Vale Results Presentation Deck

Vale's Performance in 2022: Base Metals

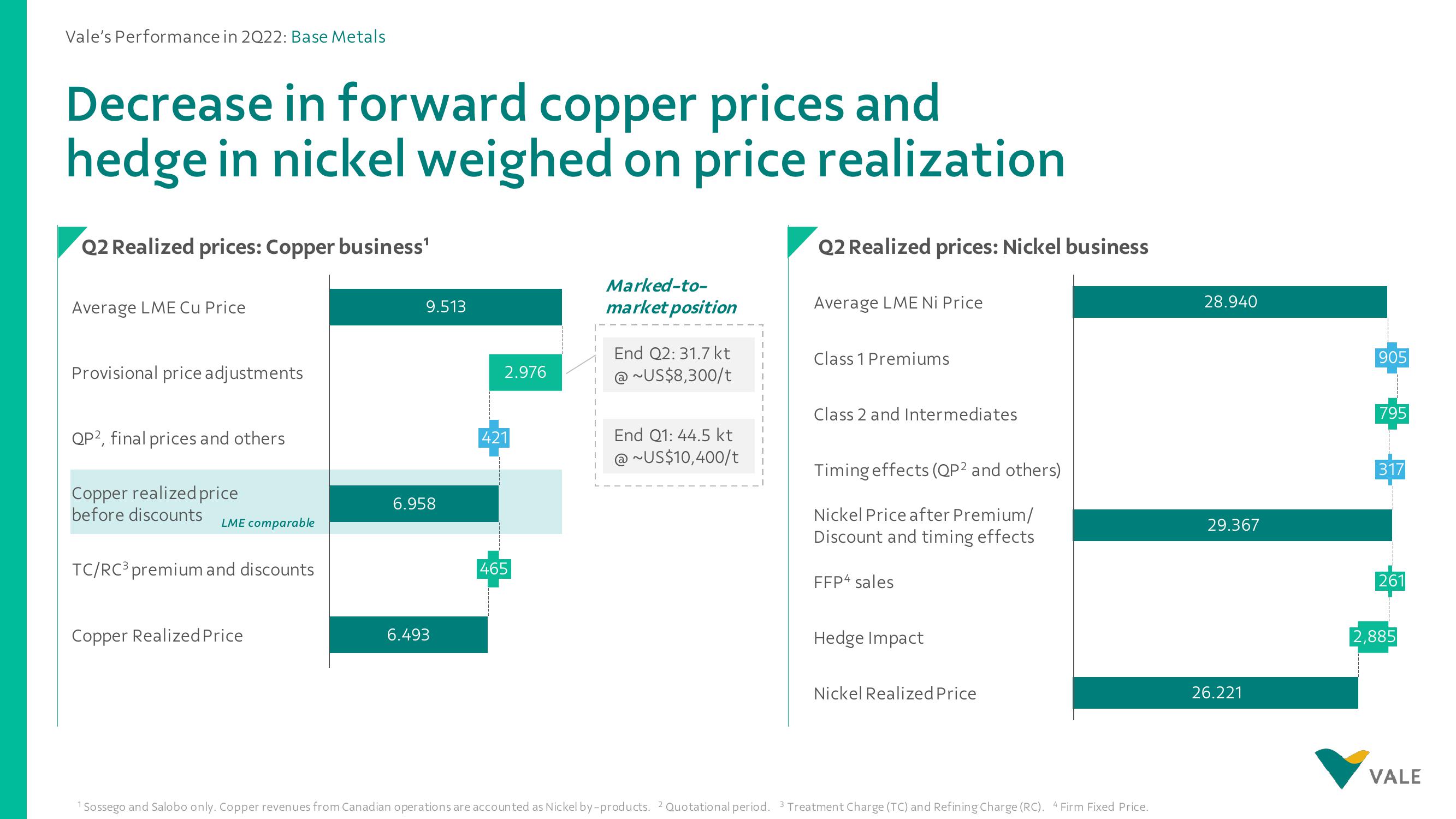

Decrease in forward copper prices and

hedge in nickel weighed on price realization

Q2 Realized prices: Copper business¹

Average LME Cu Price

Provisional price adjustments

QP2, final prices and others

Copper realized price

before discounts

LME comparable

TC/RC³ premium and discounts

Copper Realized Price

9.513

6.958

6.493

2.976

421

-01

465

Marked-to-

market position

End Q2: 31.7 kt

@ ~US$8,300/t

End Q1: 44.5 kt

@~US$10,400/t

Q2 Realized prices: Nickel business

Average LME Ni Price

Class 1 Premiums

Class 2 and Intermediates

Timing effects (QP² and others)

Nickel Price after Premium/

Discount and timing effects

FFP4 sales

Hedge Impact

Nickel Realized Price

¹ Sossego and Salobo only. Copper revenues from Canadian operations are accounted as Nickel by-products. 2 Quotational period. 3 Treatment Charge (TC) and Refining Charge (RC). 4 Firm Fixed Price.

28.940

29.367

26.221

905

795

317

261

2,885

VALEView entire presentation