Silicon Valley Bank Results Presentation Deck

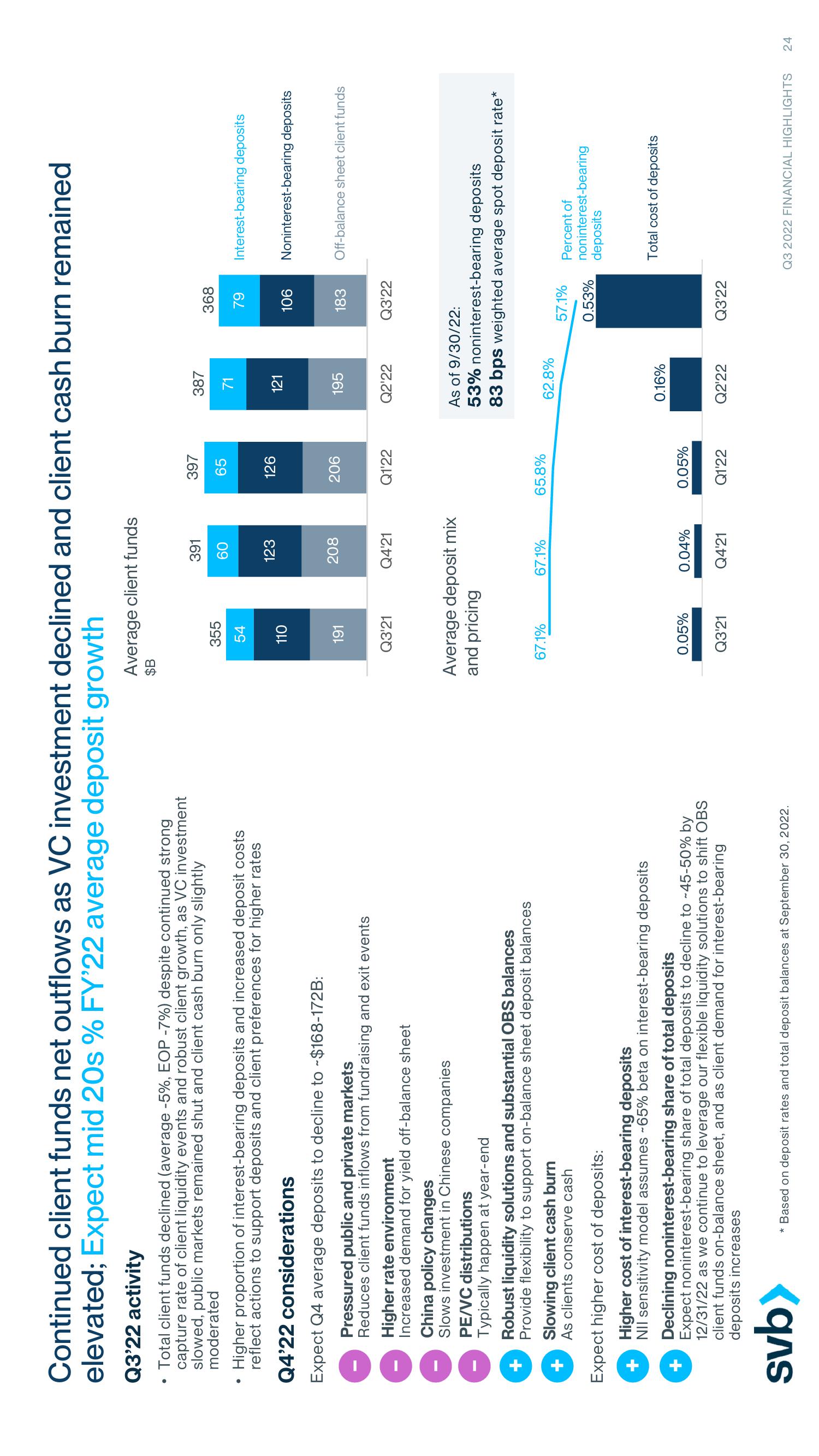

Continued client funds net outflows as VC investment declined and client cash burn remained

elevated; Expect mid 20s % FY'22 average deposit growth

Q3'22 activity

Total client funds declined (average -5%, EOP -7%) despite continued strong

capture rate of client liquidity events and robust client growth, as VC investment

slowed, public markets remained shut and client cash burn only slightly

moderated

Higher proportion of interest-bearing deposits and increased deposit costs

reflect actions to support deposits and client preferences for higher rates

Q4'22 considerations

Expect Q4 average deposits to decline to ~$168-172B:

Pressured public and private markets

Reduces client funds inflows from fundraising and exit events

+

Higher rate environment

Increased demand for yield off-balance sheet

China policy changes

Slows investment in Chinese companies

PE/VC distributions

Typically happen at year-end

Robust liquidity solutions and substantial OBS balances

Provide flexibility to support on-balance sheet deposit balances

Slowing client cash burn

As clients conserve cash

Expect higher cost of deposits:

Higher cost of interest-bearing deposits

NII sensitivity model assumes -65% beta on interest-bearing deposits

Declining noninterest-bearing share of total deposits

Expect noninterest-bearing share of total deposits to decline to ~45-50% by

12/31/22 as we continue to leverage our flexible liquidity solutions to shift OBS

client funds on-balance sheet, and as client demand for interest-bearing

deposits increases

svb>

* Based on deposit rates and total deposit balances at September 30, 2022.

Average client funds

$B

355

54

110

191

Q3'21

67.1%

0.05%

391

60

Q3'21

123

Average deposit mix

and pricing

208

Q4'21

67.1%

0.04%

Q4'21

397

65

126

206

Q1'22

65.8%

0.05%

Q1'22

387

71

121

195

Q2'22

62.8%

0.16%

368

79 Interest-bearing deposits

Q2'22

106 Noninterest-bearing deposits

183

As of 9/30/22:

53% noninterest-bearing deposits

83 bps weighted average spot deposit rate*

Q3'22

57.1%

0.53%

Off-balance sheet client funds

Q3'22

Percent of

noninterest-bearing

deposits

Total cost of deposits

Q3 2022 FINANCIAL HIGHLIGHTS 24View entire presentation