Baird Investment Banking Pitch Book

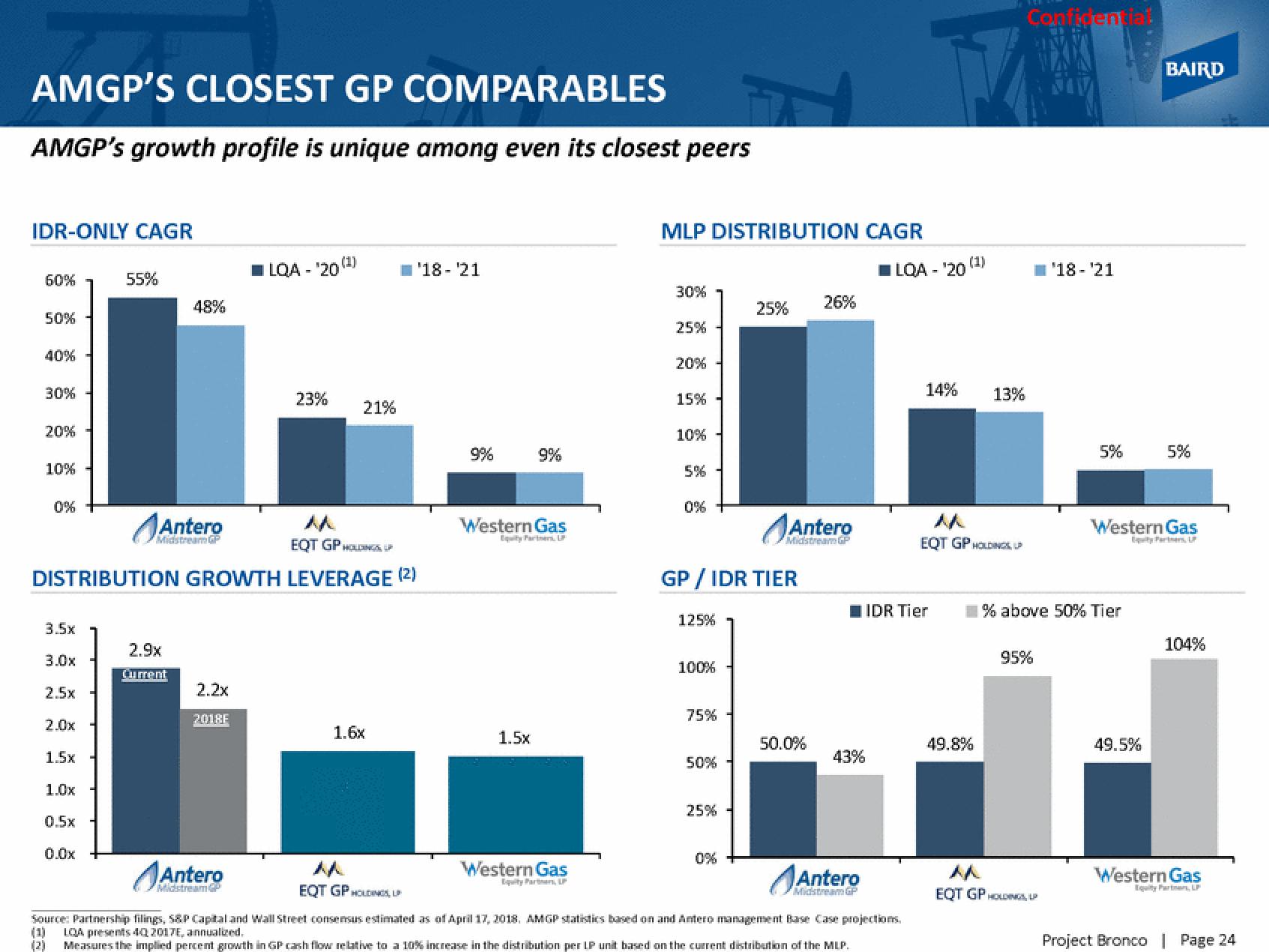

AMGP'S CLOSEST GP COMPARABLES

AMGP's growth profile is unique among even its closest peers

IDR-ONLY CAGR

60%

50%

40%

30%

20%

10%

0%

3.5x

3.0x

2.5x

2.0x

1.5x

55%

1.0x

0.5x

0.0x

48%

EQT GP HOLDINGS, P

DISTRIBUTION GROWTH LEVERAGE (2)

Midstream GP

2.9x

Current

2.2x

2018F

ILQA - '20 (¹)

Antero

Midstream P

23%

21%

'18-21

1.6x

9%

9%

Western Gas

Equity Partners LP

1.5x

Western Gas

Equity Partners LP

MLP DISTRIBUTION CAGR

30%

25%

20%

15%

10%

5%

0%

125%

GP/IDR TIER

100%

75%

50%

25%

25%

0%

Antero

Midstream GP

26%

50.0%

43%

Antero

Midstream GP

■LQA - ¹20 (¹)

14%

EQT GP HOLDINGS UP

Source: Partnership filings, S&P Capital and Wall Street consensus estimated as of April 17, 2018. AMGP statistics based on and Antero management Base Case projections.

(1) LOA presents 4Q 2017E, annualized.

(2)

Measures the implied percent growth in GP cash flow relative to a 10% increase in the distribution per LP unit based on the current distribution of the MLP.

IDR Tier

EQT GP HOLDINGS UP

13%

49.8%

Confidential

95%

'18-'21

^^

EQT GP HOLDINGS UP

5%

% above 50% Tier

Cont

49.5%

BAIRD

Western Gas

tyre, UP

5%

104%

Western Gas

Equity Partners, LP

Project Bronco | Page 24View entire presentation