HSBC Investor Day Presentation Deck

Cost efficiency

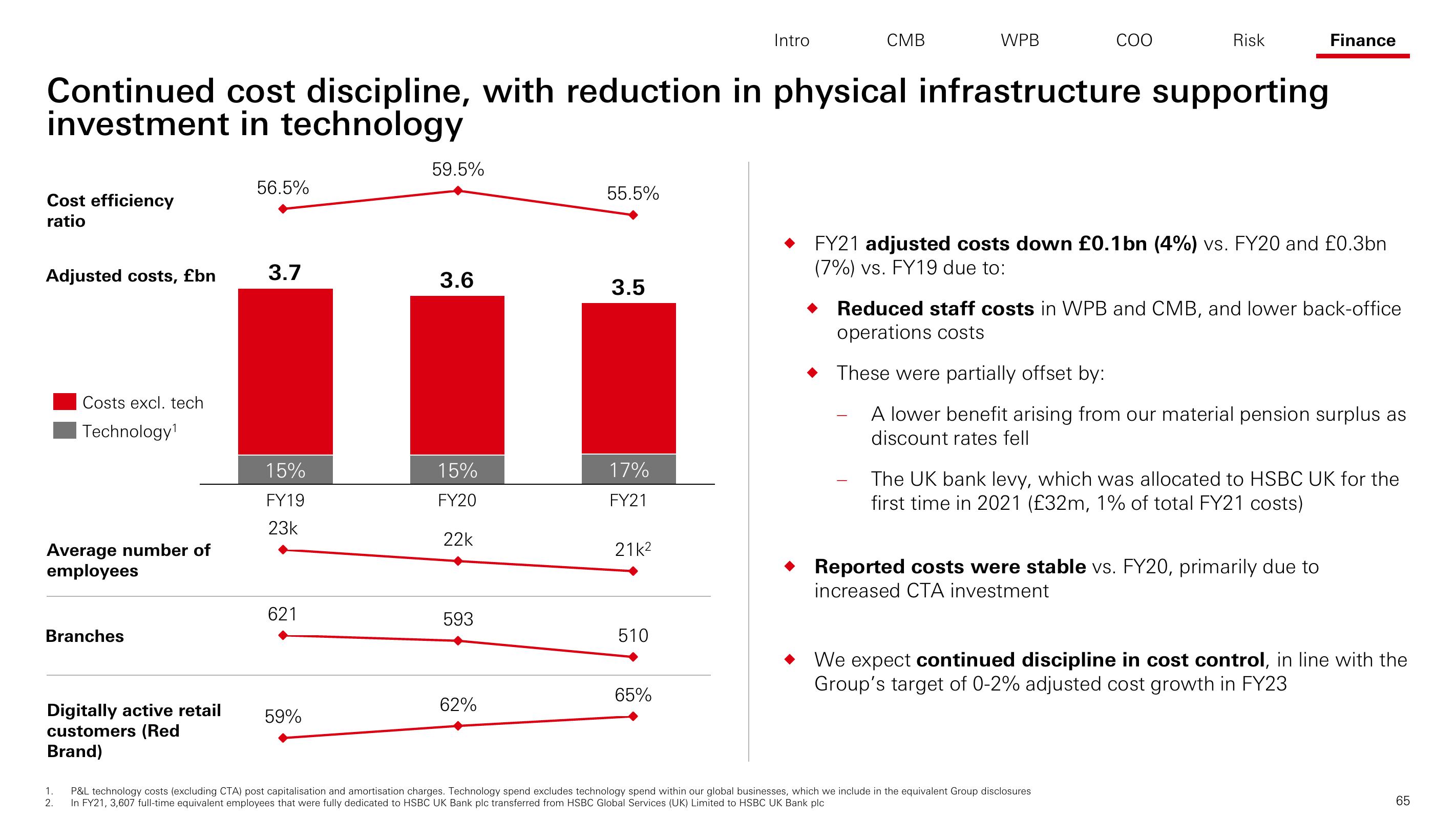

ratio

Adjusted costs, £bn

Costs excl. tech

Technology¹

Average number of

employees

Continued cost discipline, with reduction in physical infrastructure supporting

investment in technology

Branches

Digitally active retail

customers (Red

Brand)

1.

2.

56.5%

3.7

15%

FY19

23k

621

59%

59.5%

3.6

15%

FY20

22k

593

62%

55.5%

3.5

17%

FY21

21k²

510

Intro

65%

CMB

WPB

COO

Risk

FY21 adjusted costs down £0.1bn (4%) vs. FY20 and £0.3bn

(7%) vs. FY19 due to:

Finance

Reduced staff costs in WPB and CMB, and lower back-office

operations costs

These were partially offset by:

A lower benefit arising from our material pension surplus as

discount rates fell

The UK bank levy, which was allocated to HSBC UK for the

first time in 2021 (£32m, 1% of total FY21 costs)

Reported costs were stable vs. FY20, primarily due to

increased CTA investment

P&L technology costs (excluding CTA) post capitalisation and amortisation charges. Technology spend excludes technology spend within our global businesses, which we include in the equivalent Group disclosures

In FY21, 3,607 full-time equivalent employees that were fully dedicated to HSBC UK Bank plc transferred from HSBC Global Services (UK) Limited to HSBC UK Bank plc

We expect continued discipline in cost control, in line with the

Group's target of 0-2% adjusted cost growth in FY23

65View entire presentation