Ginkgo Results Presentation Deck

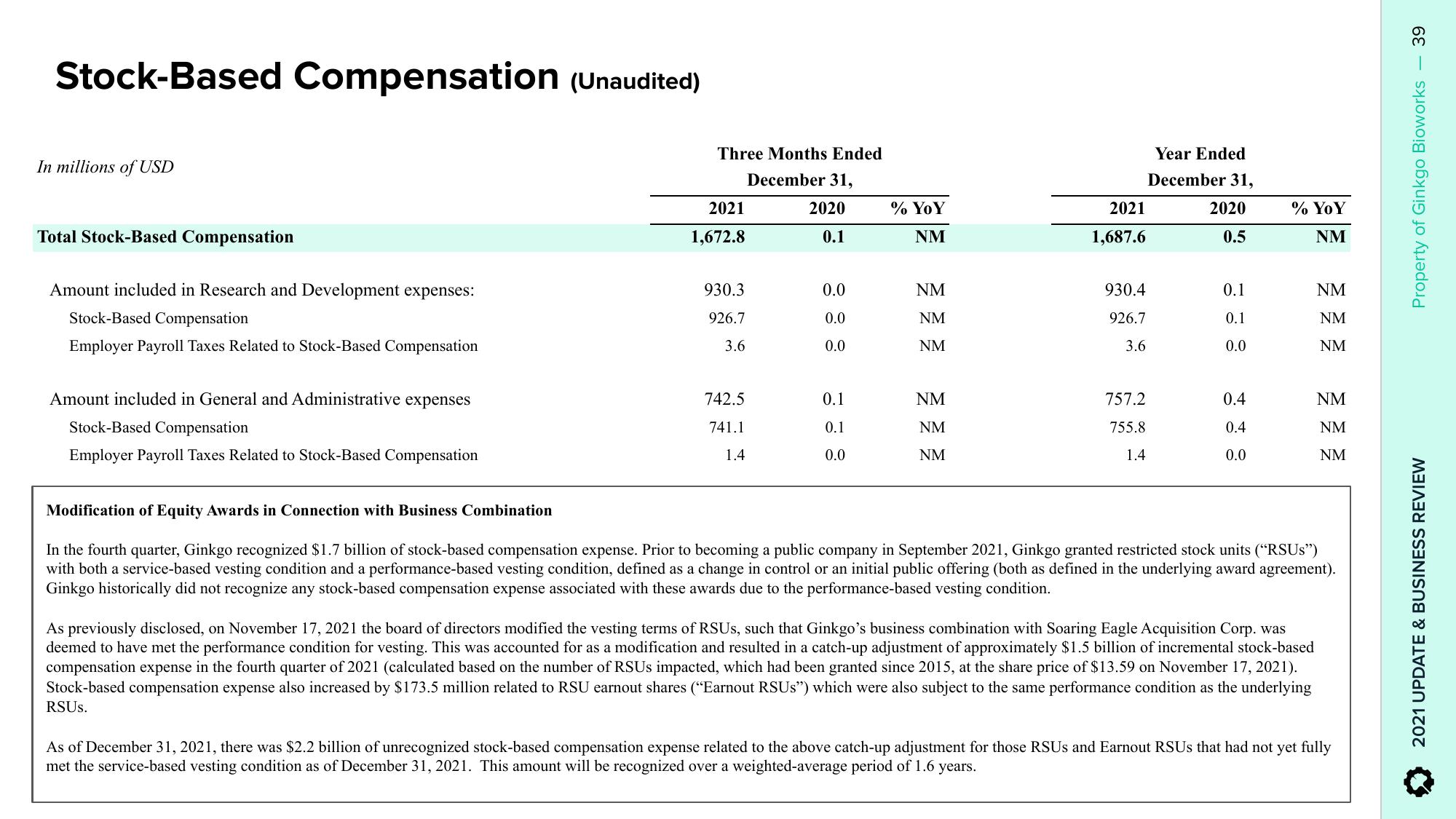

Stock-Based Compensation (Unaudited)

In millions of USD

Total Stock-Based Compensation

Amount included in Research and Development expenses:

Stock-Based Compensation

Employer Payroll Taxes Related to Stock-Based Compensation

Amount included in General and Administrative expenses

Stock-Based Compensation

Employer Payroll Taxes Related to Stock-Based Compensation

Three Months Ended

December 31,

2020

0.1

2021

1,672.8

930.3

926.7

3.6

742.5

741.1

1.4

0.0

0.0

0.0

0.1

0.1

0.0

% YoY

NM

NM

NM

NM

NM

NM

NM

2021

1,687.6

930.4

926.7

3.6

757.2

755.8

1.4

Year Ended

December 31,

2020

0.5

0.1

0.1

0.0

0.4

0.4

0.0

% YoY

NM

NM

NM

NM

As previously disclosed, on November 17, 2021 the board of directors modified the vesting terms of RSUs, such that Ginkgo's business combination with Soaring Eagle Acquisition Corp. was

deemed to have met the performance condition for vesting. This was accounted for as a modification and resulted in a catch-up adjustment of approximately $1.5 billion of incremental stock-based

compensation expense in the fourth quarter of 2021 (calculated based on the number of RSUS impacted, which had been granted since 2015, at the share price of $13.59 on November 17, 2021).

Stock-based compensation expense also increased by $173.5 million related to RSU earnout shares ("Earnout RSUs") which were also subject to the same performance condition as the underlying

RSUS.

NM

NM

NM

Modification of Equity Awards in Connection with Business Combination

In the fourth quarter, Ginkgo recognized $1.7 billion of stock-based compensation expense. Prior to becoming a public company in September 2021, Ginkgo granted restricted stock units ("RSUS")

with both a service-based vesting condition and a performance-based vesting condition, defined as a change in control or an initial public offering (both as defined in the underlying award agreement).

Ginkgo historically did not recognize any stock-based compensation expense associated with these awards due to the performance-based vesting condition.

As of December 31, 2021, there was $2.2 billion of unrecognized stock-based compensation expense related to the above catch-up adjustment for those RSUS and Earnout RSUS that had not yet fully

met the service-based vesting condition as of December 31, 2021. This amount will be recognized over a weighted-average period of 1.6 years.

39

Property of Ginkgo Bioworks

2021 UPDATE & BUSINESS REVIEWView entire presentation