratios.

$

2023

Six Months Ended

June 30

(122)

100

43

184

205

62

4

42

5

2

320

$

$

2022

25

63

26

193

307

4

(5)

27

13

6

352

32View entire presentation