Apollo Global Management Investor Day Presentation Deck

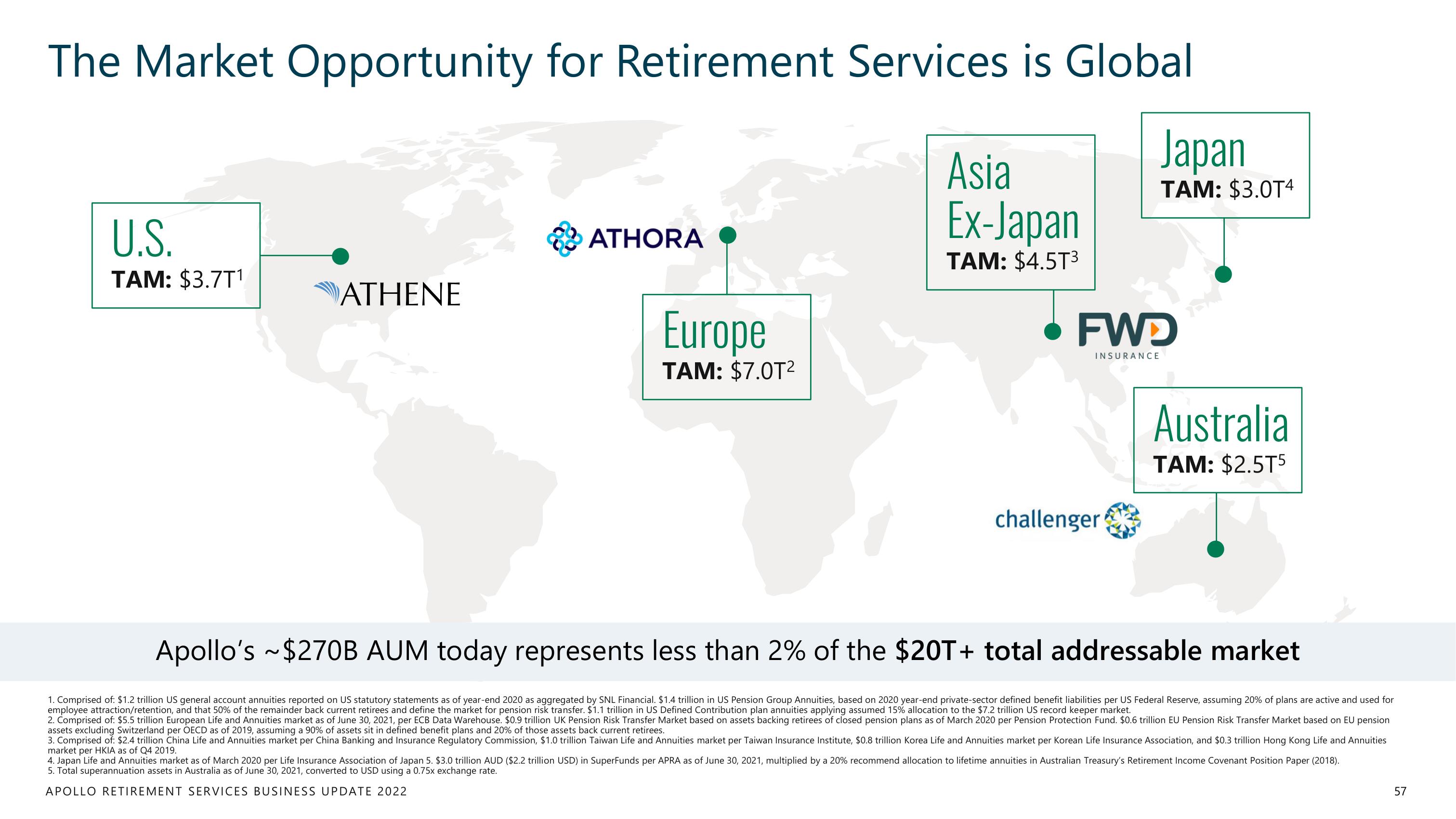

The Market Opportunity for Retirement Services is Global

Japan

TAM: $3.0T4

U.S.

TAM: $3.7T¹

ATHENE

ATHORA

Europe

TAM: $7.0T²

Asia

Ex-Japan

TAM: $4.5T³

• FWD

INSURANCE

challenger

Australia

TAM: $2.5T5

Apollo's ~$270B AUM today represents less than 2% of the $20T+ total addressable market

1. Comprised of: $1.2 trillion US general account annuities reported on US statutory statements as of year-end 2020 as aggregated by SNL Financial. $1.4 trillion in US Pension Group Annuities, based on 2020 year-end private-sector defined benefit liabilities per US Federal Reserve, assuming 20% of plans are active and used for

employee attraction/retention, and that 50% of the remainder back current retirees and define the market for pension risk transfer. $1.1 trillion in US Defined Contribution plan annuities applying assumed 15% allocation to the $7.2 trillion US record keeper market.

2. Comprised of: $5.5 trillion European Life and Annuities market as of June 30, 2021, per ECB Data Warehouse. $0.9 trillion UK Pension Risk Transfer Market based on assets backing retirees of closed pension plans as of March 2020 per Pension Protection Fund. $0.6 trillion EU Pension Risk Transfer Market based on EU pension

assets excluding Switzerland per OECD as of 2019, assuming a 90% of assets sit in defined benefit plans and 20% of those assets back current retirees.

3. Comprised of: $2.4 trillion China Life and Annuities market per China Banking and Insurance Regulatory Commission, $1.0 trillion Taiwan Life and Annuities market per Taiwan Insurance Institute, $0.8 trillion Korea Life and Annuities market per Korean Life Insurance Association, and $0.3 trillion Hong Kong Life and Annuities

market per HKIA as of Q4 2019.

4. Japan Life and Annuities market as of March 2020 per Life Insurance Association of Japan 5. $3.0 trillion AUD ($2.2 trillion USD) in SuperFunds per APRA as of June 30, 2021, multiplied by a 20% recommend allocation to lifetime annuities in Australian Treasury's Retirement Income Covenant Position Paper (2018).

5. Total superannuation assets in Australia as of June 30, 2021, converted to USD using a 0.75x exchange rate.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

57View entire presentation