Enact IPO Presentation Deck

Enact | Investor Presentation

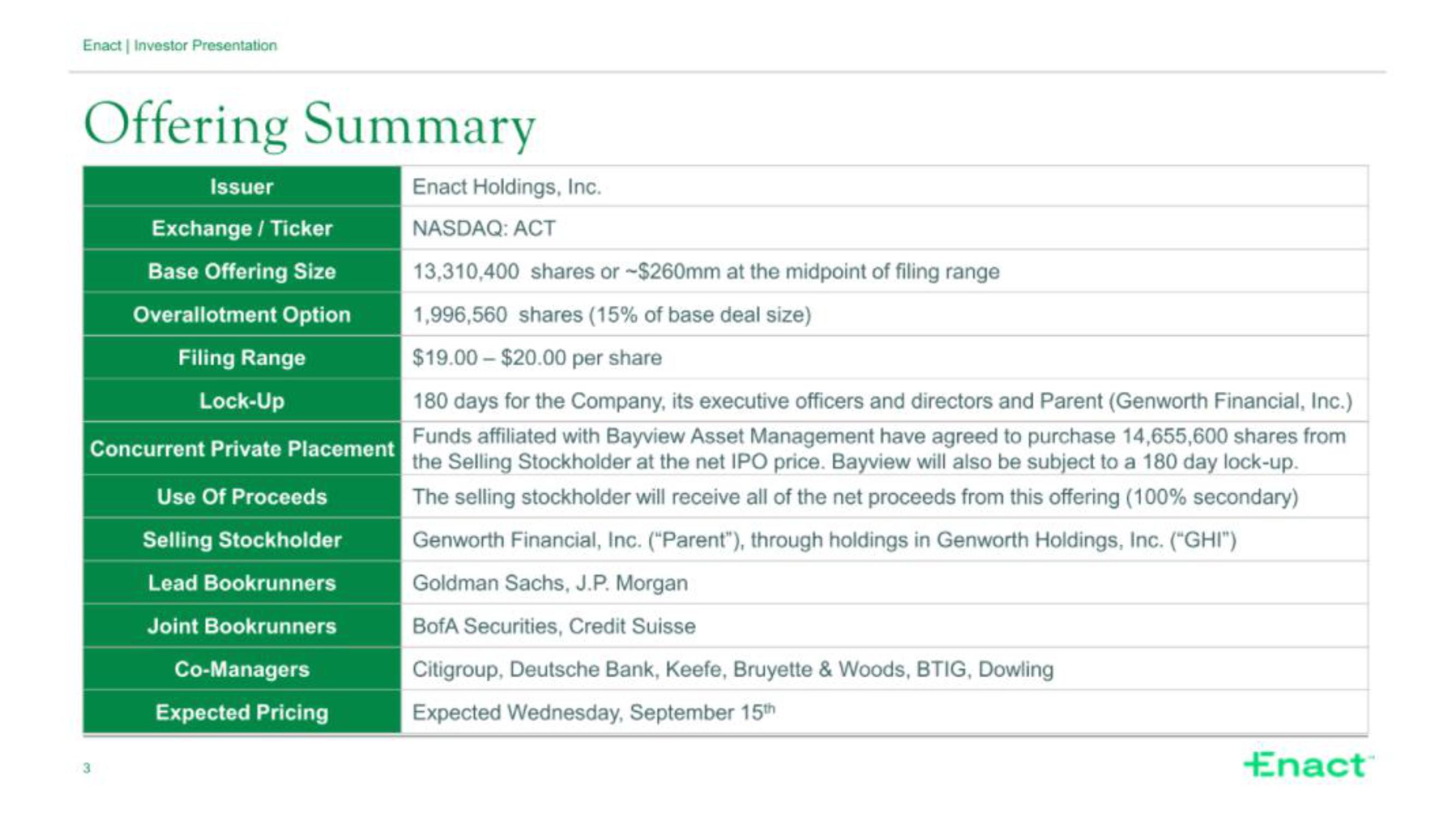

Offering Summary

Issuer

Exchange / Ticker

Base Offering Size

Overallotment Option

Filing Range

Lock-Up

Concurrent Private Placement

Use Of Proceeds

Selling Stockholder

Lead Bookrunners

Joint Bookrunners

Co-Managers

Expected Pricing

Enact Holdings, Inc.

NASDAQ: ACT

13,310,400 shares or -$260mm at the midpoint of filing range

1,996,560 shares (15% of base deal size)

$19.00-$20.00 per share

180 days for the Company, its executive officers and directors and Parent (Genworth Financial, Inc.)

Funds affiliated with Bayview Asset Management have agreed to purchase 14,655,600 shares from

the Selling Stockholder at the net IPO price. Bayview will also be subject to a 180 day lock-up.

The selling stockholder will receive all of the net proceeds from this offering (100% secondary)

Genworth Financial, Inc. ("Parent"), through holdings in Genworth Holdings, Inc. ("GHI")

Goldman Sachs, J.P. Morgan

BofA Securities, Credit Suisse

Citigroup, Deutsche Bank, Keefe, Bruyette & Woods, BTIG, Dowling

Expected Wednesday, September 15th

EnactView entire presentation