Informatica Investor Presentation Deck

Cloud vs. Self-Managed

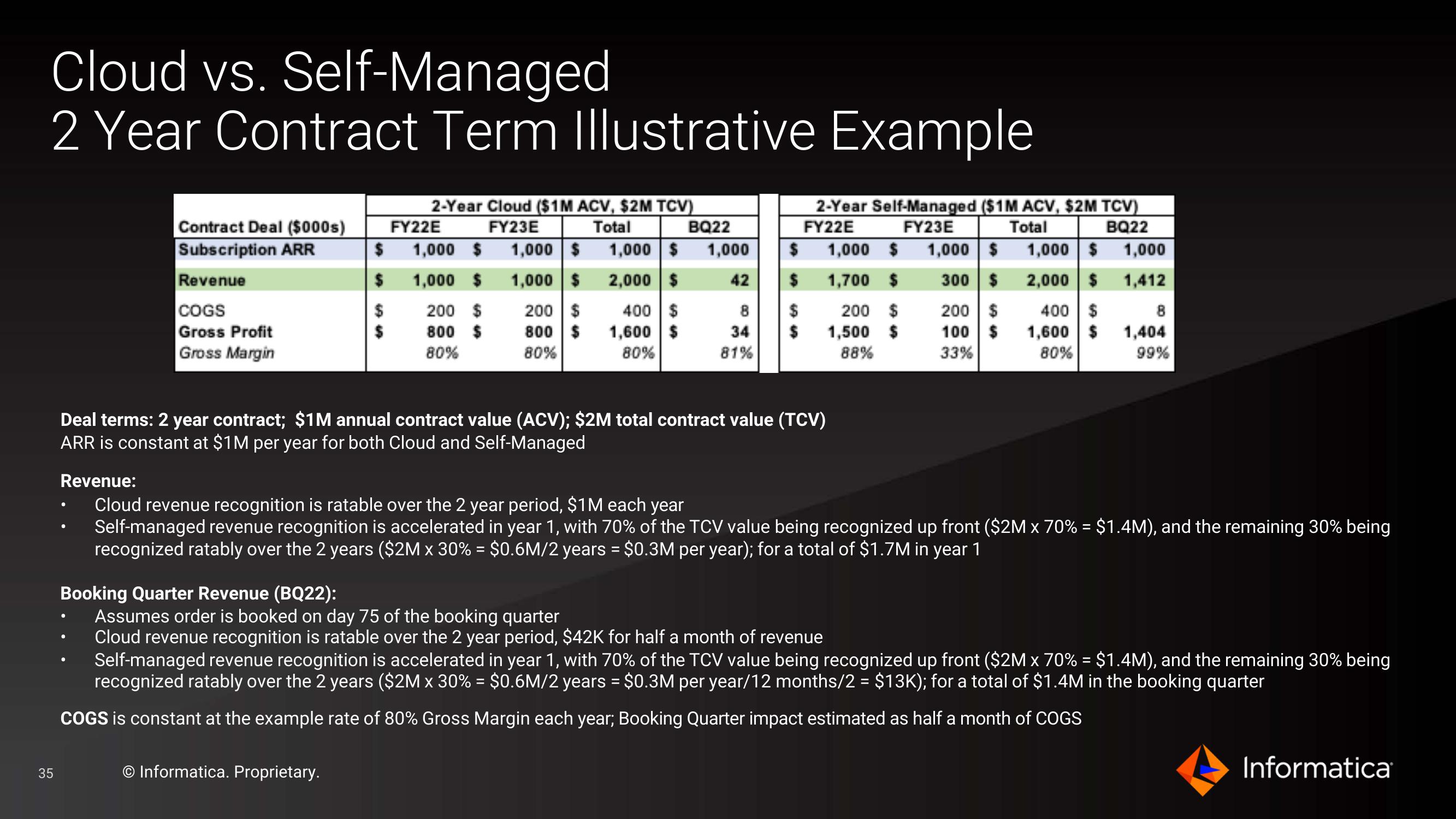

2 Year Contract Term Illustrative Example

35

Contract Deal ($000s)

Subscription ARR

Revenue

COGS

Gross Profit

Gross Margin

$

●

2-Year Cloud ($1M ACV, $2M TCV)

Total

FY23E

1,000 $1,000 $

1,000 $ 2,000

200 $

800 $

80%

FY22E

1,000 $

1,000

200 $

800 $

80%

400 $

1,600 $

80%

Informatica. Proprietary.

BQ22

1,000

42

8

34

81%

Deal terms: 2 year contract; $1M annual contract value (ACV); $2M total contract value (TCV)

ARR is constant at $1M per year for both Cloud and Self-Managed

$

$

$

2-Year Self-Managed ($1M ACV, $2M TCV)

FY22E FY23E

Total

BQ22

1,000 $ 1,000 $ 1,000 $1,000

1,700 $ 300 $ 2,000 $ 1,412

200 $ 200 $ 400 $

8

$ 1,500 $ 100 $ 1,600 $

88%

33%

80%

1,404

99%

Revenue:

Cloud revenue recognition is ratable over the 2 year period, $1M each year

Self-managed revenue recognition is accelerated in year 1, with 70% of the TCV value being recognized up front ($2M x 70% = $1.4M), and the remaining 30% being

recognized ratably over the 2 years ($2M x 30% = $0.6M/2 years = $0.3M per year); for a total of $1.7M in year 1

Booking Quarter Revenue (BQ22):

Assumes order is booked on day 75 of the booking quarter

Cloud revenue recognition is ratable over the 2 year period, $42K for half a month of revenue

Self-managed revenue recognition is accelerated in year 1, with 70% of the TCV value being recognized up front ($2M x 70% = $1.4M), and the remaining 30% being

recognized ratably over the 2 years ($2M x 30% = $0.6M/2 years = $0.3M per year/12 months/2 = $13K); for a total of $1.4M in the booking quarter

COGS is constant at the example rate of 80% Gross Margin each year; Booking Quarter impact estimated as half a month of COGS

InformaticaView entire presentation