FY 2023 Second Quarter Earnings Call

Q2 FY23 Adjusted-EBITDA

///// ////

/////

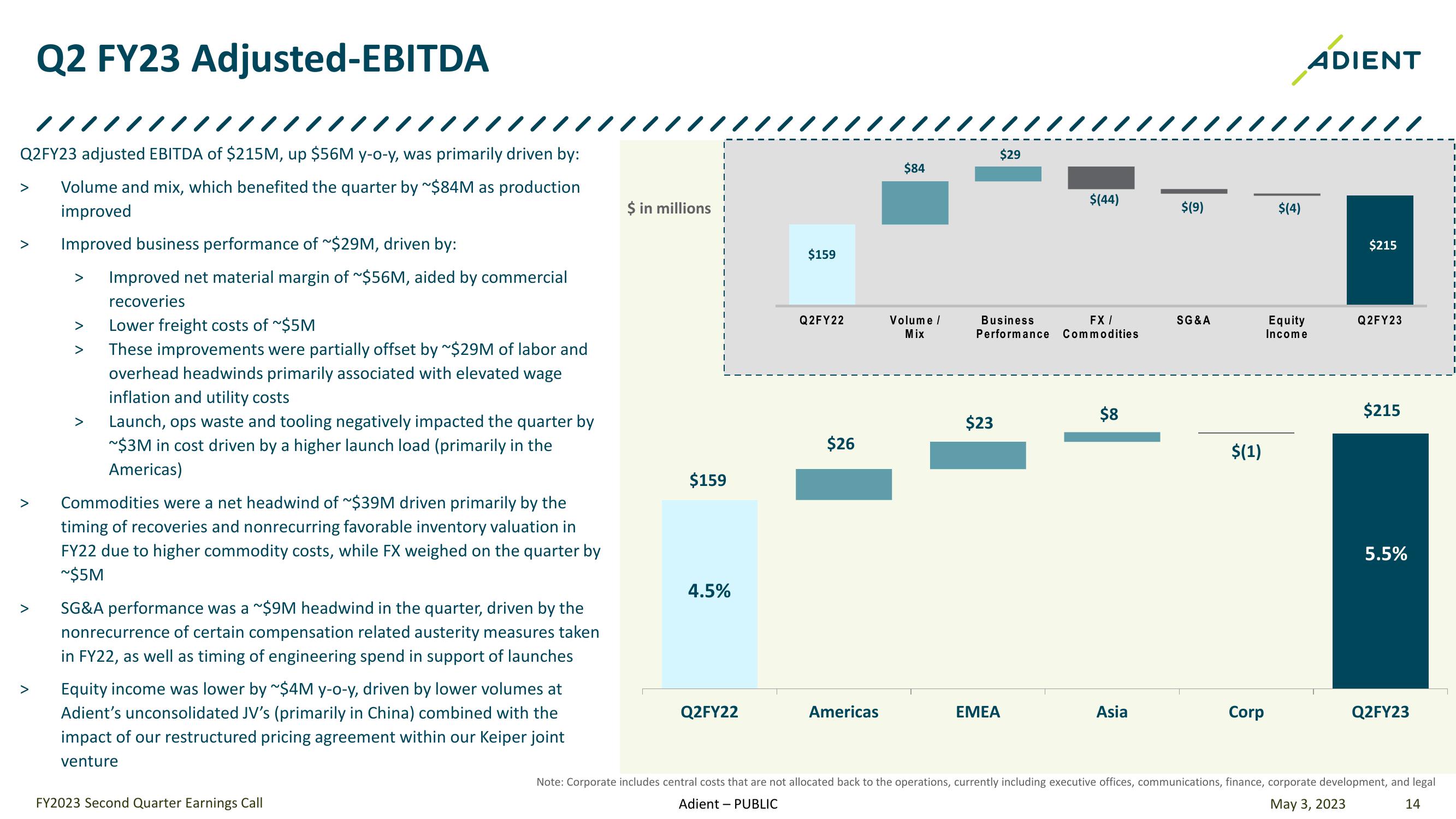

Q2FY23 adjusted EBITDA of $215M, up $56M y-o-y, was primarily driven by:

> Volume and mix, which benefited the quarter by ~$84M as production

improved

>

Improved business performance of ~$29M, driven by:

> Improved net material margin of ~$56M, aided by commercial

recoveries

>

Lower freight costs of ~$5M

>

These improvements were partially offset by ~$29M of labor and

overhead headwinds primarily associated with elevated wage

inflation and utility costs

>

Launch, ops waste and tooling negatively impacted the quarter by

~$3M in cost driven by a higher launch load (primarily in the

Americas)

>

>

>

Commodities were a net headwind of ~$39M driven primarily by the

timing of recoveries and nonrecurring favorable inventory valuation in

FY22 due to higher commodity costs, while FX weighed on the quarter by

~$5M

SG&A performance was a ~$9M headwind in the quarter, driven by the

nonrecurrence of certain compensation related austerity measures taken

in FY22, as well as timing of engineering spend in support of launches

Equity income was lower by ~$4M y-o-y, driven by lower volumes at

Adient's unconsolidated JV's (primarily in China) combined with the

impact of our restructured pricing agreement within our Keiper joint

venture

FY2023 Second Quarter Earnings Call

$ in millions

ADIENT

///////////////////////////////

|

$159

I

$29

$84

Q2FY22

Volume /

Mix

I

$(44)

$(9)

$(4)

$215

I

I

Business

Performance Commodities

FX/

SG&A

Equity

Income

Q2FY23

$8

$215

$23

$26

$(1)

$159

4.5%

5.5%

Q2FY22

Americas

EMEA

Asia

Corp

Q2FY23

Note: Corporate includes central costs that are not allocated back to the operations, currently including executive offices, communications, finance, corporate development, and legal

Adient PUBLIC

May 3, 2023

14

וןView entire presentation