Inovalon Mergers and Acquisitions Presentation Deck

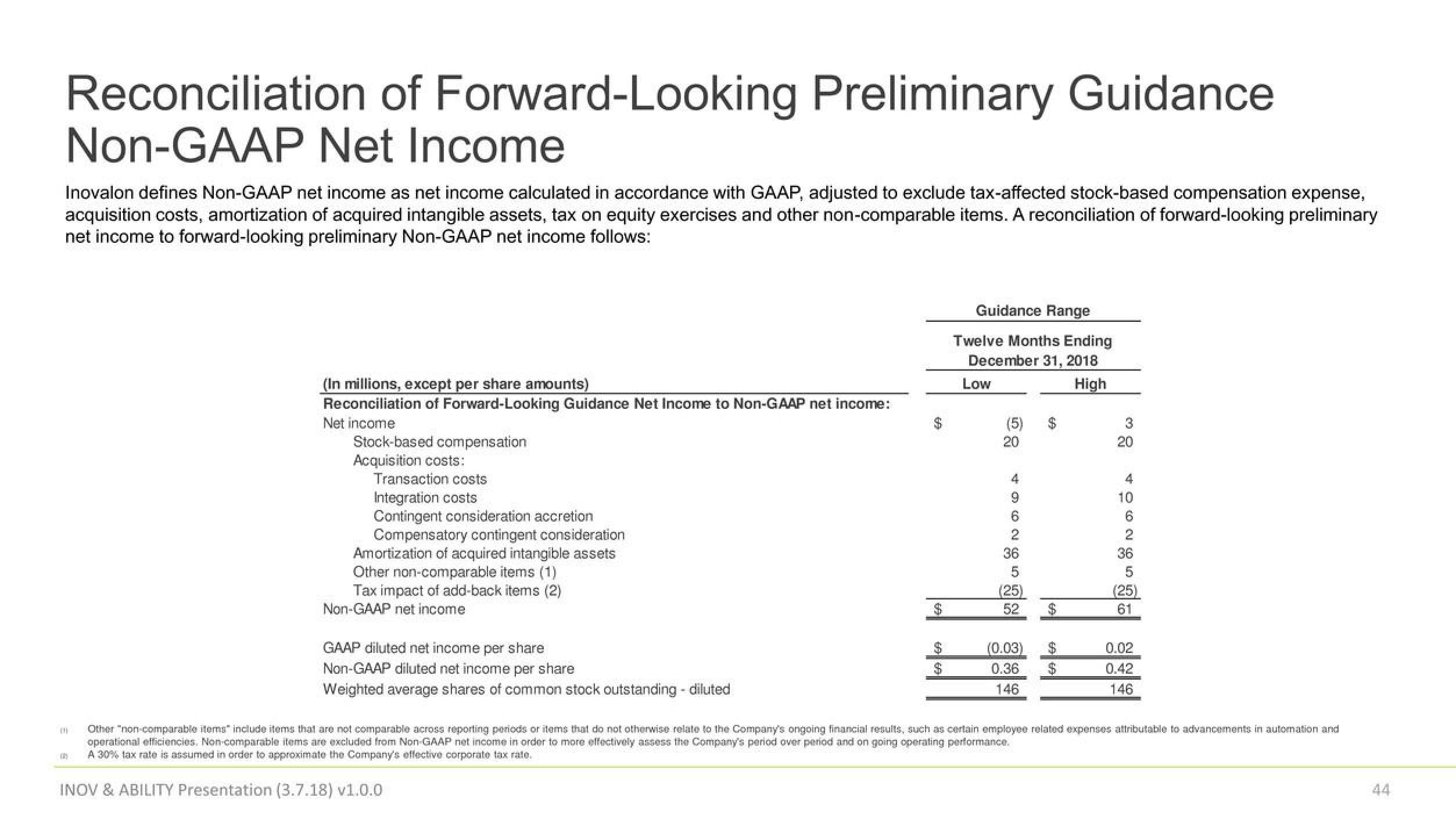

Reconciliation of Forward-Looking Preliminary Guidance

Non-GAAP Net Income

Inovalon defines Non-GAAP net income as net income calculated in accordance with GAAP, adjusted to exclude tax-affected stock-based compensation expense,

acquisition costs, amortization of acquired intangible assets, tax on equity exercises and other non-comparable items. A reconciliation of forward-looking preliminary

net income to forward-looking preliminary Non-GAAP net income follows:

(In millions, except per share amounts)

Reconciliation of Forward-Looking Guidance Net Income to Non-GAAP net income:

Net income

Stock-based compensation

Acquisition costs:

Transaction costs

Integration costs

Contingent consideration accretion

Compensatory contingent consideration

Amortization of acquired intangible assets

Other non-comparable items (1)

Tax impact of add-back items (2)

Non-GAAP net income

GAAP diluted net income per share

Non-GAAP diluted net income per share

Weighted average shares of common stock outstanding - diluted

$

INOV & ABILITY Presentation (3.7.18) v1.0.0

Guidance Range

Twelve Months Ending

December 31, 2018

High

Low

(5)

20

4

9

6

2

36

5

(25)

52

(0.03)

0.36

146

69

$

$

$

3

20

4O6N95

10

2

36

(25)

61

0.02

0.42

146

Other "non-comparable items include items that are not comparable across reporting periods or items that do not otherwise relate to the Company's ongoing financial results, such as certain employee related expenses attributable to advancements in automation and

operational efficiencies. Non-comparable items are excluded from Non-GAAP net income in order to more effectively assess the Company's period over period and on going operating performance.

A 30% tax rate is assumed in order to approximate the Company's effective corporate tax rate.

44View entire presentation