Trian Partners Activist Presentation Deck

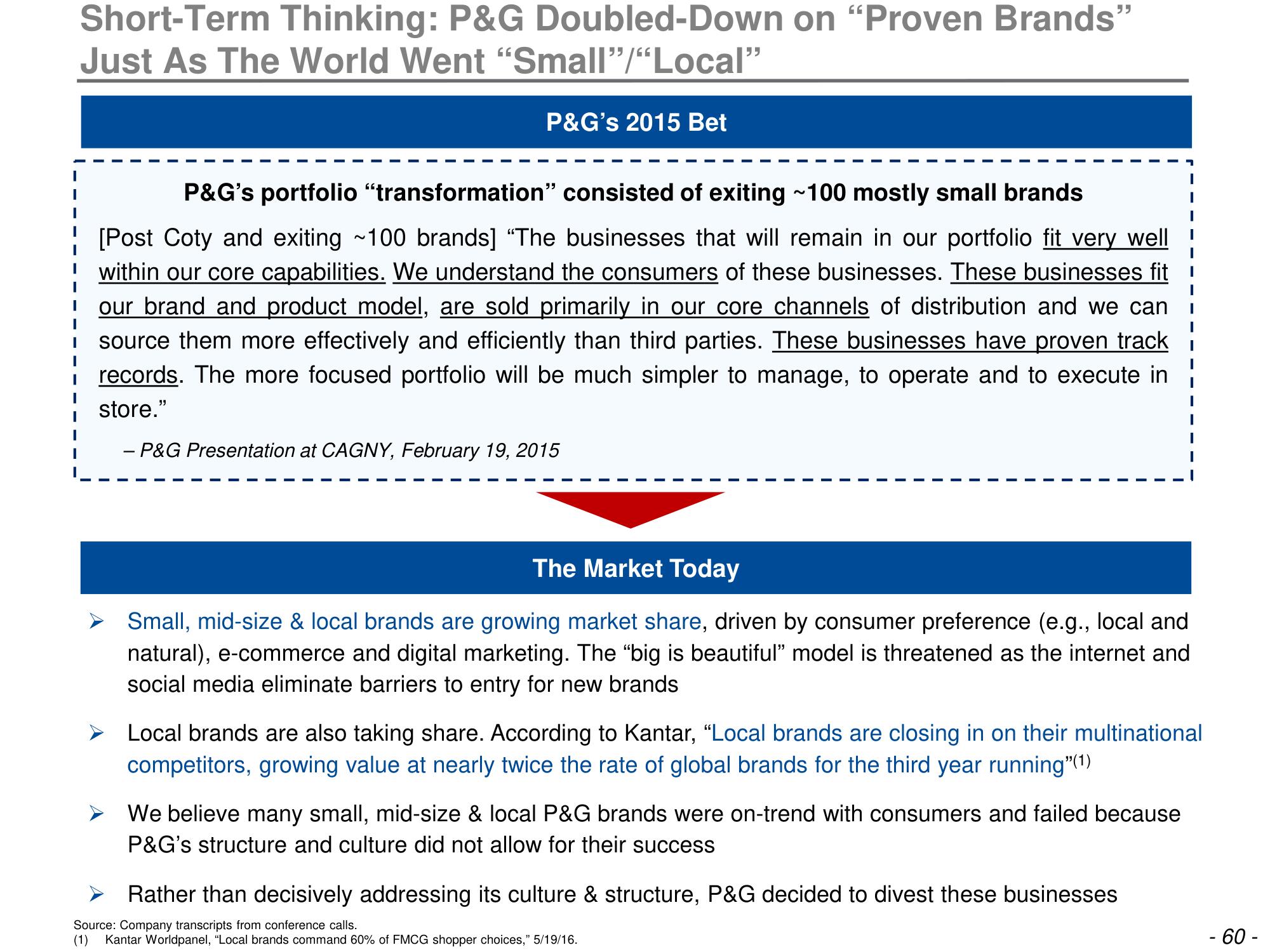

Short-Term Thinking: P&G Doubled-Down on "Proven Brands"

Just As The World Went "Small”/“Local"

P&G's 2015 Bet

P&G's portfolio "transformation" consisted of exiting ~100 mostly small brands

[Post Coty and exiting ~100 brands] "The businesses that will remain in our portfolio fit very well

within our core capabilities. We understand the consumers of these businesses. These businesses fit

our brand and product model, are sold primarily in our core channels of distribution and we can

source them more effectively and efficiently than third parties. These businesses have proven track

records. The more focused portfolio will be much simpler to manage, to operate and to execute in

store."

- P&G Presentation at CAGNY, February 19, 2015

The Market Today

Small, mid-size & local brands are growing market share, driven by consumer preference (e.g., local and

natural), e-commerce and digital marketing. The "big is beautiful" model is threatened as the internet and

social media eliminate barriers to entry for new brands

> Local brands are also taking share. According to Kantar, "Local brands are closing in on their multinational

competitors, growing value at nearly twice the rate of global brands for the third year running"(1)

We believe many small, mid-size & local P&G brands were on-trend with consumers and failed because

P&G's structure and culture did not allow for their success

Rather than decisively addressing its culture & structure, P&G decided to divest these businesses

Source: Company transcripts from conference calls.

(1) Kantar Worldpanel, "Local brands command 60% of FMCG shopper choices," 5/19/16.

- 60 -View entire presentation