Cboe Results Presentation Deck

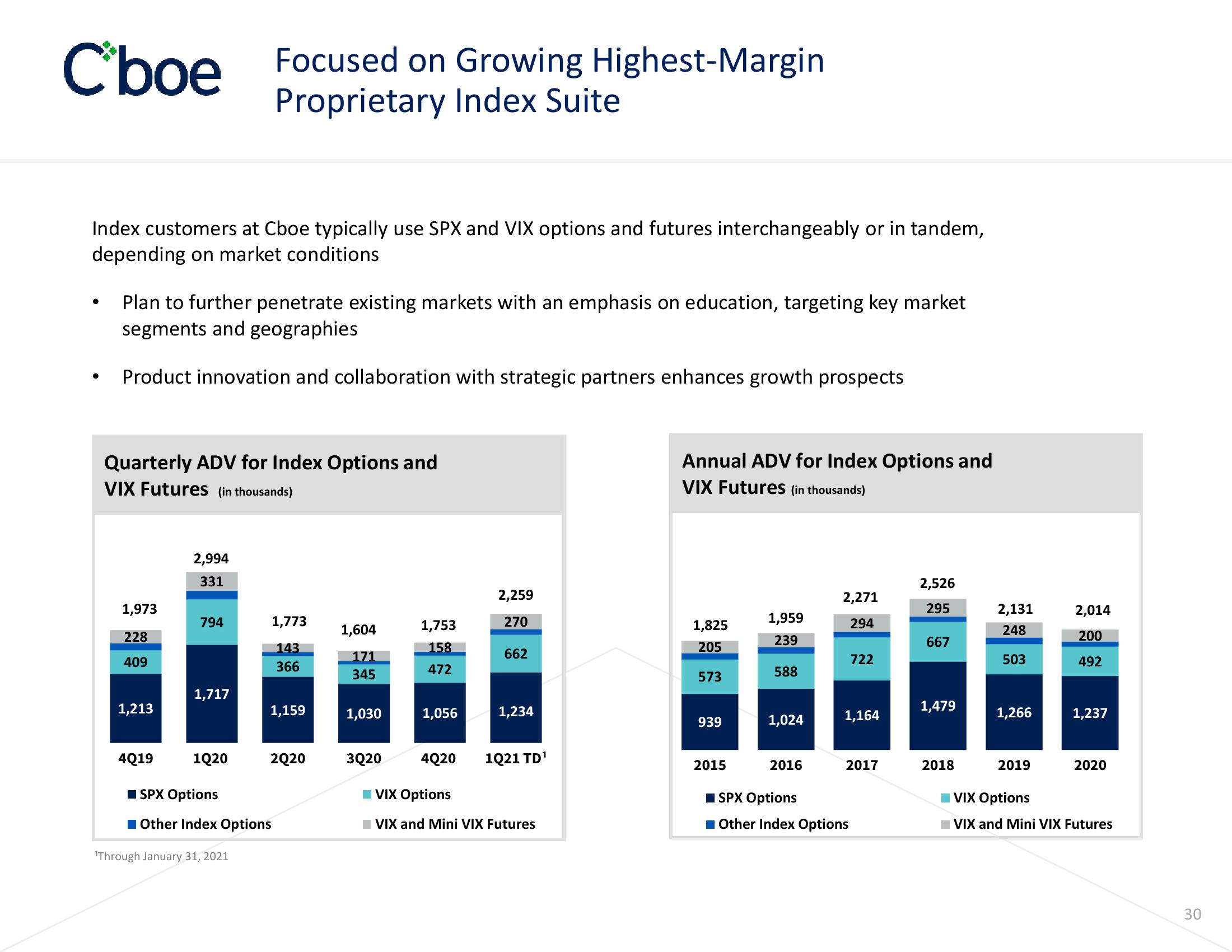

Cboe Focused on Growing Highest-Margin

Proprietary Index Suite

Index customers at Cboe typically use SPX and VIX options and futures interchangeably or in tandem,

depending on market conditions

●

Plan to further penetrate existing markets with an emphasis on education, targeting key market

segments and geographies

Product innovation and collaboration with strategic partners enhances growth prospects

Quarterly ADV for Index Options and

VIX Futures (in thousands)

1,973

228

409

1,213

4Q19

2,994

331

794

1,717

1Q20

1,773

143

366

1,159

2020

SPX Options

Other Index Options

¹Through January 31, 2021

1,604

171

345

1,030

3Q20

1,753

158

472

1,056

4Q20

2,259

270

662

1,234

1Q21 TD¹

VIX Options

VIX and Mini VIX Futures

Annual ADV for Index Options and

VIX Futures (in thousands)

1,825

205

573

939

2015

1,959

239

588

1,024

2016

2,271

294

722

1,164

2017

SPX Options

■ Other Index Options

2,526

295

667

1,479

2018

2,131

248

503

1,266

2019

2,014

200

492

1,237

2020

VIX Options

VIX and Mini VIX Futures

30View entire presentation