Bank of America Investment Banking Pitch Book

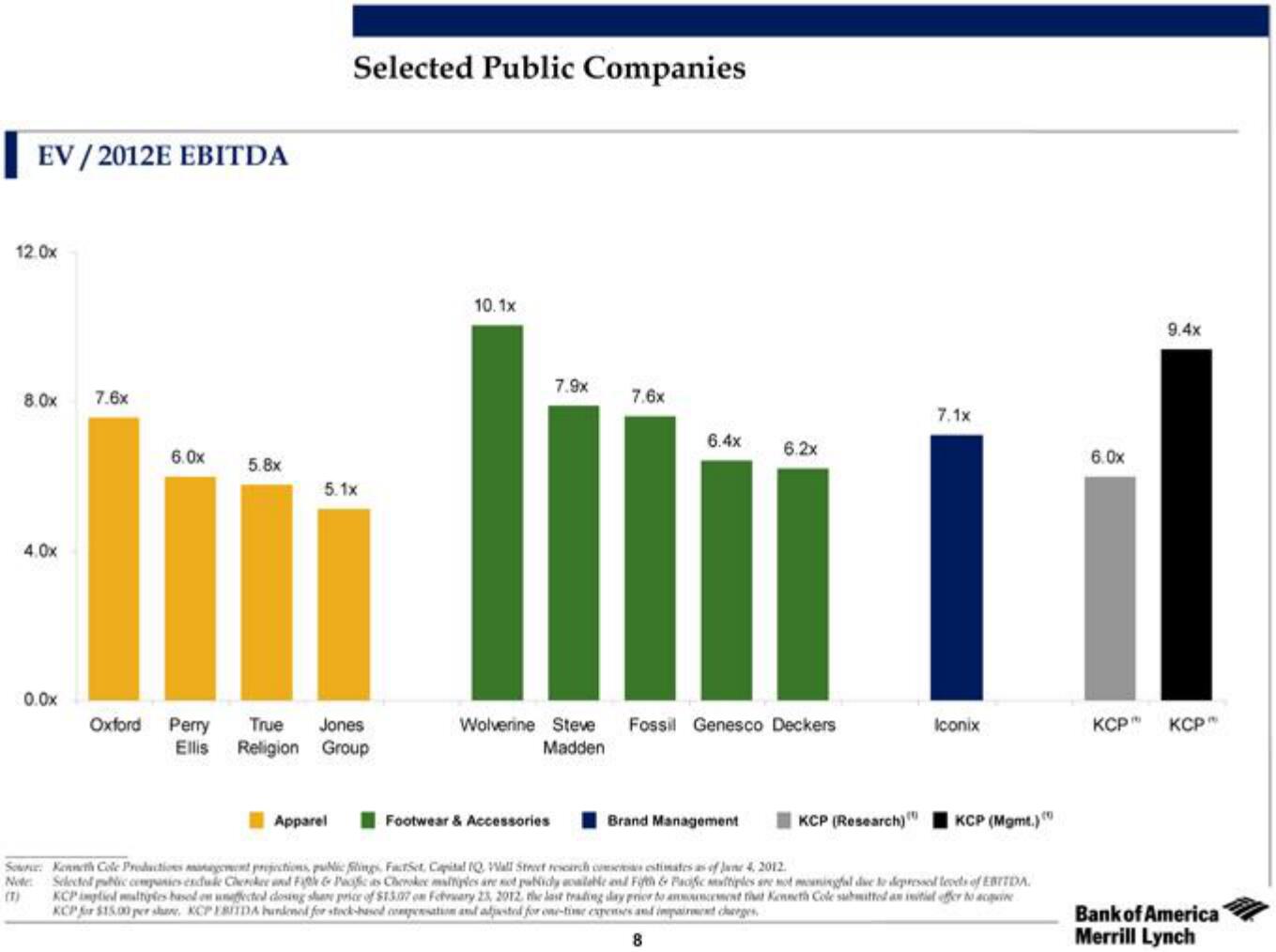

EV/2012E EBITDA

12.0x

8.0x 7.6x

4.0x

0.0x

6.0x

5.8x

Selected Public Companies

5.1x

Oxford Perry True Jones

Ellis Religion Group

Apparel

10.1x

7.9x

7.6x

Footwear & Accessories

6.4x

6.2x

Wolverine Steve Fossil Genesco Deckers

Madden

Brand Management

Source: Kenneth Cole Productions management projections, public Slings, FactSet, Capital IQ Wall Street research ceas estimates as of June 4, 2012.

Note: Selected pubic companies exdule Cherokee and Fit & Pacices Cherokee multiples are not publicly available and Fifth & Pacific multiples are not meaningfal due to depressol teeds of EBITDA.

KCP implied multiplies based on unaffected closing share price of $13.07 on February 23, 2012, the last trading day prior to announcement that Kenneth Cole submitted an initial offer to acquire

KCP for $15.00 per shan, KCP EBITDA hundened for stock-based compensation and adjusted for one-time expenses and impairment changes.

(1)

8

7.1x

KCP (Research)

Iconix

KCP (Mgmt.)

6.0x

9.4x

KCP™ KCP™

Bank of America

Merrill LynchView entire presentation