Benson Hill Results Presentation Deck

BENSON O HILL

BENSON HILL

Non-GAAP Reconciliation¹

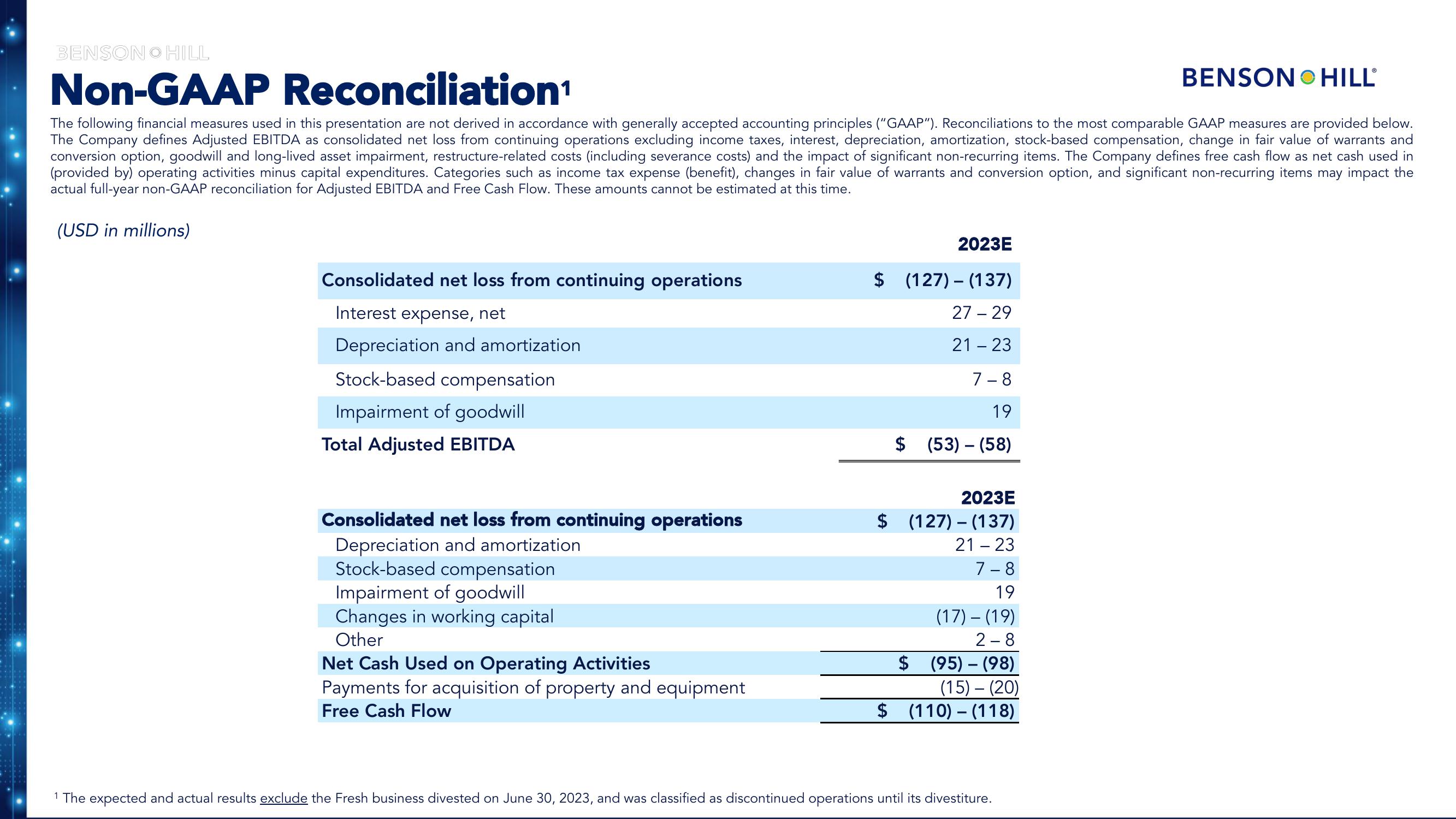

The following financial measures used in this presentation are not derived in accordance with generally accepted accounting principles ("GAAP"). Reconciliations to the most comparable GAAP measures are provided below.

The Company defines Adjusted EBITDA as consolidated net loss from continuing operations excluding income taxes, interest, depreciation, amortization, stock-based compensation, change in fair value of warrants and

conversion option, goodwill and long-lived asset impairment, restructure-related costs (including severance costs) and the impact of significant non-recurring items. The Company defines free cash flow as net cash used in

(provided by) operating activities minus capital expenditures. Categories such as income tax expense (benefit), changes in fair value of warrants and conversion option, and significant non-recurring items may impact the

actual full-year non-GAAP reconciliation for Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time.

(USD in millions)

Consolidated net loss from continuing operations

Interest expense, net

Depreciation and amortization

Stock-based compensation

Impairment of goodwill

Total Adjusted EBITDA

Consolidated net loss from continuing operations

Depreciation and amortization

Stock-based compensation

Impairment of goodwill

Changes in working capital

Other

Net Cash Used on Operating Activities

Payments for acquisition of property and equipment

Free Cash Flow

2023E

$ (127) (137)

27 - 29

21 - 23

7-8

19

$ (53) - (58)

2023E

$ (127) (137)

21 - 23

7-8

19

(17) - (19)

2-8

$ (95) - (98)

(15) - (20)

$ (110) (118)

1 The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture.View entire presentation