Apollo Global Management Investor Presentation Deck

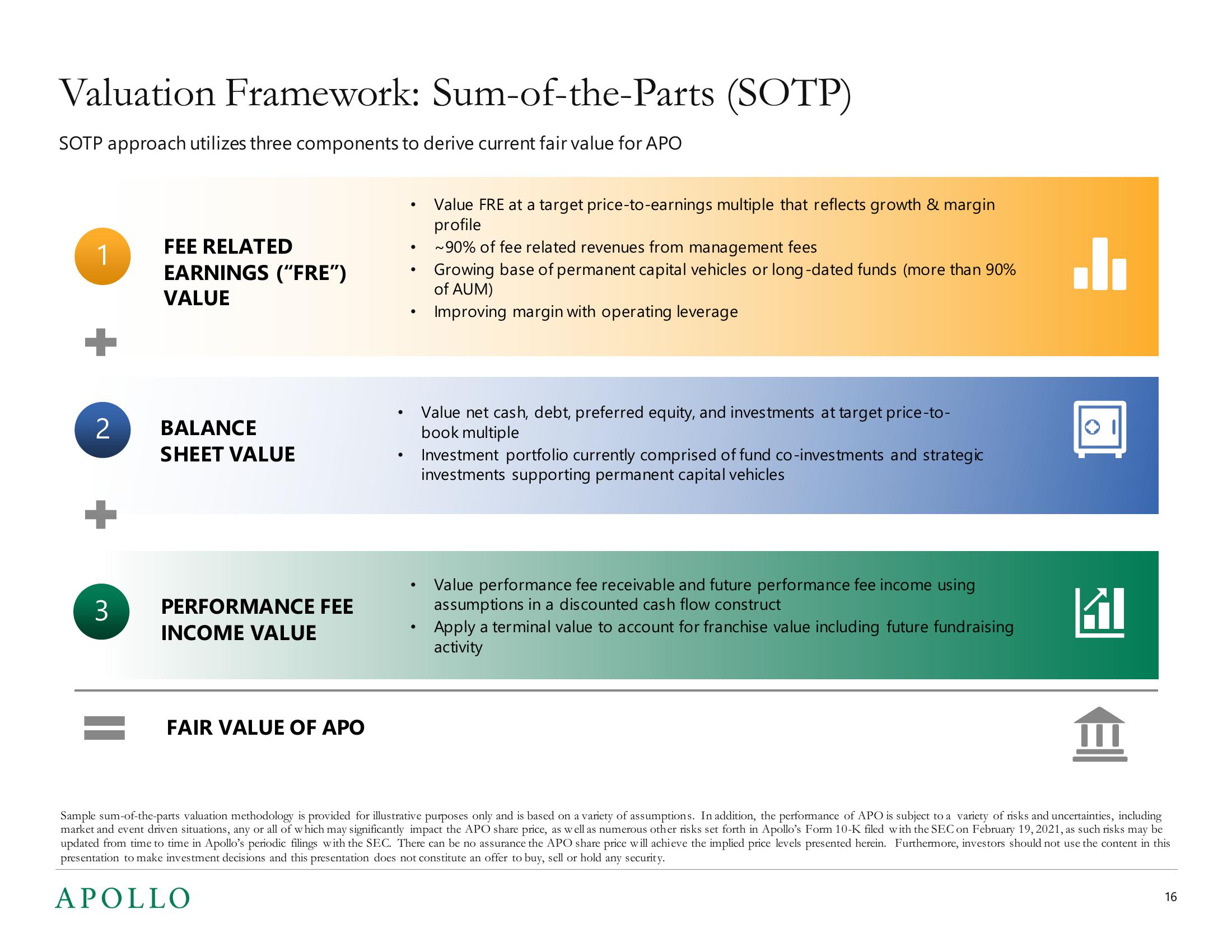

Valuation Framework: Sum-of-the-Parts (SOTP)

SOTP approach utilizes three components to derive current fair value for APO

1

+

2

+

3

FEE RELATED

EARNINGS ("FRE")

VALUE

BALANCE

SHEET VALUE

PERFORMANCE FEE

INCOME VALUE

FAIR VALUE OF APO

●

●

●

●

●

·

●

Value FRE at a target price-to-earnings multiple that reflects growth & margin

profile

~90% of fee related revenues from management fees

Growing base of permanent capital vehicles or long-dated funds (more than 90%

of AUM)

Improving margin with operating leverage

Value net cash, debt, preferred equity, and investments at target price-to-

book multiple

Investment portfolio currently comprised of fund co-investments and strategic

investments supporting permanent capital vehicles

Value performance fee receivable and future performance fee income using

assumptions in a discounted cash flow construct

Apply a terminal value to account for franchise value including future fundraising

activity

.l

G

Sample sum-of-the-parts valuation methodology is provided for illustrative purposes only and is based on a variety of assumptions. In addition, the performance of APO is subject to a variety of risks and uncertainties, including

market and event driven situations, any or all of which may significantly impact the APO share price, as well as numerous other risks set forth in Apollo's Form 10-K filed with the SEC on February 19, 2021, as such risks may be

updated from time to time in Apollo's periodic filings with the SEC. There can be no assurance the APO share price will achieve the implied price levels presented herein. Furthermore, investors should not use the content in this

presentation to make investment decisions and this presentation does not constitute an offer to buy, sell or hold any security.

APOLLO

16View entire presentation