HUB Security SPAC Presentation Deck

(US$ in millions, unless otherwise noted)

.

Sources (1) (2)

HUB Equity

SPAC Cash in Trust (3)

PIPE Cash (4)

Founder Shares

Transaction Expenses (Paid in Equity)

Total Sources

ENTONCE

Transaction Overview

Uses (1) (2)

HUB Equity

Cash to Balance Sheet (5)

Transaction Expenses (6)

Founder Shares

(1)

Total Uses

(3)

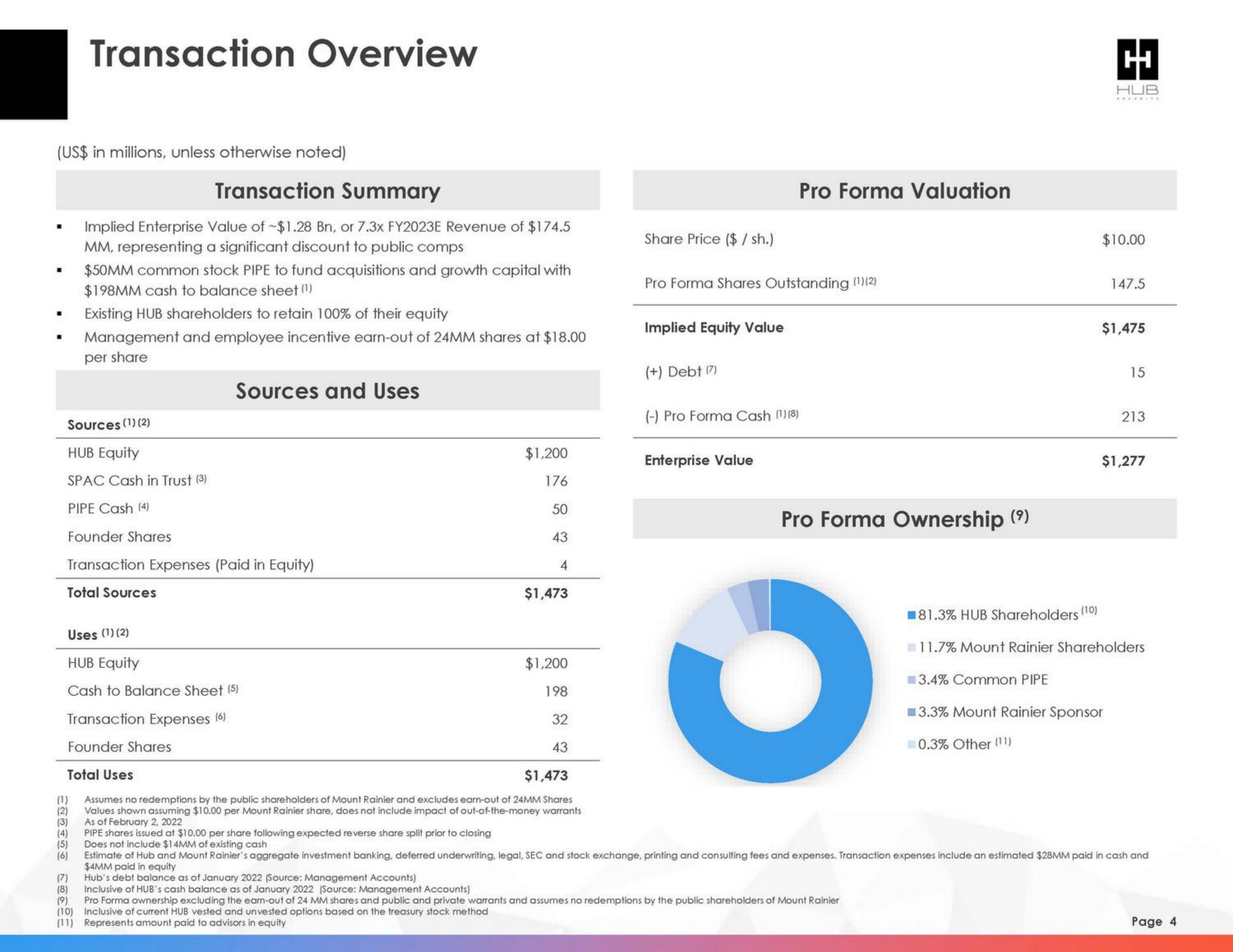

Transaction Summary

Implied Enterprise Value of ~$1.28 Bn, or 7.3x FY2023E Revenue of $174.5

MM, representing a significant discount to public comps

(4)

$50MM common stock PIPE to fund acquisitions and growth capital with

$198MM cash to balance sheet (¹)

Existing HUB shareholders to retain 100% of their equity

Management and employee incentive earn-out of 24MM shares at $18.00

per share

(5)

$1,473

Assumes no redemptions by the public shareholders of Mount Rainier and excludes earn-out of 24MM Shares

(2) Values shown assuming $10.00 per Mount Rainier share, does not include impact of out-of-the-money warrants

As of February 2, 2022

(6)

(7)

Sources and Uses

PIPE shares issued at $10.00 per share following expected reverse share split prior to closing

Does not include $14MM of existing cash

Hub's debt balance as of January 2022 (Source: Management Accounts)

$1,200

176

50

43

4

Inclusive of HUB's cash balance as of January 2022 (Source: Management Accounts)

$1,473

$1,200

198

32

43

(11) Represents amount paid to advisors in equity

Share Price ($/sh.)

Pro Forma Shares Outstanding (1)(2)

Implied Equity Value

(+) Debt (7)

Pro Forma Valuation

(-) Pro Forma Cash (1) (8)

Enterprise Value

Pro Forma Ownership (⁹)

(8)

(9)

Pro Forma ownership excluding the earn-out of 24 MM shares and public and private warrants and assumes no redemptions by the public shareholders of Mount Rainier

(10) Inclusive of current HUB vested and unvested options based on the treasury stock method

3.4% Common PIPE

H

HUB

$10.00

147.5

$1,475

3.3% Mount Rainier Sponsor

0.3% Other (11)

15

Estimate of Hub and Mount Rainier's aggregate investment banking, deferred underwriting, legal, SEC and stock exchange, printing and consulting fees and expenses. Transaction expenses include an estimated $28MM paid in cash and

$4MM paid in equity

213

$1,277

81.3% HUB Shareholders (10)

11.7% Mount Rainier Shareholders

Page 4View entire presentation