Investor Presentation

Measuring Customer Value

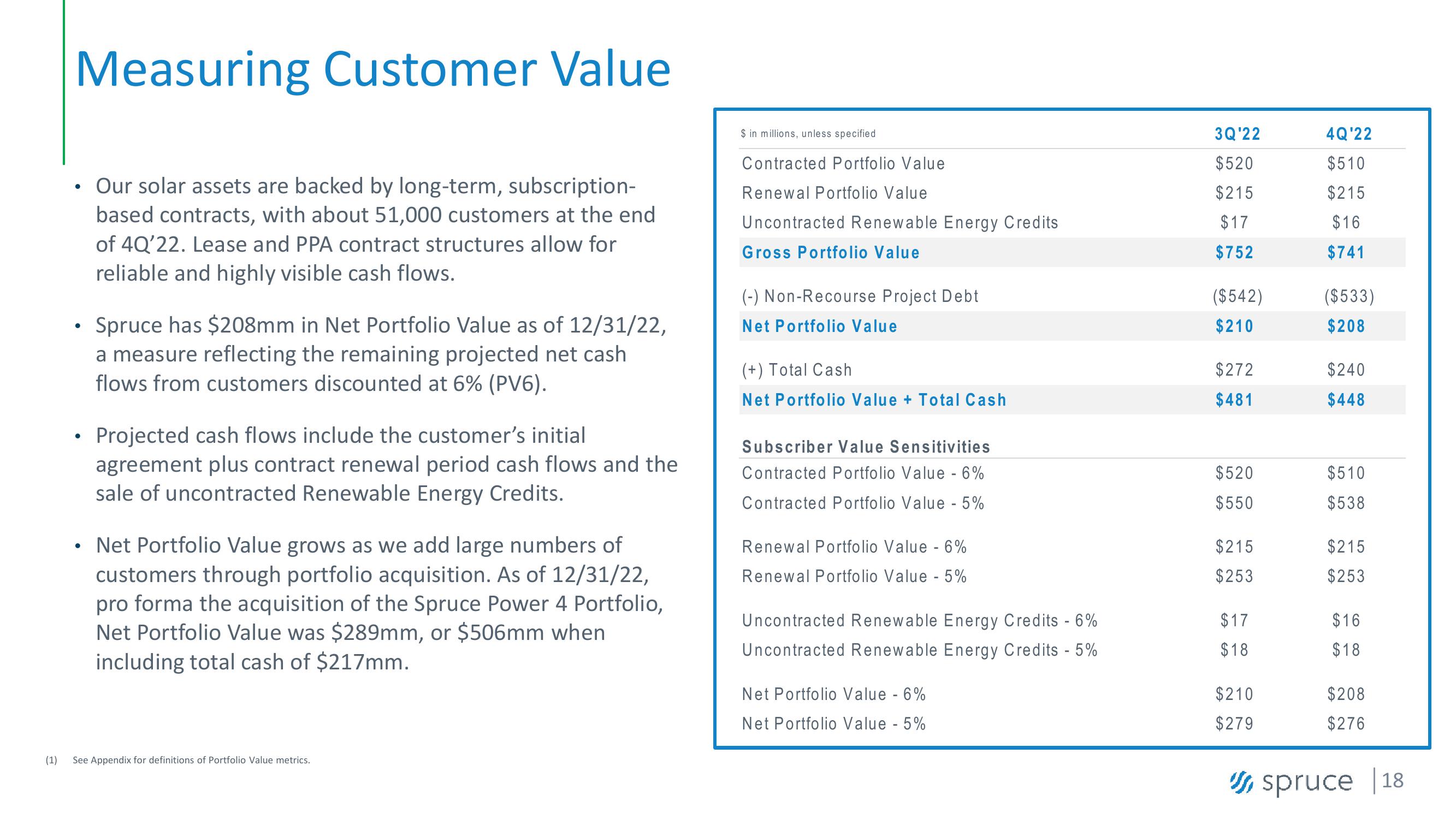

• Our solar assets are backed by long-term, subscription-

based contracts, with about 51,000 customers at the end

of 4Q'22. Lease and PPA contract structures allow for

reliable and highly visible cash flows.

•

•

Spruce has $208mm in Net Portfolio Value as of 12/31/22,

a measure reflecting the remaining projected net cash

flows from customers discounted at 6% (PV6).

Projected cash flows include the customer's initial

agreement plus contract renewal period cash flows and the

sale of uncontracted Renewable Energy Credits.

⚫ Net Portfolio Value grows as we add large numbers of

customers through portfolio acquisition. As of 12/31/22,

pro forma the acquisition of the Spruce Power 4 Portfolio,

Net Portfolio Value was $289mm, or $506mm when

including total cash of $217mm.

(1) See Appendix for definitions of Portfolio Value metrics.

$ in millions, unless specified

3Q'22

4Q'22

Contracted Portfolio Value

$520

$510

Renewal Portfolio Value

$215

$215

Uncontracted Renewable Energy Credits

$17

$16

Gross Portfolio Value

$752

$741

(-) Non-Recourse Project Debt

($542)

($533)

Net Portfolio Value

$210

$208

(+) Total Cash

$272

$240

Net Portfolio Value + Total Cash

$481

$448

Subscriber Value Sensitivities

Contracted Portfolio Value - 6%

$520

$510

Contracted Portfolio Value - 5%

$550

$538

Renewal Portfolio Value -6%

$215

$215

$253

$253

Uncontracted Renewable Energy Credits - 6%

$17

$16

Uncontracted Renewable Energy Credits - 5%

$18

$18

Net Portfolio Value - 6%

$210

$208

Net Portfolio Value - 5%

$279

$276

spruce 18

Renewal Portfolio Value - 5%View entire presentation