Better SPAC Presentation Deck

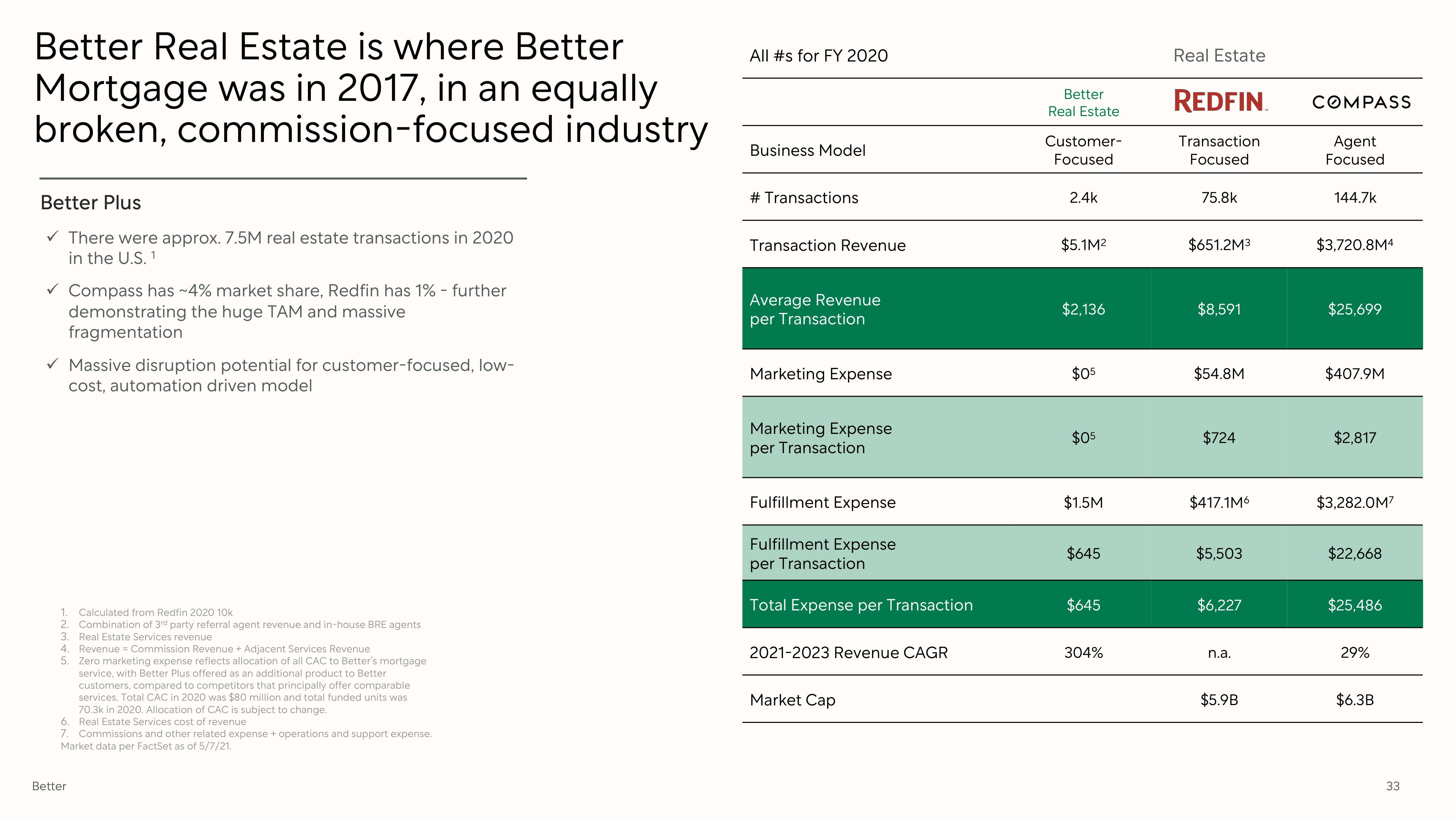

Better Real Estate is where Better

Mortgage was in 2017, in an equally

broken, commission-focused industry

Better Plus

✓ There were approx. 7.5M real estate transactions in 2020

in the U.S. 1

✓ Compass has ~4% market share, Redfin has 1% - further

demonstrating the huge TAM and massive

fragmentation

✓ Massive disruption potential for customer-focused, low-

cost, automation driven model

Calculated from Redfin 2020 10k

Combination of 3rd party referral agent revenue and in-house BRE agents

3. Real Estate Services revenue

12345

Revenue = Commission Revenue + Adjacent Services Revenue

5. Zero marketing expense reflects allocation of all CAC to Better's mortgage

service, with Better Plus offered as an additional product to Better

customers, compared to competitors that principally offer comparable

services. Total CAC in 2020 was $80 million and total funded units was

70.3k in 2020. Allocation of CAC is subject to change.

Real Estate Services cost of revenue

6.

7. Commissions and other related expense + operations and support expense.

Market data per FactSet as of 5/7/21.

Better

All #s for FY 2020

Business Model

# Transactions

Transaction Revenue

Average Revenue

per Transaction

Marketing Expense

Marketing Expense

per Transaction

Fulfillment Expense

Fulfillment Expense

per Transaction

Total Expense per Transaction

2021-2023 Revenue CAGR

Market Cap

Better

Real Estate

Customer-

Focused

2.4k

$5.1M²

$2,136

$05

$05

$1.5M

$645

$645

304%

Real Estate

REDFIN

Transaction

Focused

75.8k

$651.2M³

$8,591

$54.8M

$724

$417.1M6

$5,503

$6,227

n.a.

$5.9B

COMPASS

Agent

Focused

144.7k

$3,720.8M4

$25,699

$407.9M

$2,817

$3,282.0M7

$22,668

$25,486

29%

$6.3B

33View entire presentation