Bausch+Lomb Results Presentation Deck

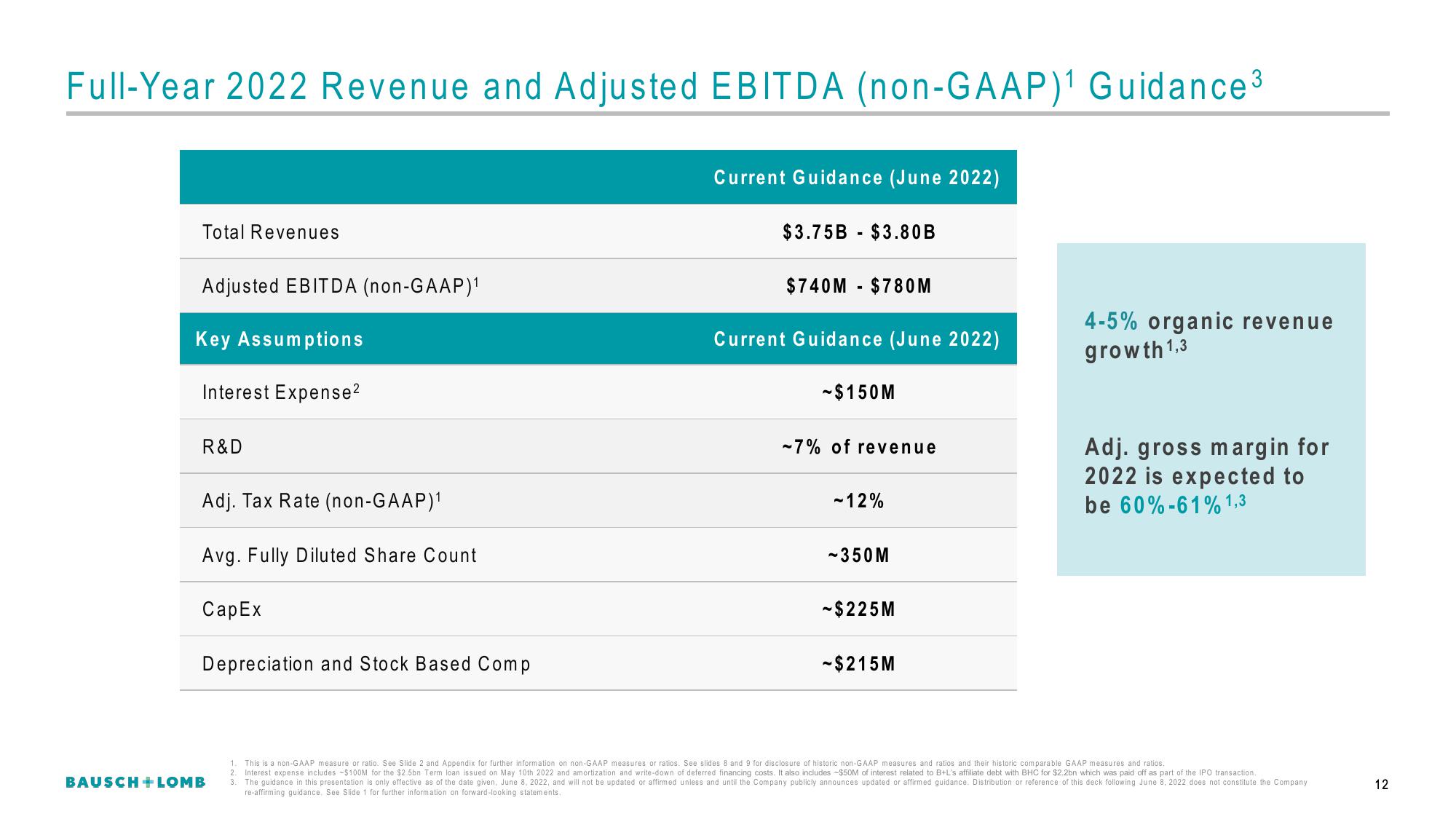

Full-Year 2022 Revenue and Adjusted EBITDA (non-GAAP)¹ Guidance³

Total Revenues

Adjusted EBITDA (non-GAAP)¹

Key Assumptions

Interest Expense²

R&D

Adj. Tax Rate (non-GAAP)¹

Avg. Fully Diluted Share Count

Cap Ex

Depreciation and Stock Based Comp

BAUSCH + LOMB

Current Guidance (June 2022)

$3.75B $3.80B

$740M $780M

Current Guidance (June 2022)

-$150M

-7% of revenue

-12%

-350M

-$225M

-$215M

4-5% organic revenue

growth 1,3

Adj. gross margin for

2022 is expected to

be 60% -61% 1,3

1.

This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures or ratios. See slides 8 and 9 for disclosure of historic non-GAAP measures and ratios and their historic comparable GAAP measures and ratios.

2. Interest expense includes -$100M for the $2.5bn Term loan issued on May 10th 2022 and amortization and write-down of deferred financing costs. It also includes $50M of interest related to B+L's affiliate debt with BHC for $2.2bn which was paid off as part of the IPO transaction.

3. The guidance in this presentation is only effective as of the date given, June 8, 2022, and will not be updated or affirmed unless and until the Company publicly announces updated or affirmed guidance. Distribution or reference of this deck following June 8, 2022 does not constitute the Company

re-affirming guidance. See Slide 1 for further information on forward-looking statements.

12View entire presentation