GMS Results Presentation Deck

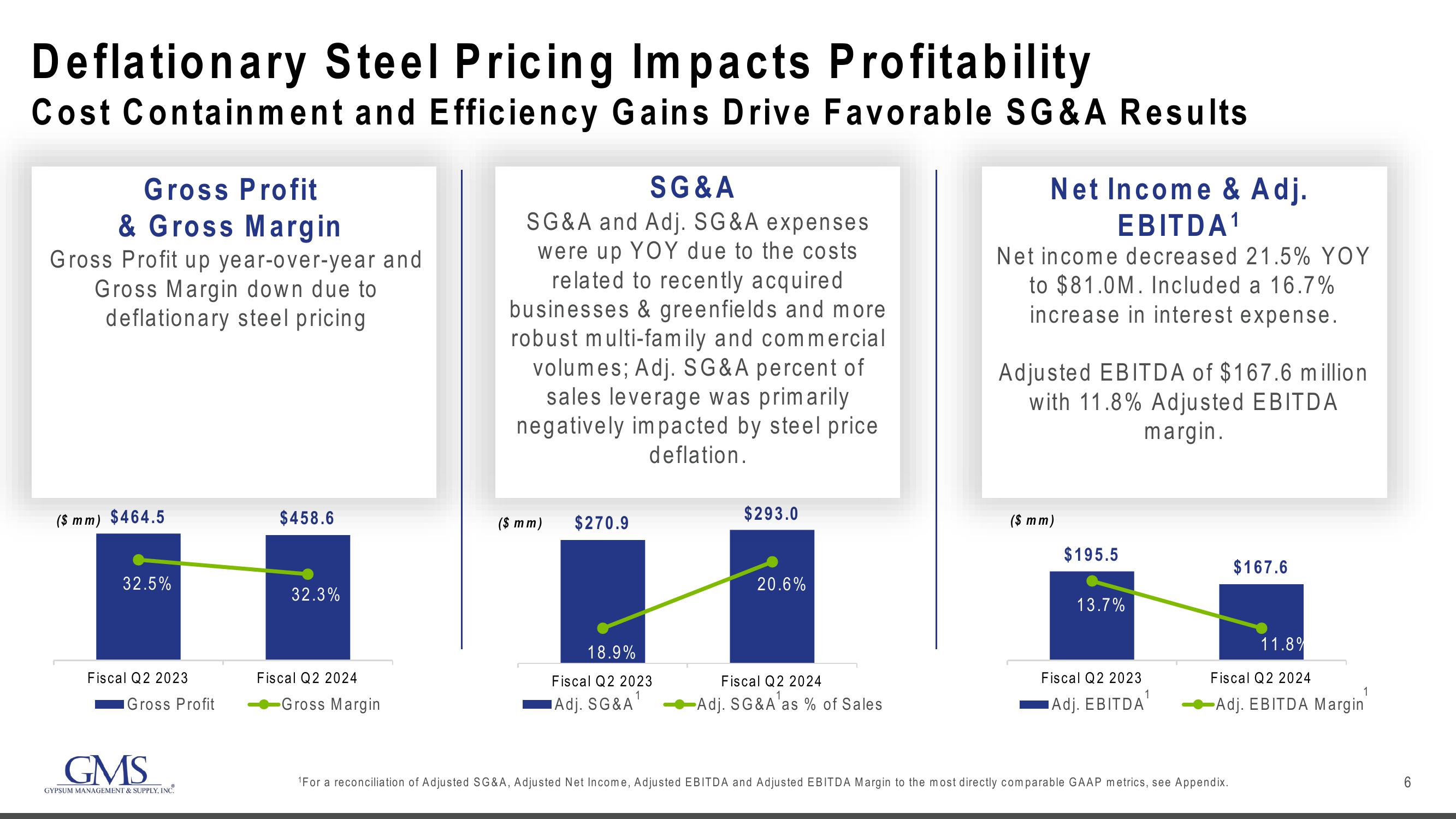

Deflationary Steel Pricing Impacts Profitability

Cost Containment and Efficiency Gains Drive Favorable SG&A Results

Gross Profit

& Gross Margin

Gross Profit up year-over-year and

Gross Margin down due to

deflationary steel pricing

($ mm) $464.5

32.5%

Fiscal Q2 2023

Gross Profit

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

$458.6

32.3%

Fiscal Q2 2024

Gross Margin

SG&A

SG&A and Adj. SG&A expenses

were up YOY due to the costs.

related to recently acquired

businesses & greenfields and more

robust multi-family and commercial

volumes; Adj. SG&A percent of

sales leverage was primarily

negatively impacted by steel price

deflation.

($ mm) $270.9

18.9%

Fiscal Q2 2023

Adj. SG&A

$293.0

20.6%

Fiscal Q2 2024

Adj. SG&A as % of Sales

Net Income & Adj.

EBITDA ¹

Net income decreased 21.5% YOY

to $81.0M. Included a 16.7%

increase in interest expense.

Adjusted EBITDA of $167.6 million

with 11.8% Adjusted EBITDA

margin.

($ mm)

$195.5

13.7%

Fiscal Q2 2023

1

Adj. EBITDA

$167.6

¹For a reconciliation of Adjusted SG&A, Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA Margin to the most directly comparable GAAP metrics, see Appendix.

11.8%

Fiscal Q2 2024

1

-Adj. EBITDA Margin

6View entire presentation