First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

1

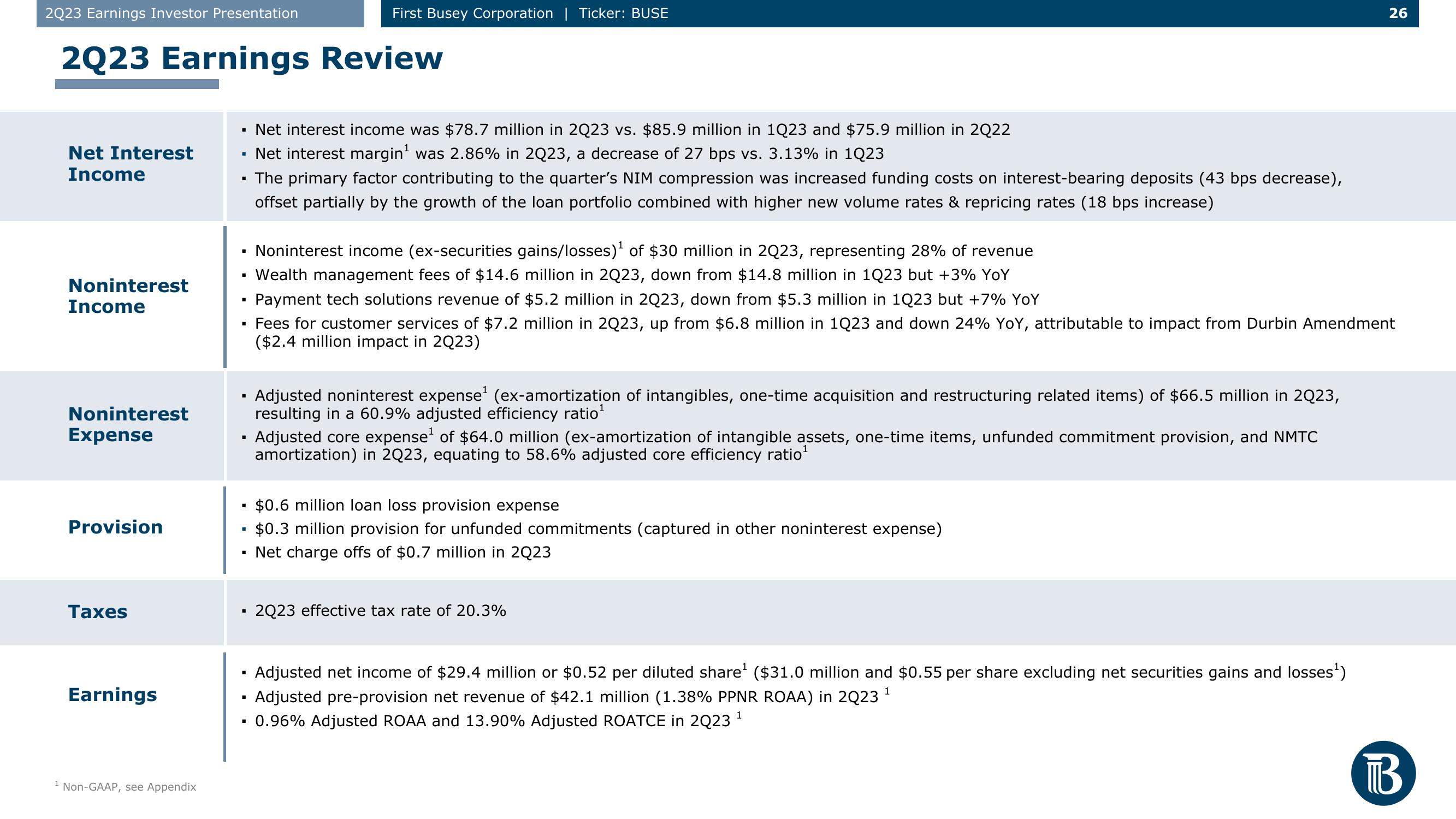

2Q23 Earnings Review

Net Interest

Income

Noninterest

Income

Noninterest

Expense

Provision

Taxes

Earnings

Non-GAAP, see Appendix

■

▪ The primary factor contributing to the quarter's NIM compression was increased funding costs on interest-bearing deposits (43 bps decrease),

offset partially by the growth of the loan portfolio combined with higher new volume rates & repricing rates (18 bps increase)

■

■

■

■

First Busey Corporation | Ticker: BUSE

■

■

Net interest income was $78.7 million in 2Q23 vs. $85.9 million in 1Q23 and $75.9 million in 2Q22

Net interest margin¹ was 2.86% in 2Q23, a decrease of 27 bps vs. 3.13% in 1Q23

■

$0.6 million loan loss provision expense

▪ $0.3 million provision for unfunded commitments (captured in other noninterest expense)

Net charge offs of $0.7 million in 2Q23

Noninterest income (ex-securities gains/losses)¹ of $30 million in 2Q23, representing 28% of revenue

Wealth management fees of $14.6 million in 2Q23, down from $14.8 million in 1Q23 but +3% YoY

Payment tech solutions revenue of $5.2 million in 2Q23, down from $5.3 million in 1Q23 but +7% YoY

Fees for customer services of $7.2 million in 2Q23, up from $6.8 million in 1Q23 and down 24% YoY, attributable to impact from Durbin Amendment

($2.4 million impact in 2Q23)

Adjusted noninterest expense¹ (ex-amortization of intangibles, one-time acquisition and restructuring related items) of $66.5 million in 2Q23,

resulting in a 60.9% adjusted efficiency ratio ¹

Adjusted core expense¹ of $64.0 million (ex-amortization of intangible assets, one-time items, unfunded commitment provision, and NMTC

amortization) in 2Q23, equating to 58.6% adjusted core efficiency ratio ¹

2Q23 effective tax rate of 20.3%

Adjusted net income of $29.4 million or $0.52 per diluted share¹ ($31.0 million and $0.55 per share excluding net securities gains and losses¹)

▪ Adjusted pre-provision net revenue of $42.1 million (1.38% PPNR ROAA) in 2Q23 ¹

1

▪ 0.96% Adjusted ROAA and 13.90% Adjusted ROATCE in 2Q23 ¹

1

26

BView entire presentation