Endeavour Mining Results Presentation Deck

OPERATING CASH FLOW

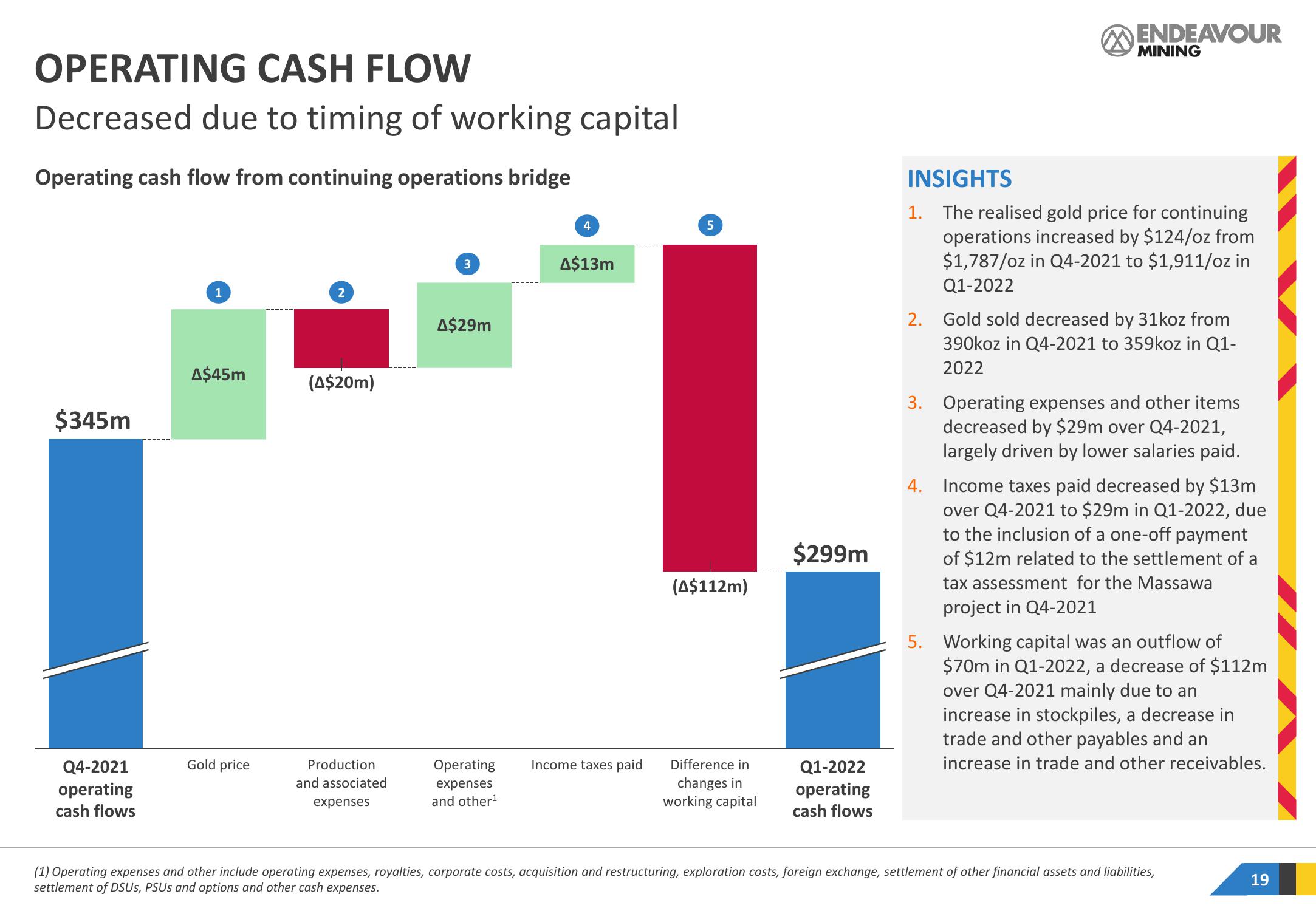

Decreased due to timing of working capital

Operating cash flow from continuing operations bridge

$345m

Q4-2021

operating

cash flows

1

A$45m

Gold price

2

(A$20m)

Production

and associated

expenses

3

A$29m

Operating

expenses

and other¹

4

A$13m

Income taxes paid

5

(A$112m)

Difference in

changes in

working capital

$299m

Q1-2022

operating

cash flows

ENDEAVOUR

MINING

INSIGHTS

1. The realised gold price for continuing

operations increased by $124/oz from

$1,787/oz in Q4-2021 to $1,911/oz in

Q1-2022

2. Gold sold decreased by 31koz from

390koz in Q4-2021 to 359koz in Q1-

2022

3. Operating expenses and other items

decreased by $29m over Q4-2021,

largely driven by lower salaries paid.

4. Income taxes paid decreased by $13m

over Q4-2021 to $29m in Q1-2022, due

to the inclusion of a one-off payment

of $12m related to the settlement of a

tax assessment for the Massawa

project in Q4-2021

5. Working capital was an outflow of

$70m in Q1-2022, a decrease of $112m

over Q4-2021 mainly due to an

increase in stockpiles, a decrease in

trade and other payables and an

increase in trade and other receivables.

(1) Operating expenses and other include operating expenses, royalties, corporate costs, acquisition and restructuring, exploration costs, foreign exchange, settlement of other financial assets and liabilities,

settlement of DSUS, PSUs and options and other cash expenses.

19View entire presentation