First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

First Busey Corporation | Ticker: BUSE

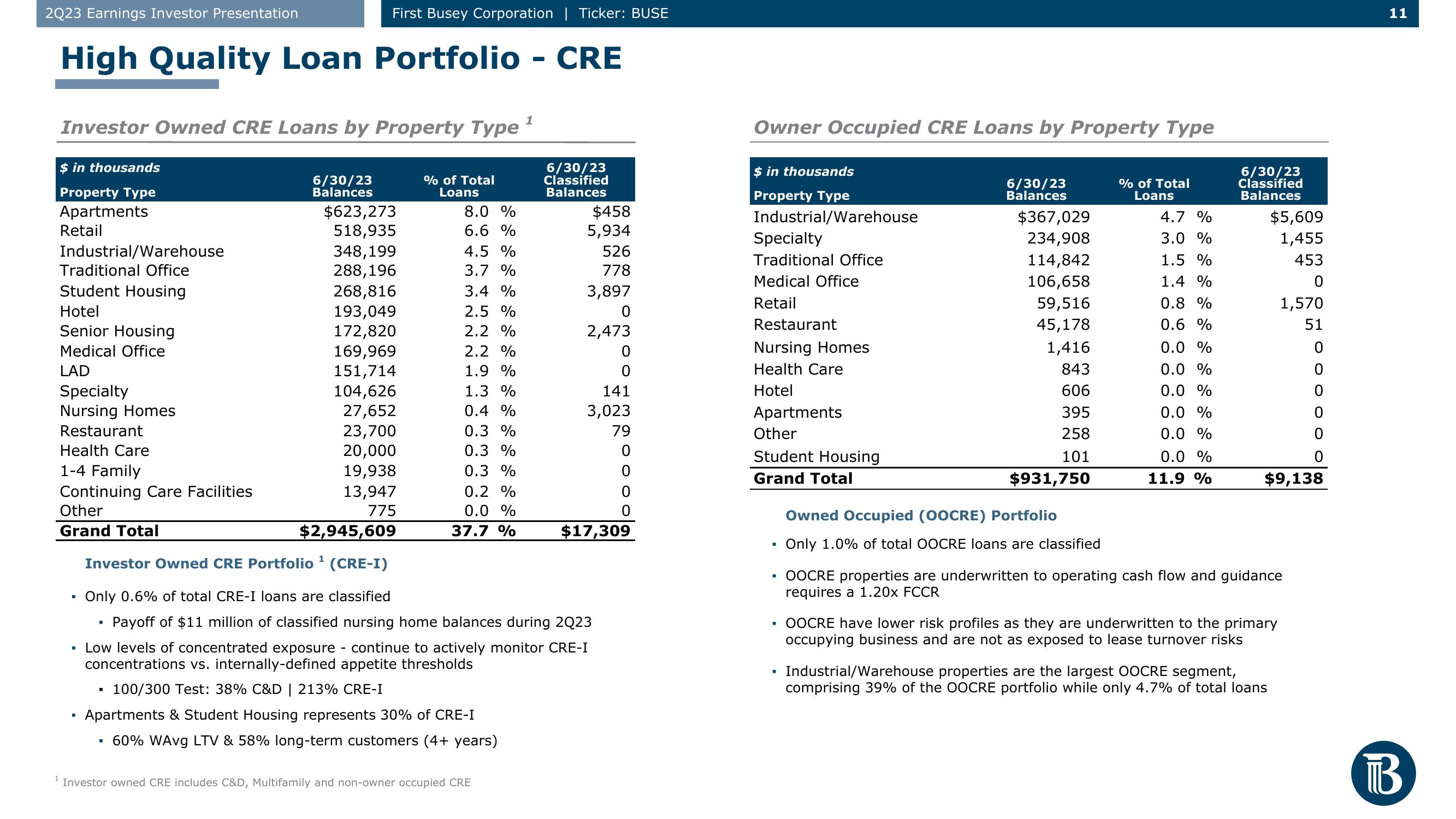

High Quality Loan Portfolio - CRE

Investor Owned CRE Loans by Property Type

$ in thousands

Property Type

Apartments

Retail

Industrial/Warehouse

Traditional Office

Student Housing

Hotel

Senior Housing

Medical Office

LAD

1

Specialty

Nursing Homes

Restaurant

Health Care

1-4 Family

Continuing Care Facilities

Other

Grand Total

■

■

■

6/30/23

Balances

■

$623,273

518,935

348,199

288,196

268,816

193,049

172,820

169,969

151,714

104,626

27,652

23,700

20,000

19,938

13,947

775

% of Total

Loans

8.0 %

6.6 %

4.5 %

3.7 %

3.4 %

2.5 %

2.2 %

2.2 %

1.9 %

1.3 %

0.4 %

0.3 %

0.3 %

0.3 %

0.2 %

0.0 %

37.7 %

1

Investor owned CRE includes C&D, Multifamily and non-owner occupied CRE

6/30/23

Classified

Balances

$458

5,934

526

778

3,897

2,473

$2,945,609

Investor Owned CRE Portfolio ¹ (CRE-I)

Only 0.6% of total CRE-I loans are classified

Payoff of $11 million of classified nursing home balances during 2Q23

Low levels of concentrated exposure - continue to actively monitor CRE-I

concentrations vs. internally-defined appetite thresholds

100/300 Test: 38% C&D | 213% CRE-I

Apartments & Student Housing represents 30% of CRE-I

60% WAvg LTV & 58% long-term customers (4+ years)

141

3,023

79

0

$17,309

Owner Occupied CRE Loans by Property Type

$ in thousands

Property Type

Industrial/Warehouse

Specialty

Traditional Office

Medical Office

Retail

Restaurant

Nursing Homes

Health Care

Hotel

Apartments

Other

Student Housing

Grand Total

■

■

■

6/30/23

Balances

$367,029

234,908

114,842

106,658

59,516

45,178

1,416

843

606

395

258

101

$931,750

Owned Occupied (OOCRE) Portfolio

Only 1.0% of total OOCRE loans are classified

% of Total

Loans

4.7 %

3.0 %

1.5 %

1.4 %

0.8 %

0.6 %

0.0 %

0.0 %

0.0 %

0.0 %

0.0 %

0.0 %

11.9 %

6/30/23

Classified

Balances

$5,609

1,455

453

0

1,570

51

0

$9,138

OOCRE properties are underwritten to operating cash flow and guidance

requires a 1.20x FCCR

OOCRE have lower risk profiles as they are underwritten to the primary

occupying business and are not as exposed to lease turnover risks

Industrial/Warehouse properties are the largest OOCRE segment,

comprising 39% of the OOCRE portfolio while only 4.7% of total loans

11

BView entire presentation