Melrose Results Presentation Deck

Interest

Melrose

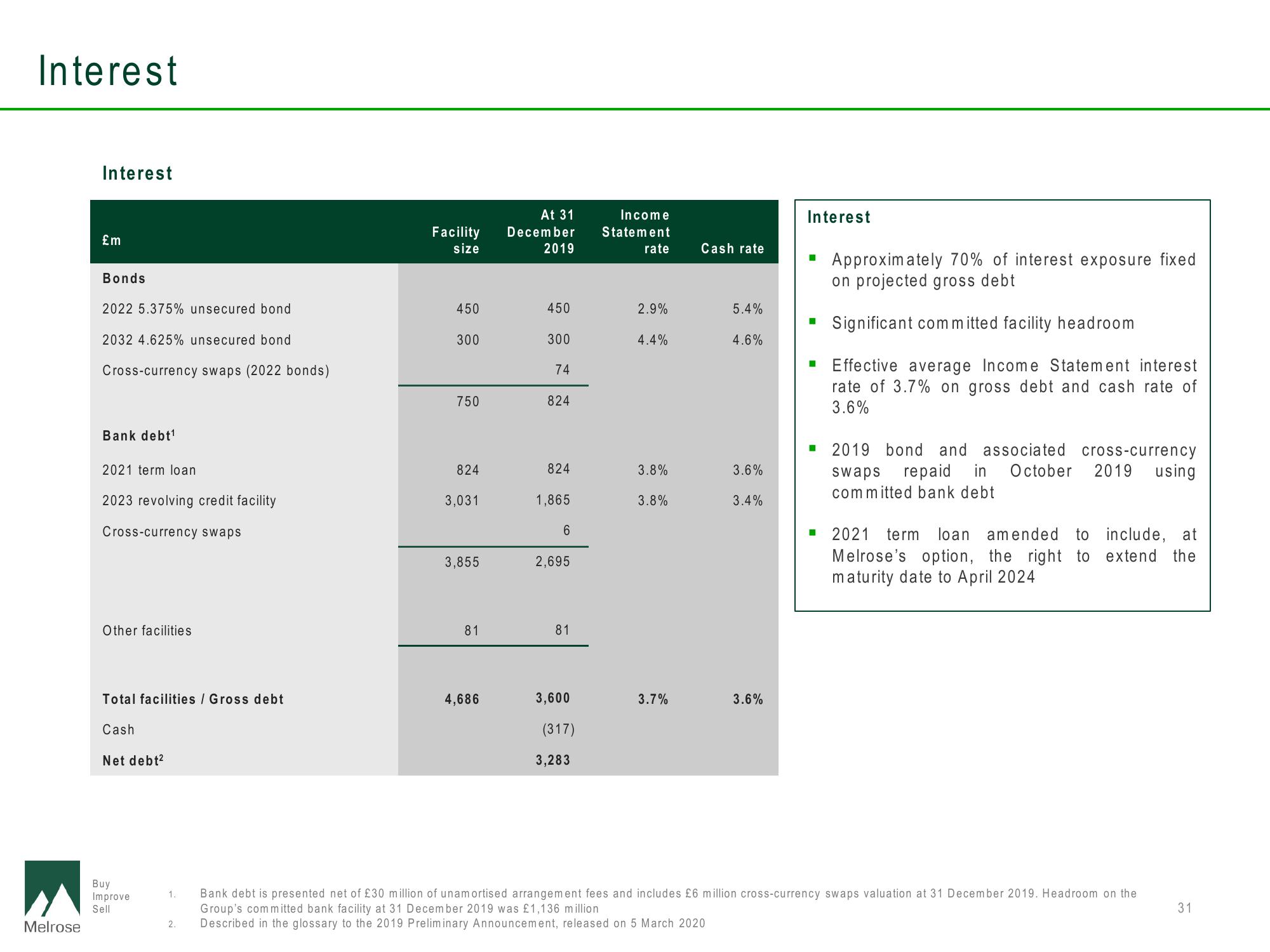

Interest

£m

Bonds

2022 5.375% unsecured bond

2032 4.625% unsecured bond

Cross-currency swaps (2022 bonds)

Bank debt¹

2021 term loan

2023 revolving credit facility

Cross-currency swaps

Other facilities

Total facilities / Gross debt

Cash

Net debt²

Buy

Improve

Sell

1.

2.

Facility

size

450

300

750

824

3,031

3,855

81

4,686

At 31

December

2019

450

300

74

824

824

1,865

6

2,695

81

3,600

(317)

3,283

Income

Statement

rate

2.9%

4.4%

3.8%

3.8%

3.7%

Cash rate

5.4%

4.6%

3.6%

3.4%

3.6%

Interest

■

■

Approximately 70% of interest exposure fixed

on projected gross debt

Significant committed facility headroom

Effective average Income Statement interest

rate of 3.7% on gross debt and cash rate of

3.6%

2019 bond and associated cross-currency

swaps repaid in October 2019 using

committed bank debt

2021 term loan amended to include, at

Melrose's option, the right to extend the

maturity date to April 2024

Bank debt is presented net of £30 million of unamortised arrangement fees and includes £6 million cross-currency swaps valuation at 31 December 2019. Headroom on the

Group's committed bank facility at 31 December 2019 was £1,136 million

Described in the glossary to the 2019 Preliminary Announcement, released on 5 March 2020

31View entire presentation