Freyr Results Presentation Deck

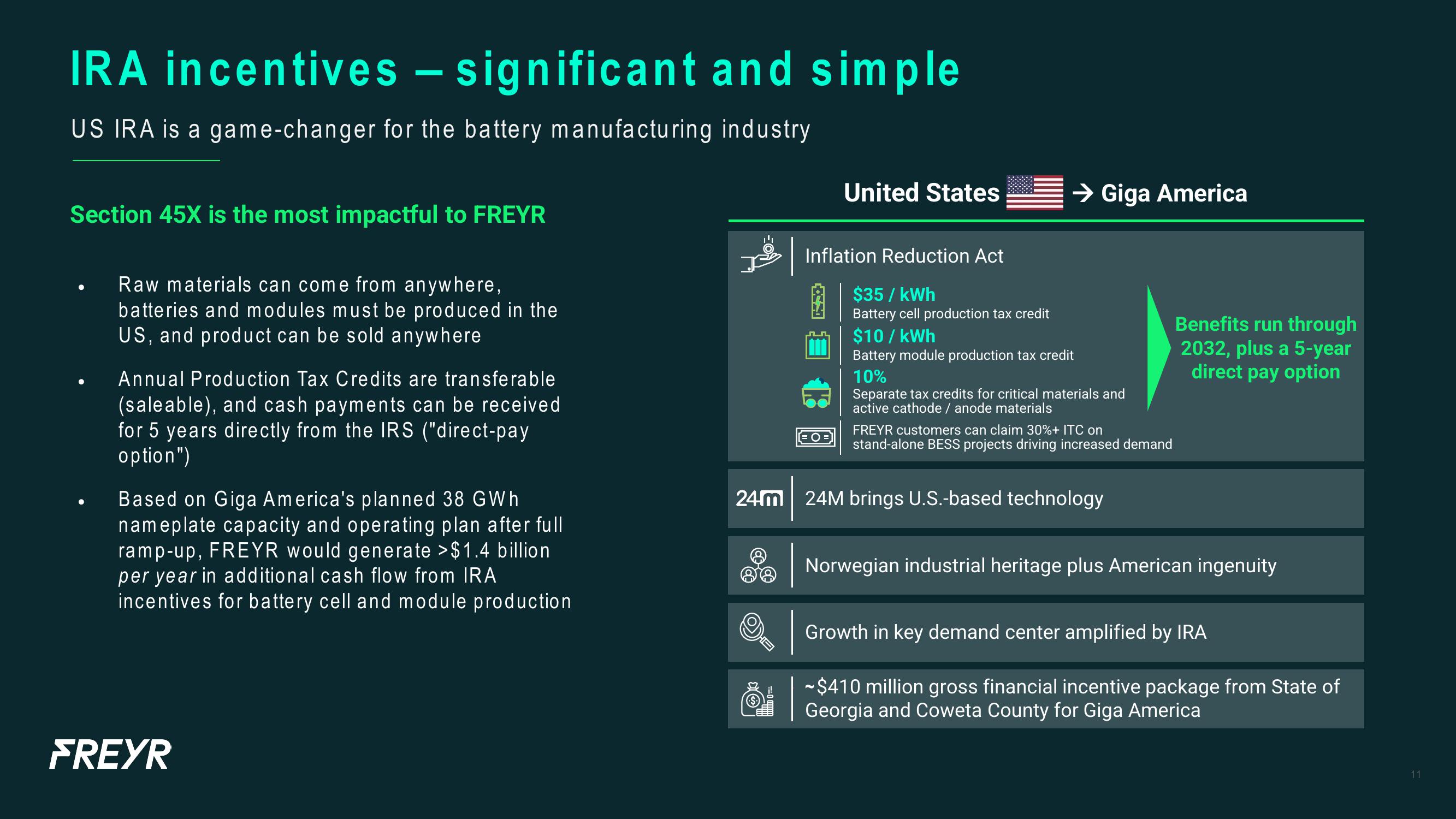

IRA incentives - significant and simple

US IRA is a game-changer for the battery manufacturing industry

Section 45X is the most impactful to FREYR

Raw materials can come from anywhere,

batteries and modules must be produced in the

US, and product can be sold anywhere

Annual Production Tax Credits are transferable

(saleable), and cash payments can be received

for 5 years directly from the IRS ("direct-pay

option")

Based on Giga America's planned 38 GWh

nameplate capacity and operating plan after full

ramp-up, FREYR would generate >$1.4 billion

per year in additional cash flow from IRA

incentives for battery cell and module production

FREYR

United States

Inflation Reduction Act

[=O=)

$35/kWh

Battery cell production tax credit

$10/kWh

→ Giga America

Battery module production tax credit

10%

Separate tax credits for critical materials and

active cathode / anode materials

FREYR customers can claim 30%+ ITC on

stand-alone BESS projects driving increased demand

24m 24M brings U.S.-based technology

Benefits run through

2032, plus a 5-year

direct pay option

Norwegian industrial heritage plus American ingenuity

Growth in key demand center amplified by IRA

-$410 million gross financial incentive package from State of

Georgia and Coweta County for Giga America

11View entire presentation