Affirm Results Presentation Deck

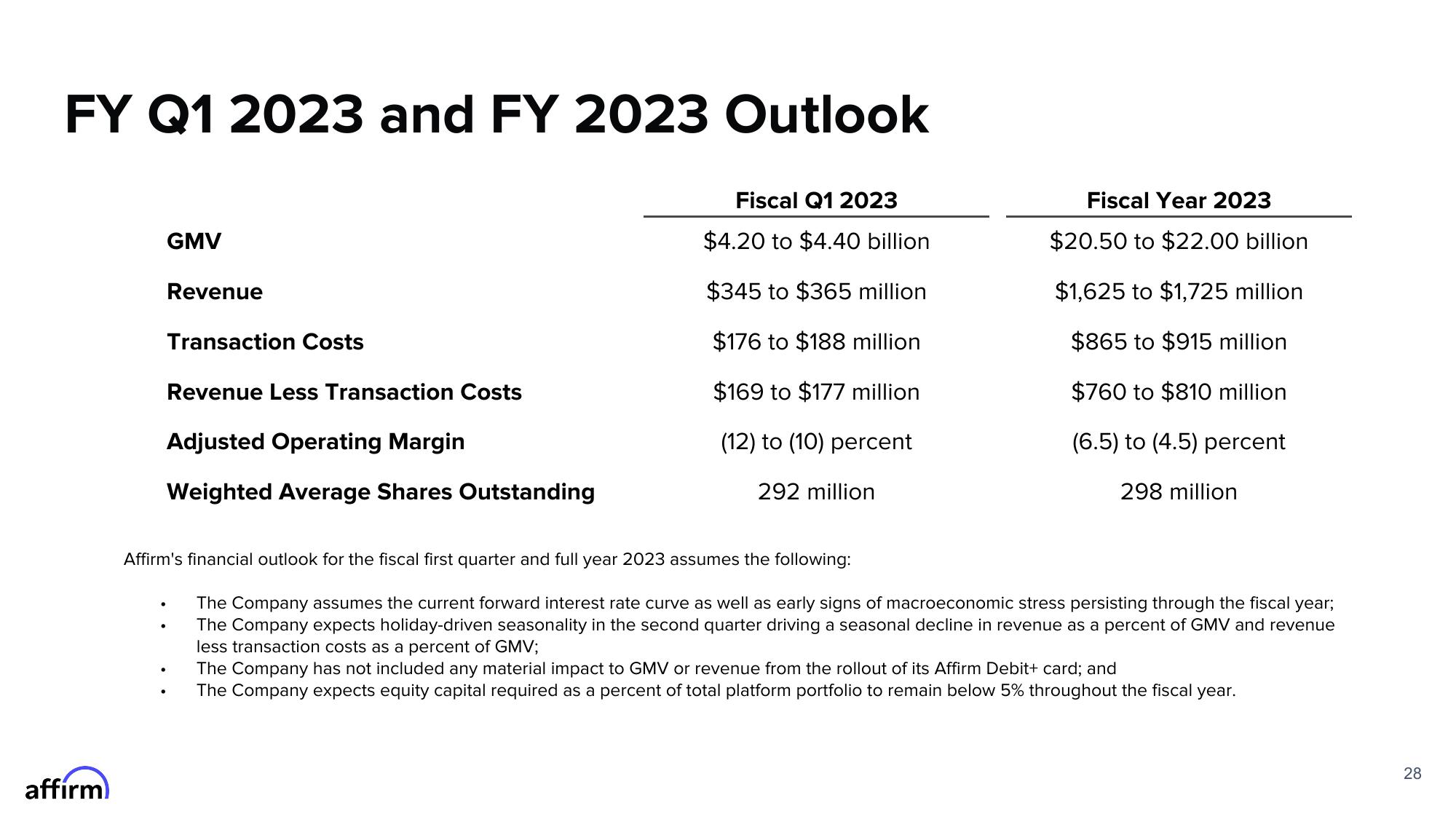

FY Q1 2023 and FY 2023 Outlook

Fiscal Q1 2023

$4.20 to $4.40 billion

$345 to $365 million

$176 to $188 million

$169 to $177 million

(12) to (10) percent

292 million

affirm

GMV

Revenue

Transaction Costs

Revenue Less Transaction Costs

Adjusted Operating Margin

Weighted Average Shares Outstanding

Fiscal Year 2023

$20.50 to $22.00 billion

$1,625 to $1,725 million

$865 to $915 million

$760 to $810 million

(6.5) to (4.5) percent

298 million

Affirm's financial outlook for the fiscal first quarter and full year 2023 assumes the following:

The Company assumes the current forward interest rate curve as well as early signs of macroeconomic stress persisting through the fiscal year;

The Company expects holiday-driven seasonality in the second quarter driving a seasonal decline in revenue as a percent of GMV and revenue

less transaction costs as a percent of GMV;

The Company has not included any material impact to GMV or revenue from the rollout of its Affirm Debit+ card; and

The Company expects equity capital required as a percent of total platform portfolio to remain below 5% throughout the fiscal year.

28View entire presentation