Spotify Results Presentation Deck

Executive Summary

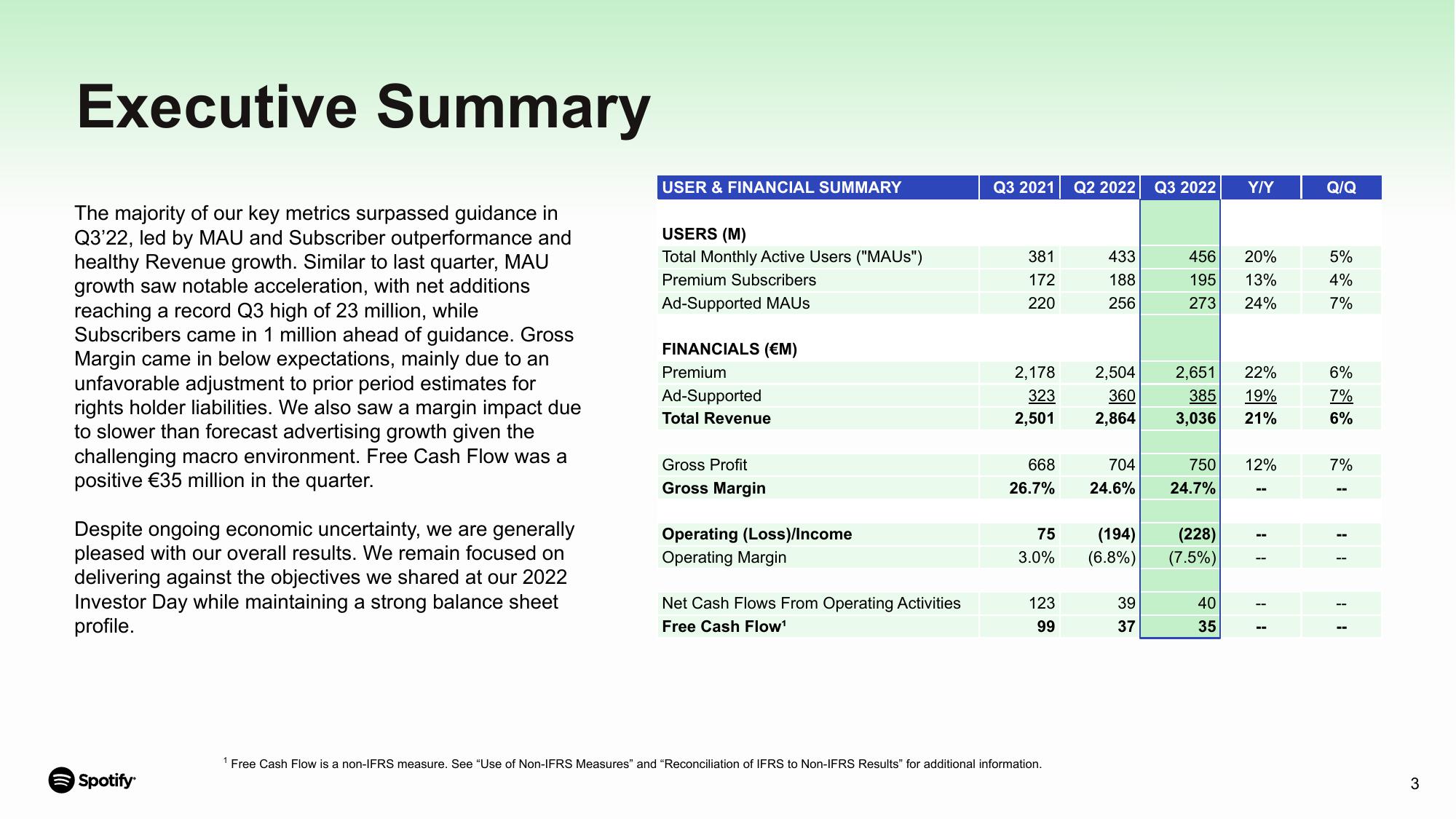

The majority of our key metrics surpassed guidance in

Q3'22, led by MAU and Subscriber outperformance and

healthy Revenue growth. Similar to last quarter, MAU

growth saw notable acceleration, with net additions

reaching a record Q3 high of 23 million, while

Subscribers came in 1 million ahead of guidance. Gross

Margin came in below expectations, mainly due to an

unfavorable adjustment to prior period estimates for

rights holder liabilities. We also saw a margin impact due

to slower than forecast advertising growth given the

challenging macro environment. Free Cash Flow was a

positive €35 million in the quarter.

Despite ongoing economic uncertainty, we are generally

pleased with our overall results. We remain focused on

delivering against the objectives we shared at our 2022

Investor Day while maintaining a strong balance sheet

profile.

Spotify

USER & FINANCIAL SUMMARY

USERS (M)

Total Monthly Active Users ("MAUS")

Premium Subscribers

Ad-Supported MAUS

FINANCIALS (€M)

Premium

Ad-Supported

Total Revenue

Gross Profit

Gross Margin

Operating (Loss)/Income

Operating Margin

Net Cash Flows From Operating Activities

Free Cash Flow¹

Q3 2021

381

172

220

2,178

323

2,501

668

26.7%

75

3.0%

123

99

1 Free Cash Flow is a non-IFRS measure. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to Non-IFRS Results" for additional information.

Q2 2022

433

188

256

2,504

360

2,864

704

24.6%

(194)

(6.8%)

39

37

Q3 2022

456

195

273

2,651

385

3,036

750

24.7%

(228)

(7.5%)

40

35

Y/Y

20%

13%

24%

22%

19%

21%

12%

--

--

11

Q/Q

5%

4%

7%

6%

7%

6%

7%

3View entire presentation