KKR Real Estate Finance Trust Results Presentation Deck

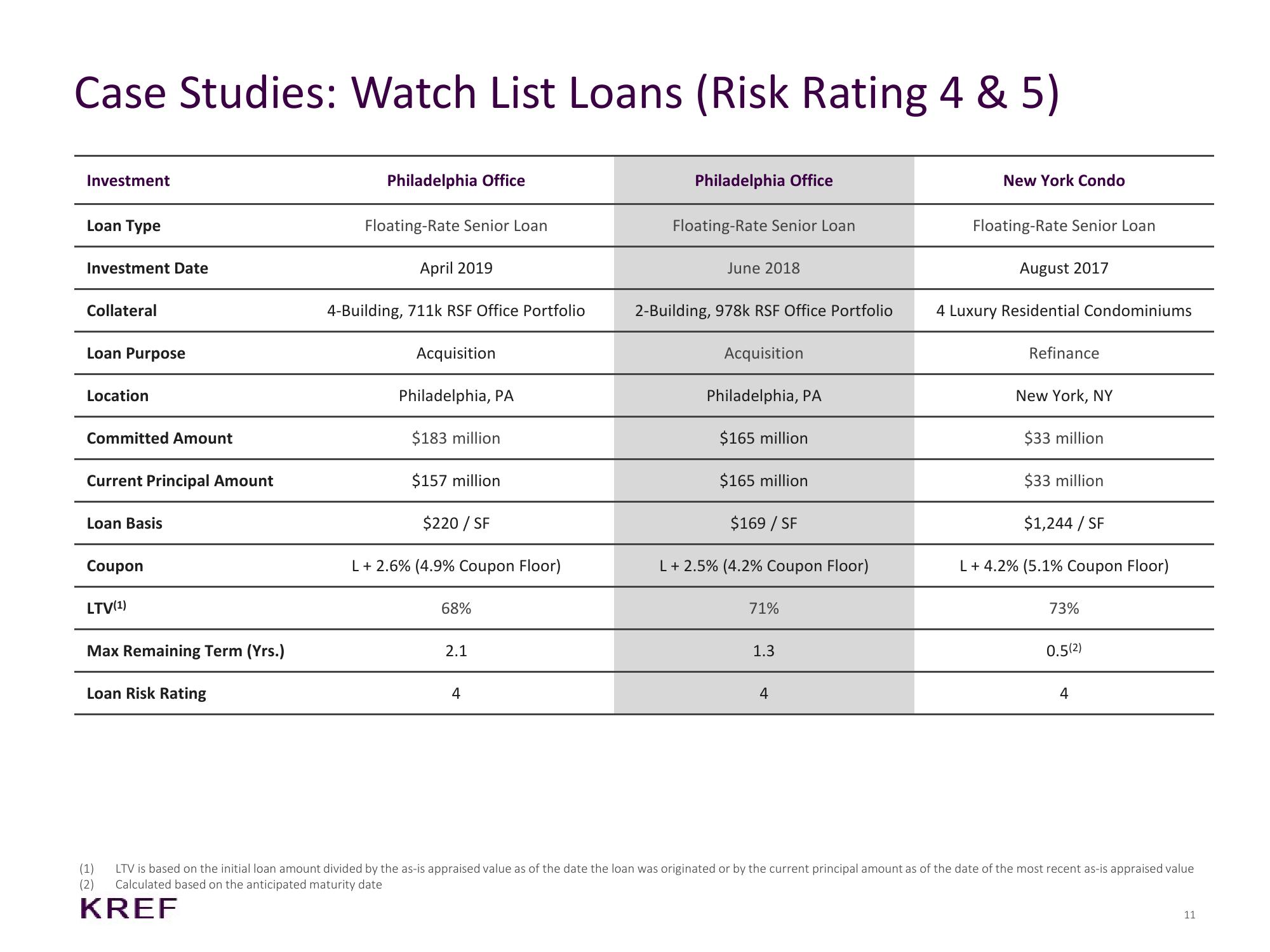

Case Studies: Watch List Loans (Risk Rating 4 & 5)

Investment

Loan Type

Investment Date

Collateral

Loan Purpose

Location

Committed Amount

Current Principal Amount

Loan Basis

Coupon

LTV(¹)

Max Remaining Term (Yrs.)

Loan Risk Rating

(1)

(2)

Philadelphia Office

Floating-Rate Senior Loan

April 2019

4-Building, 711k RSF Office Portfolio

Acquisition

Philadelphia, PA

$183 million

$157 million

$220 / SF

L + 2.6% (4.9% Coupon Floor)

68%

2.1

4

Philadelphia Office

Floating-Rate Senior Loan

June 2018

2-Building, 978k RSF Office Portfolio

Acquisition

Philadelphia, PA

$165 million

$165 million

$169 / SF

L + 2.5% (4.2% Coupon Floor)

71%

1.3

4

New York Condo

Floating-Rate Senior Loan

August 2017

4 Luxury Residential Condominiums

Refinance

New York, NY

$33 million

$33 million

$1,244 / SF

L+ 4.2% (5.1% Coupon Floor)

73%

0.5(2)

4

LTV is based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value

Calculated based on the anticipated maturity date

KREF

11View entire presentation