Baird Investment Banking Pitch Book

AR BENCHMARKING

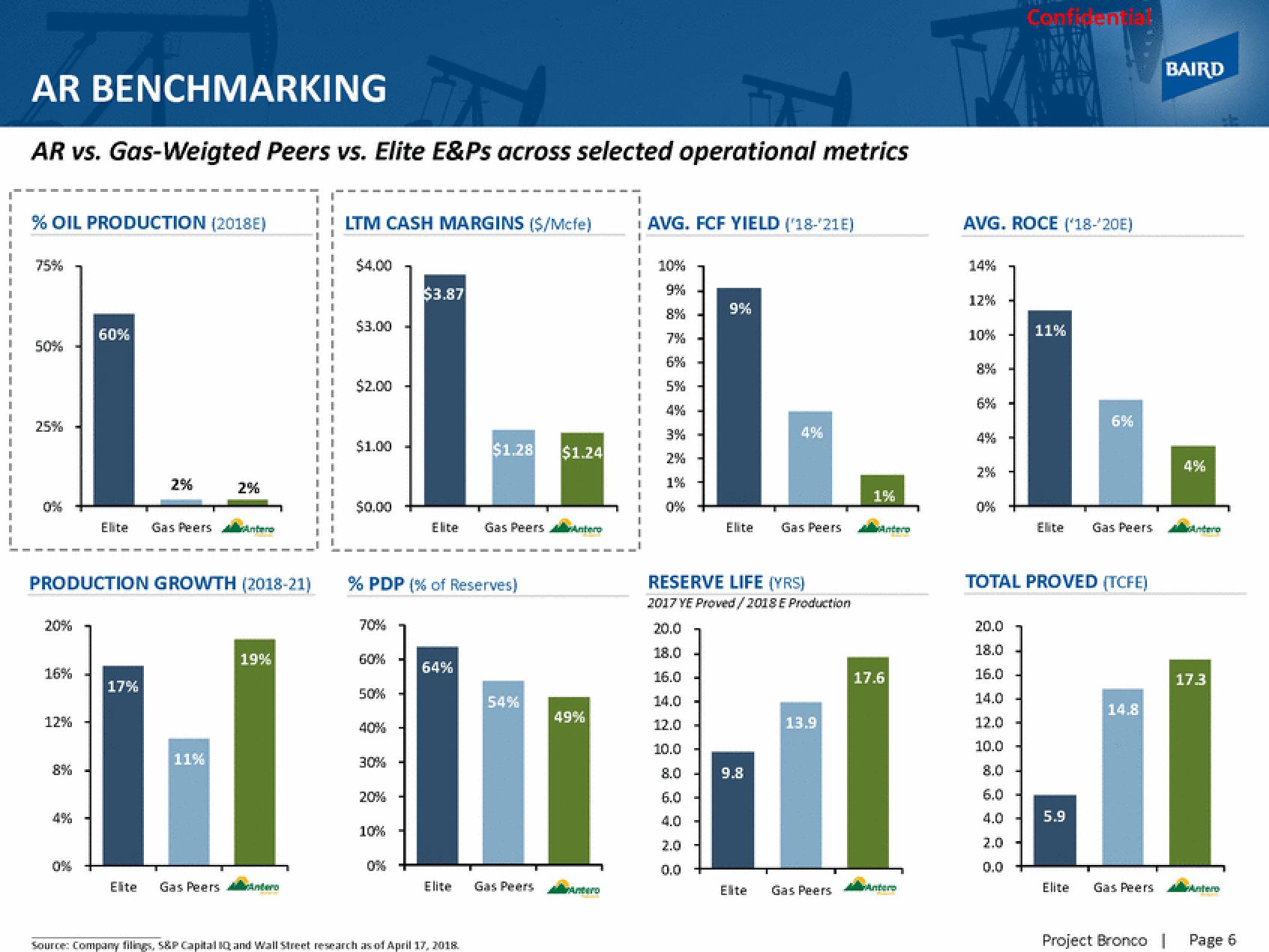

AR vs. Gas-Weigted Peers vs. Elite E&Ps across selected operational metrics

% OIL PRODUCTION (2018E)

75%

50%

25%

20%

16%

12%

8%

PRODUCTION GROWTH (2018-21)

4%

60%

0%

Elite

2%

17%

Gas Peers

11%

2%

Elite Gas Peers

19%

I

! LTM CASH MARGINS ($/Mcfe)

1

$4.00

$3.00

$2.00

$1.00

$0.00

70%

60%

% PDP (% of Reserves)

50%

40%

30% -

20%

$3.87

10%

Elite Gas Peers Antero

64%

$1.28

Elite

Source: Company filings, S&P Capital IQ and Wall Street research as of April 17, 2018.

54%

$1.24

Gas Peers

49%

Antero

AVG. FCF YIELD ('18-21E)

10%

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

9%

2.0

0.0

Elite

4%

RESERVE LIFE (YRS)

2017 YE Proved/2018 E Production

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

9.8

Gas Peers

13.9

Elite Gas Peers

1%

Antero

17.6

Antero

AVG. ROCE (18-20E)

14%

12%

10%

8%

6%

4%

2%

0%

Confidential

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

0.0

11%

6%

Elite Gas Peers

TOTAL PROVED (TCFE)

5.9

14.8

Elite Gas Peers

Project Bronco

BAIRD

4%

Antero

17.3

Intero

Page 6View entire presentation