Engine No. 1 Activist Presentation Deck

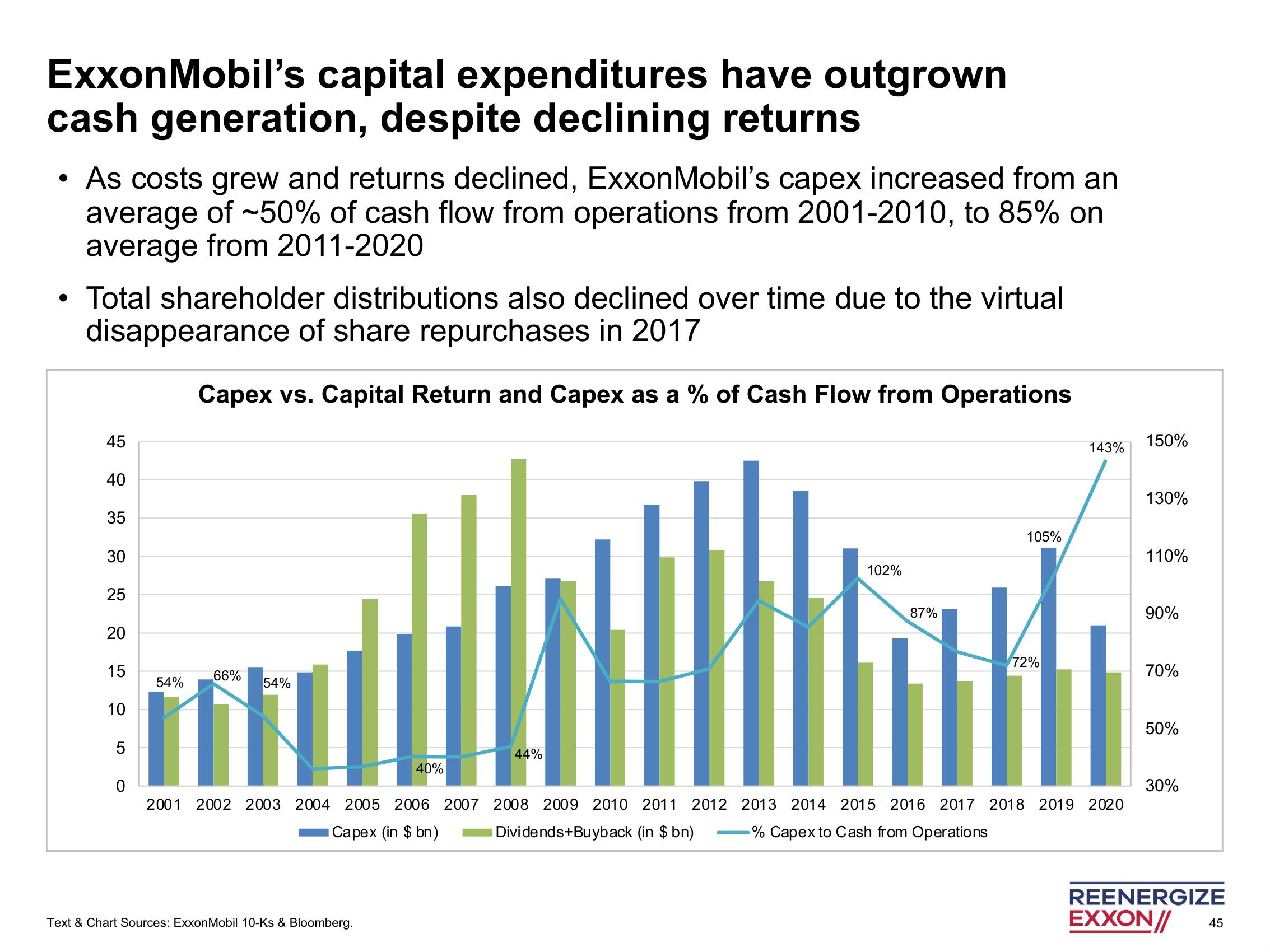

ExxonMobil's capital expenditures have outgrown

cash generation, despite declining returns

• As costs grew and returns declined, ExxonMobil's capex increased from an

average of ~50% of cash flow from operations from 2001-2010, to 85% on

average from 2011-2020

●

• Total shareholder distributions also declined over time due to the virtual

disappearance of share repurchases in 2017

Capex vs. Capital Return and Capex as a % of Cash Flow from Operations

45

40

35

30

25

20

15

10

5

0

54%

66%

54%

40%

Text & Chart Sources: ExxonMobil 10-Ks & Bloomberg.

44%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Dividends+Buyback (in $bn)

Capex (in $bn)

102%

87%

105%

72%

143%

2013 2014 2015 2016 2017 2018 2019 2020

% Capex to Cash from Operations

150%

130%

110%

90%

70%

50%

30%

REENERGIZE

EXXON//

45View entire presentation