Azerion SPAC Presentation Deck

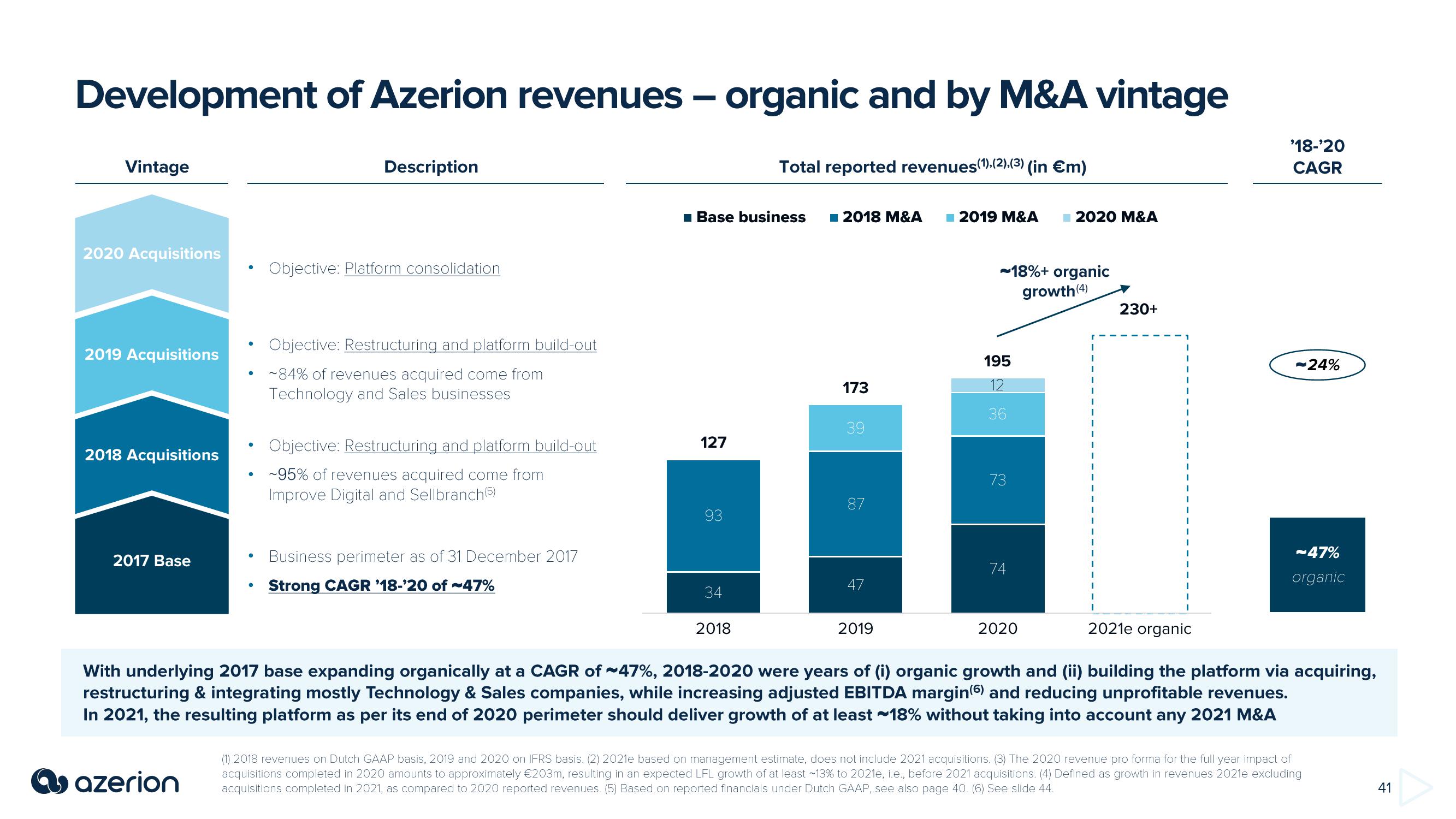

Development of Azerion revenues - organic and by M&A vintage

Vintage

2020 Acquisitions

2019 Acquisitions

2018 Acquisitions

2017 Base

Description

azerion

Objective: Platform consolidation

Objective: Restructuring and platform build-out

~84% of revenues acquired come from

Technology and Sales businesses

Objective: Restructuring and platform build-out

~95% of revenues acquired come from

Improve Digital and Sellbranch(5)

Business perimeter as of 31 December 2017

Strong CAGR '18-'20 of 47%

■ Base business

127

93

34

Total reported revenues (1), (2),(3) (in €m)

2018

■2018 M&A ■2019 M&A ■2020 M&A

173

39

87

47

2019

~18%+ organic

growth (4)

195

12

36

73

74

2020

1

I

I

230+

1

T

I

1

1

1

I

I

I

I

1

1

2021e organic

'18-'20

CAGR

-24%

~47%

organic

With underlying 2017 base expanding organically at a CAGR of ~47%, 2018-2020 were years of (i) organic growth and (ii) building the platform via acquiring,

restructuring & integrating mostly Technology & Sales companies, while increasing adjusted EBITDA margin() and reducing unprofitable revenues.

In 2021, the resulting platform as per its end of 2020 perimeter should deliver growth of at least 18% without taking into account any 2021 M&A

(1) 2018 revenues on Dutch GAAP basis, 2019 and 2020 on IFRS basis. (2) 2021e based on management estimate, does not include 2021 acquisitions. (3) The 2020 revenue pro forma for the full year impact of

acquisitions completed in 2020 amounts to approximately €203m, resulting in an expected LFL growth of at least ~13% to 2021e, i.e., before 2021 acquisitions. (4) Defined as growth in revenues 2021e excluding

acquisitions completed in 2021, as compared to 2020 reported revenues. (5) Based on reported financials under Dutch GAAP, see also page 40. (6) See slide 44.

41View entire presentation