HSBC ESG Presentation Deck

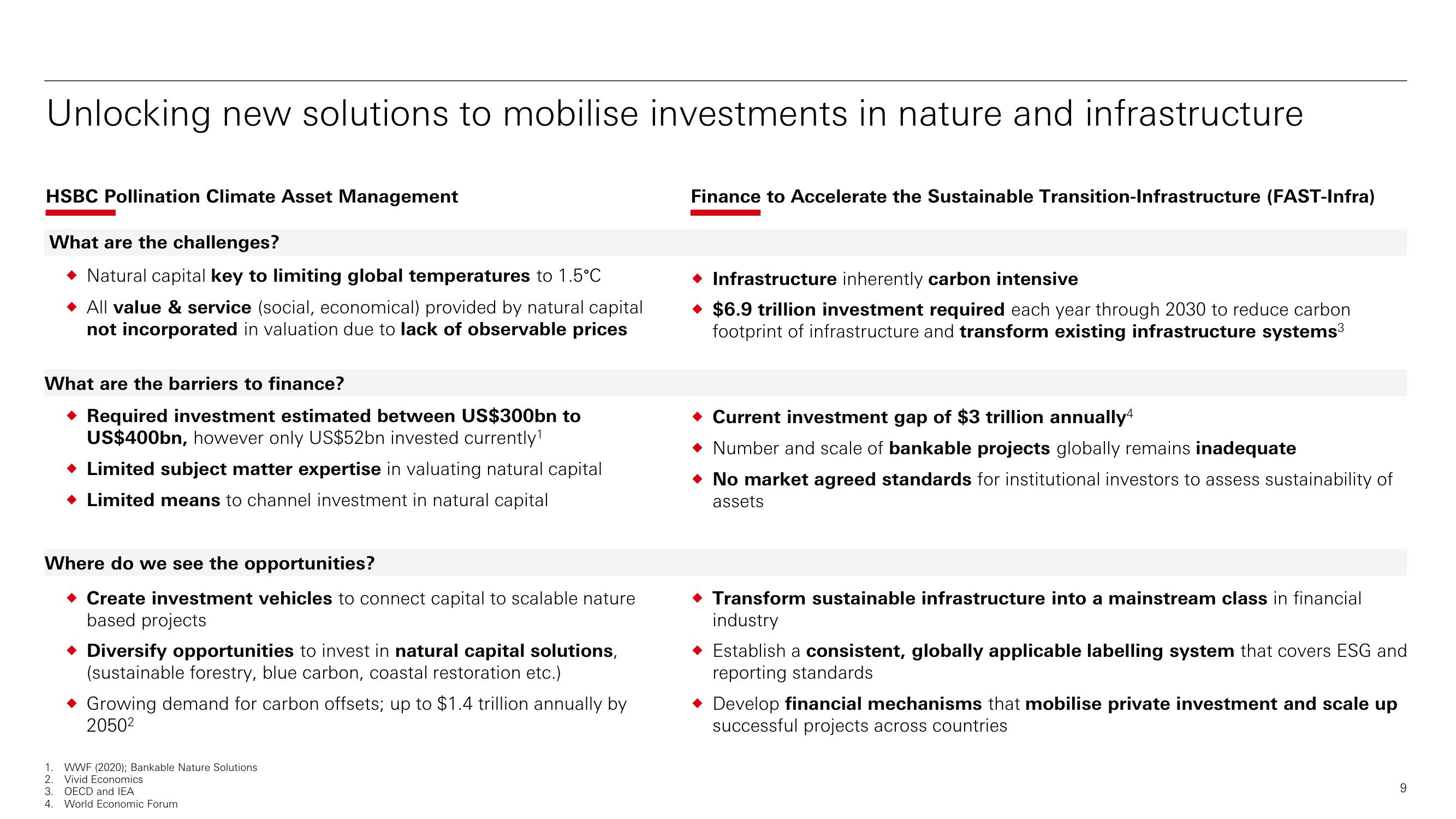

Unlocking new solutions to mobilise investments in nature and infrastructure

HSBC Pollination Climate Asset Management

What are the challenges?

Natural capital key to limiting global temperatures to 1.5°C

All value & service (social, economical) provided by natural capital

not incorporated in valuation due to lack of observable prices

What are the barriers to finance?

◆ Required investment estimated between US$300bn to

US$400bn, however only US$52bn invested currently¹

◆ Limited subject matter expertise in valuating natural capital

◆ Limited means to channel investment in natural capital

Where do we see the opportunities?

◆ Create investment vehicles to connect capital to scalable nature

based projects

◆ Diversify opportunities to invest in natural capital solutions,

(sustainable forestry, blue carbon, coastal restoration etc.)

Growing demand for carbon offsets; up to $1.4 trillion annually by

2050²

1. WWF (2020); Bankable Nature Solutions

2. Vivid Economics

3. OECD and IEA

4. World Economic Forum

Finance to Accelerate the Sustainable Transition-Infrastructure (FAST-Infra)

Infrastructure inherently carbon intensive

$6.9 trillion investment required each year through 2030 to reduce carbon

footprint of infrastructure and transform existing infrastructure systems³

◆ Current investment gap of $3 trillion annually4

Number and scale of bankable projects globally remains inadequate

No market agreed standards for institutional investors to assess sustainability of

assets

◆ Transform sustainable infrastructure into a mainstream class in financial

industry

Establish a consistent, globally applicable labelling system that covers ESG and

reporting standards

Develop financial mechanisms that mobilise private investment and scale up

successful projects across countries

9View entire presentation