Meyer Burger Investor Presentation

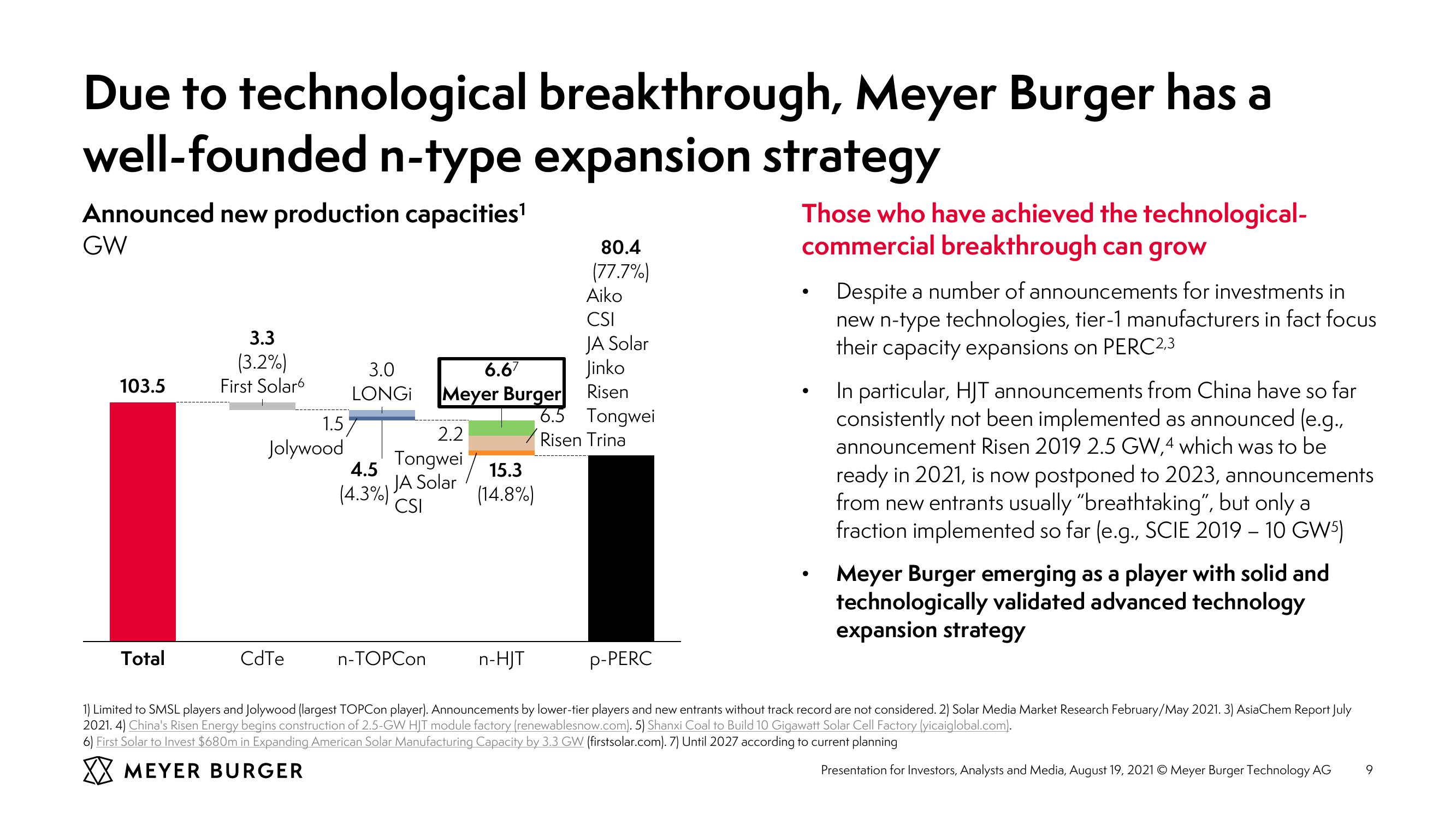

Due to technological breakthrough, Meyer Burger has a

well-founded n-type expansion strategy

Announced new production capacities¹

GW

103.5

3.3

(3.2%)

First Solar

80.4

(77.7%)

Aiko

CSI

JA Solar

Jinko

Risen

3.0

LONGi

6.67

Meyer Burger

1.57

6.5

2.2

Jolywood

Tongwei

Risen Trina

4.5

(4.3%)

Tongwei

JA Solar

CSI

15.3

(14.8%)

Those who have achieved the technological-

commercial breakthrough can grow

•

•

•

Despite a number of announcements for investments in

new n-type technologies, tier-1 manufacturers in fact focus

their capacity expansions on PERC2,3

In particular, HJT announcements from China have so far

consistently not been implemented as announced (e.g.,

announcement Risen 2019 2.5 GW,4 which was to be

ready in 2021, is now postponed to 2023, announcements

from new entrants usually "breathtaking", but only a

fraction implemented so far (e.g., SCIE 2019 – 10 GW5)

Meyer Burger emerging as a player with solid and

technologically validated advanced technology

expansion strategy

Total

CdTe

n-TOPCon

n-HJT

p-PERC

1) Limited to SMSL players and Jolywood (largest TOPCon player). Announcements by lower-tier players and new entrants without track record are not considered. 2) Solar Media Market Research February/May 2021. 3) AsiaChem Report July

2021. 4) China's Risen Energy begins construction of 2.5-GW HJT module factory (renewablesnow.com). 5) Shanxi Coal to Build 10 Gigawatt Solar Cell Factory (yicaiglobal.com).

6) First Solar to Invest $680m in Expanding American Solar Manufacturing Capacity by 3.3 GW (firstsolar.com). 7) Until 2027 according to current planning

MEYER BURGER

Presentation for Investors, Analysts and Media, August 19, 2021 Meyer Burger Technology AG

9View entire presentation