Adani Green Energy Limited

Profitable Growth Leading to Superior Returns

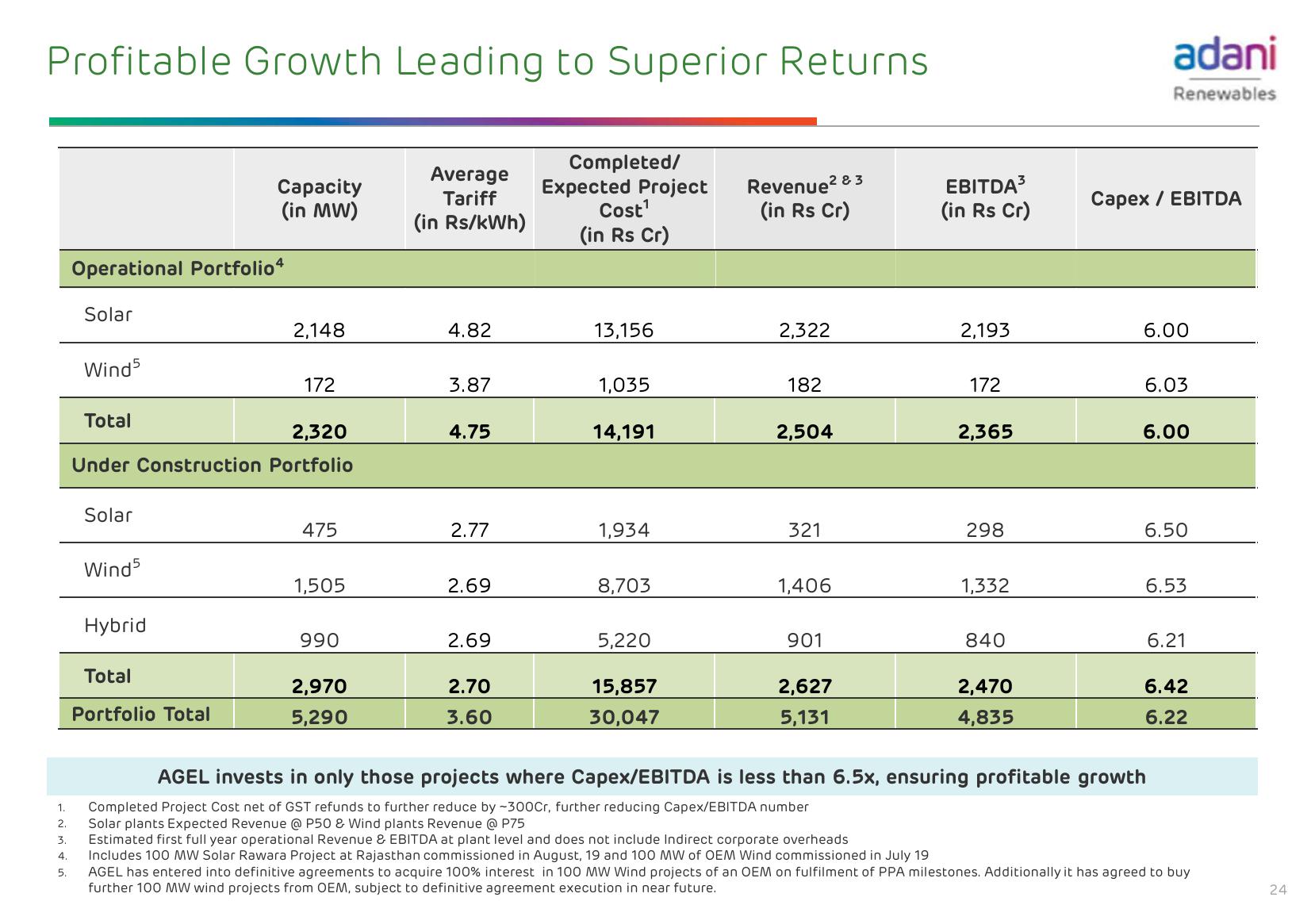

1.

2.

3.

4.

5.

Capacity

(in MW)

Operational Portfolio

4

Solar

Wind5

Total

adani

Renewables

Average

Tariff

(in Rs/kWh)

Completed/

Expected Project

Cost¹

(in Rs Cr)

Revenue²

(in Rs Cr)

2 & 3

EBITDA³

(in Rs Cr)

Capex/ EBITDA

2,148

4.82

13,156

2,322

2,193

6.00

172

3.87

1,035

182

172

6.03

2,320

4.75

14,191

2,504

2,365

6.00

Under Construction Portfolio

Solar

475

2.77

1,934

321

298

6.50

Wind5

1,505

2.69

8,703

1,406

1,332

6.53

Hybrid

990

2.69

5,220

901

840

6.21

Total

2,970

2.70

15,857

2,627

2,470

6.42

Portfolio Total

5,290

3.60

30,047

5,131

4,835

6.22

AGEL invests in only those projects where Capex/EBITDA is less than 6.5x, ensuring profitable growth

Completed Project Cost net of GST refunds to further reduce by -300Cr, further reducing Capex/EBITDA number

Solar plants Expected Revenue @ P50 & Wind plants Revenue @ P75

Estimated first full year operational Revenue & EBITDA at plant level and does not include Indirect corporate overheads

Includes 100 MW Solar Rawara Project at Rajasthan commissioned in August, 19 and 100 MW of OEM Wind commissioned in July 19

AGEL has entered into definitive agreements to acquire 100% interest in 100 MW Wind projects of an OEM on fulfilment of PPA milestones. Additionally it has agreed to buy

further 100 MW wind projects from OEM, subject to definitive agreement execution in near future.

24View entire presentation