Tesla Results Presentation Deck

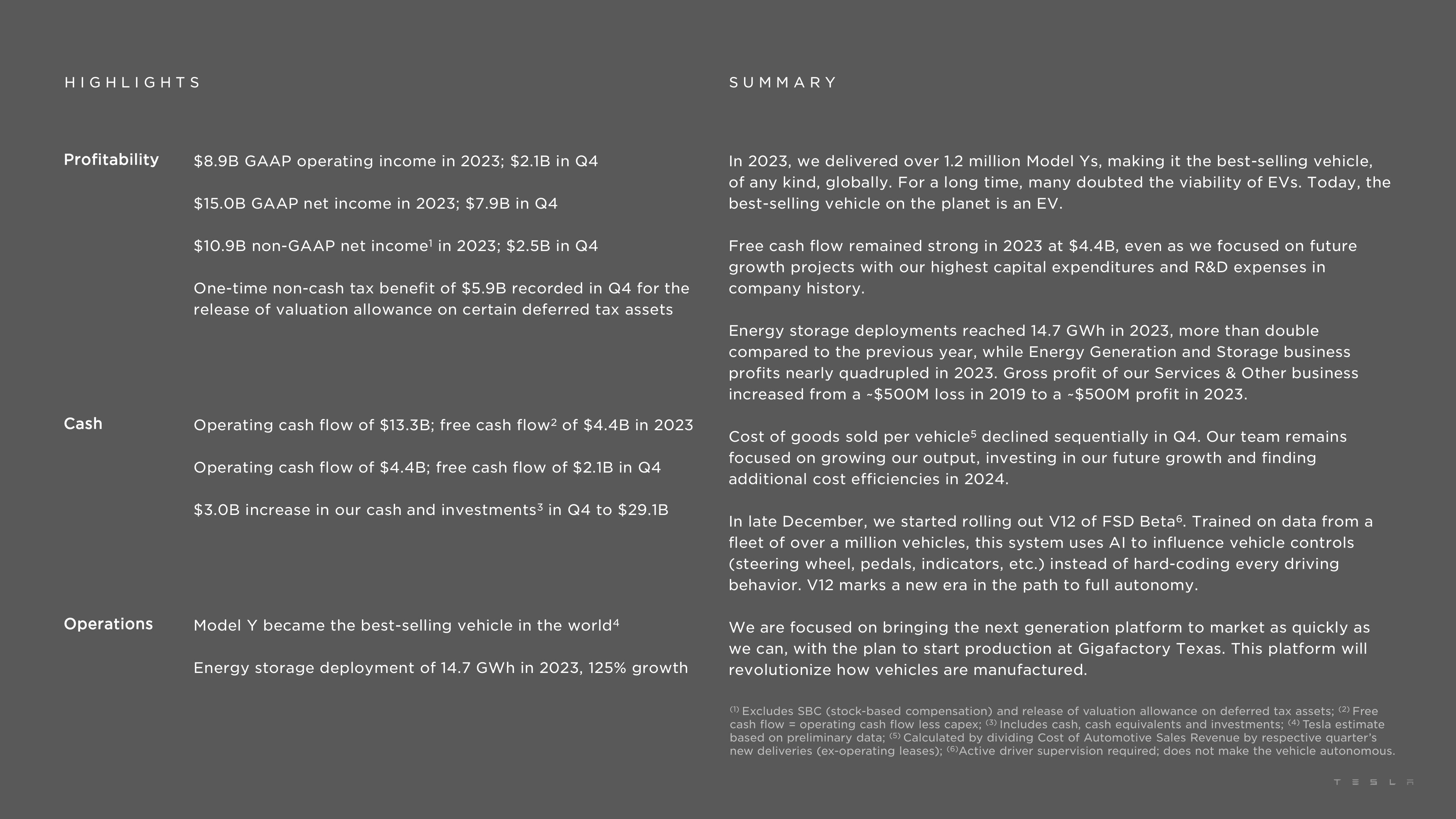

HIGHLIGHTS

Profitability

Cash

Operations

$8.9B GAAP operating income in 2023; $2.1B in Q4

$15.OB GAAP net income in 2023; $7.9B in Q4

$10.9B non-GAAP net income¹ in 2023; $2.5B in Q4

One-time non-cash tax benefit of $5.9B recorded in Q4 for the

release of valuation allowance on certain deferred tax assets

Operating cash flow of $13.3B; free cash flow² of $4.4B in 2023

Operating cash flow of $4.4B; free cash flow of $2.1B in Q4

$3.0B increase in our cash and investments3 in Q4 to $29.1B

Model Y became the best-selling vehicle in the world4

Energy storage deployment of 14.7 GWh in 2023, 125% growth

SUMMARY

In 2023, we delivered over 1.2 million Model Ys, making it the best-selling vehicle,

of any kind, globally. For a long time, many doubted the viability of EVs. Today, the

best-selling vehicle on the planet is an EV.

Free cash flow remained strong in 2023 at $4.4B, even as we focused on future

growth projects with our highest capital expenditures and R&D expenses in

company history.

Energy storage deployments reached 14.7 GWh in 2023, more than double

compared to the previous year, while Energy Generation and Storage business

profits nearly quadrupled in 2023. Gross profit of our Services & Other business

increased from a ~$500M loss in 2019 to a $500M profit in 2023.

Cost of goods sold per vehicle5 declined sequentially in Q4. Our team remains

focused on growing our output, investing in our future growth and finding

additional cost efficiencies in 2024.

In late December, we started rolling out V12 of FSD Beta6. Trained on data from a

fleet of over a million vehicles, this system uses Al to influence vehicle controls

(steering wheel, pedals, indicators, etc.) instead of hard-coding every driving

behavior. V12 marks a new era in the path to full autonomy.

We are focused on bringing the next generation platform to market as quickly as

we can, with the plan to start production at Gigafactory Texas. This platform will

revolutionize how vehicles are manufactured.

(1) Excludes SBC (stock-based compensation) and release of valuation allowance on deferred tax assets; (2) Free

cash flow = operating cash flow less capex; (3) Includes cash, cash equivalents and investments; (4) Tesla estimate

based on preliminary data; (5) Calculated by dividing Cost of Automotive Sales Revenue by respective quarter's

new deliveries (ex-operating leases); (6) Active driver supervision required; does not make the vehicle autonomous.

TESLAView entire presentation