HSBC Investor Event Presentation Deck

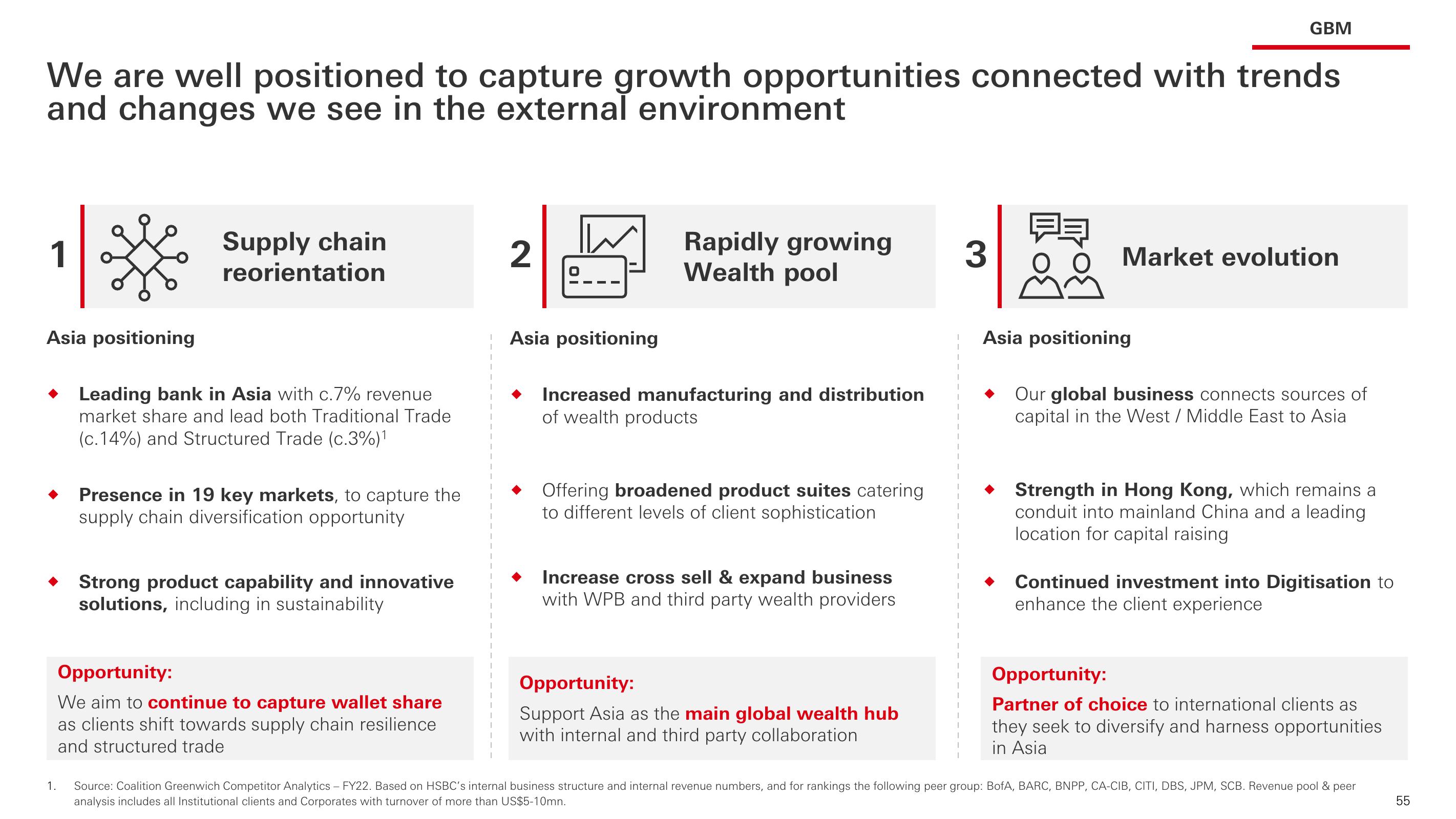

We are well positioned to capture growth opportunities connected with trends

and changes we see in the external environment

Asia positioning

1.

Supply chain

reorientation

Leading bank in Asia with c.7% revenue

market share and lead both Traditional Trade

(c.14%) and Structured Trade (c.3%)¹

Presence in 19 key markets, to capture the

supply chain diversification opportunity

Strong product capability and innovative

solutions, including in sustainability

Opportunity:

We aim to continue to capture wallet share

as clients shift towards supply chain resilience

and structured trade

2

Asia positioning

Rapidly growing

Wealth pool

Increased manufacturing and distribution

of wealth products

Offering broadened product suites catering

to different levels of client sophistication

Increase cross sell & expand business

with WPB and third party wealth providers

Opportunity:

Support Asia as the main global wealth hub

with internal and third party collaboration

Pa

88

Asia positioning

GBM

3

Market evolution

Our global business connects sources of

capital in the West / Middle East to Asia

Strength in Hong Kong, which remains a

conduit into mainland China and a leading

location for capital raising

Continued investment into Digitisation to

enhance the client experience

Opportunity:

Partner of choice to international clients as

they seek to diversify and harness opportunities

in Asia

Source: Coalition Greenwich Competitor Analytics - FY22. Based on HSBC's internal business structure and internal revenue numbers, and for rankings the following peer group: BofA, BARC, BNPP, CA-CIB, CITI, DBS, JPM, SCB. Revenue pool & peer

analysis includes all Institutional clients and Corporates with turnover of more than US$5-10mn.

55View entire presentation