Despegar Investor Day Presentation Deck

DESPEGAR

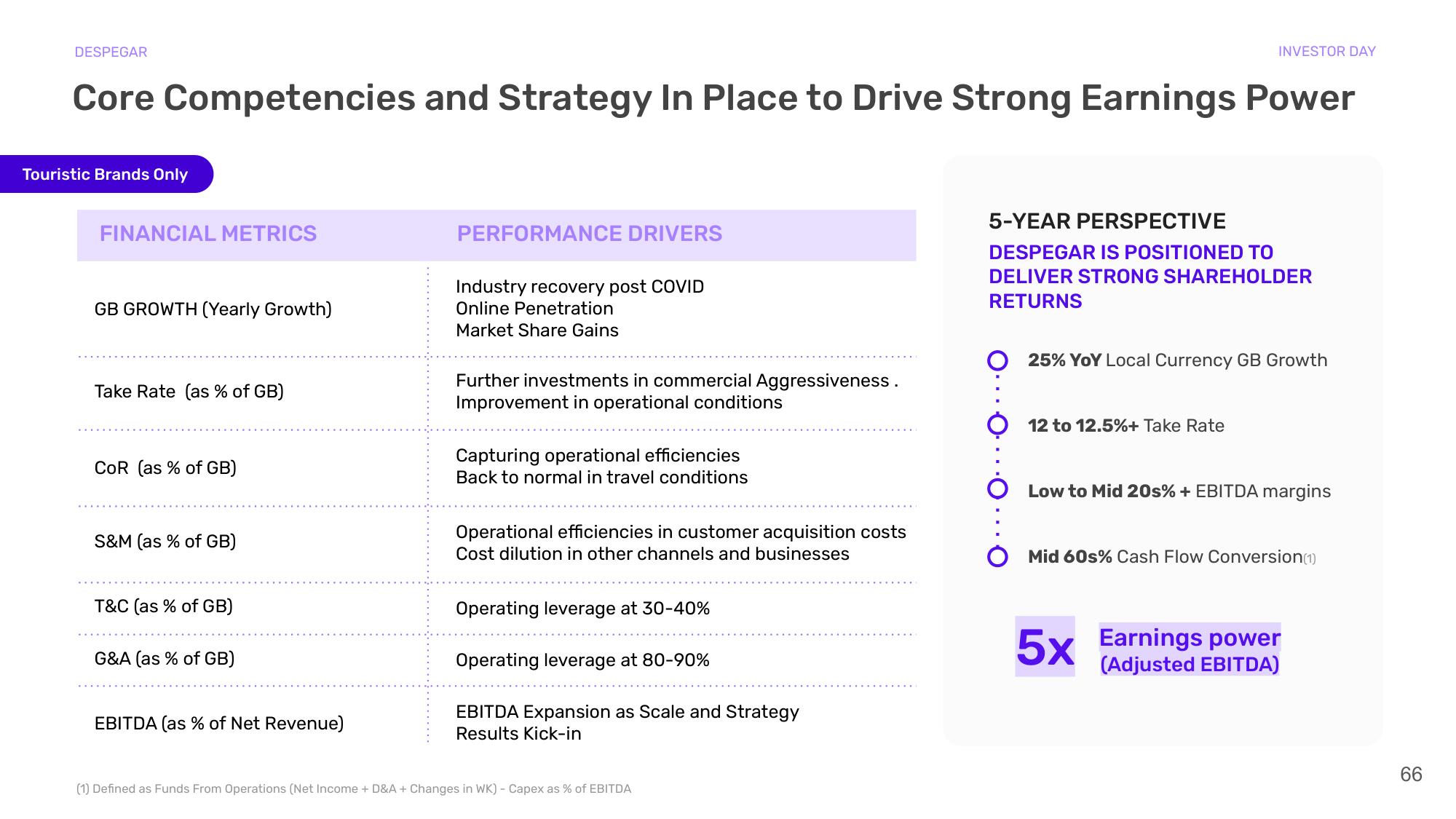

Core Competencies and Strategy In Place to Drive Strong Earnings Power

Touristic Brands Only

FINANCIAL METRICS

GB GROWTH (Yearly Growth)

Take Rate (as % of GB)

COR (as % of GB)

S&M (as % of GB)

T&C (as % of GB)

G&A (as % of GB)

EBITDA (as % of Net Revenue)

PERFORMANCE DRIVERS

Industry recovery post COVID

Online Penetration

Market Share Gains

Further investments in commercial Aggressiveness.

Improvement in operational conditions

Capturing operational efficiencies

Back to normal in travel conditions

Operational efficiencies in customer acquisition costs

Cost dilution in other channels and businesses

Operating leverage at 30-40%

Operating leverage at 80-90%

EBITDA Expansion as Scale and Strategy

Results Kick-in

(1) Defined as Funds From Operations (Net Income + D&A + Changes in WK) - Capex as % of EBITDA

INVESTOR DAY

5-YEAR PERSPECTIVE

DESPEGAR IS POSITIONED TO

DELIVER STRONG SHAREHOLDER

RETURNS

25% YoY Local Currency GB Growth

12 to 12.5%+ Take Rate

Low to Mid 20s% + EBITDA margins

Mid 60s% Cash Flow Conversion (1)

5x Earnings power

(Adjusted EBITDA)

66View entire presentation