Maersk Investor Presentation Deck

Strategic transformation

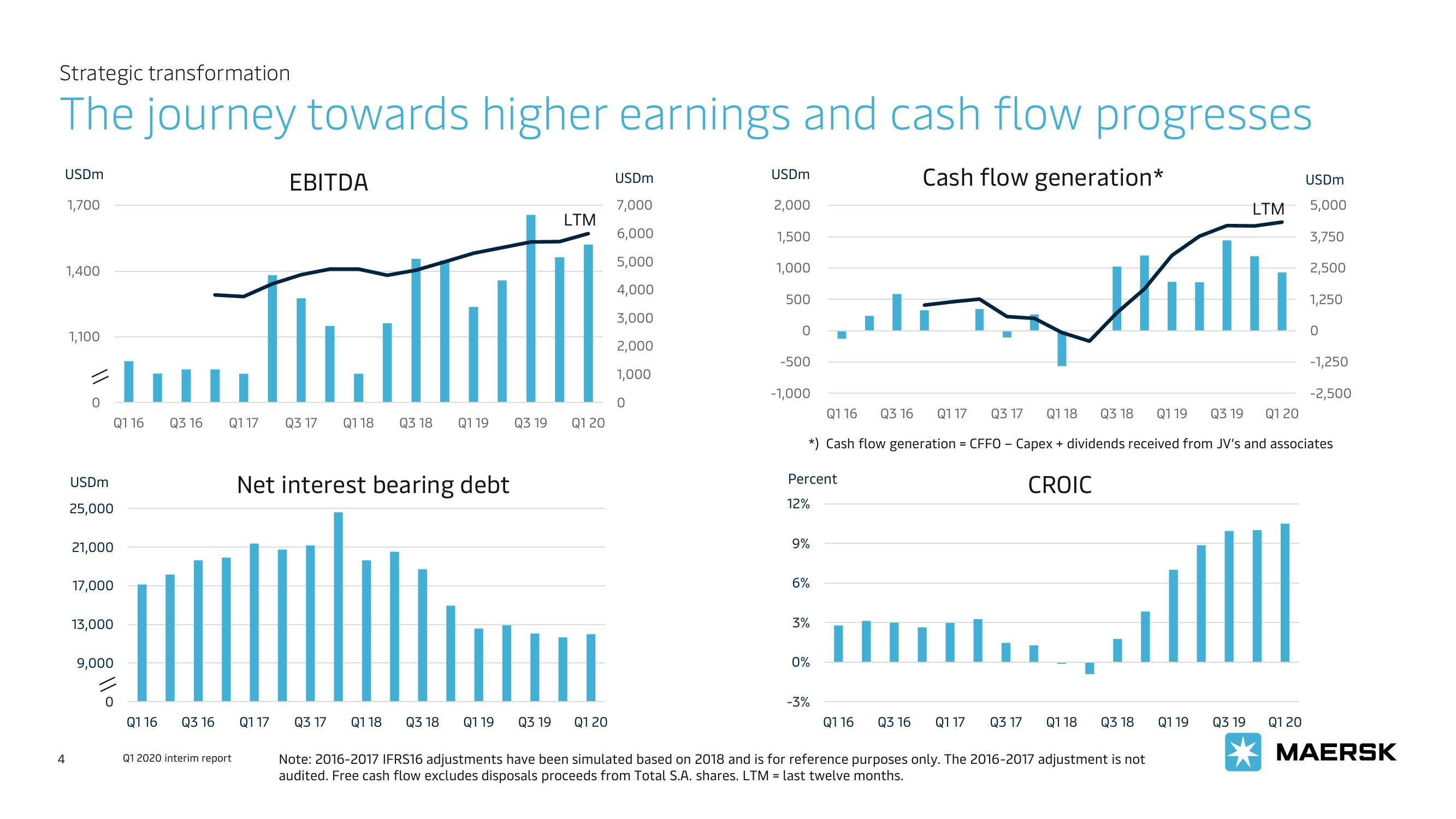

The journey towards higher earnings and cash flow progresses

Cash flow generation*

USDm

4

1,700

1,400

1,100

0

Q116

USDm

25,000

21,000

17,000

13,000

9,000

0

Q116

Q3 16

Q3 16

Q117 Q3 17 Q1 18 Q3 18 Q1 19

Q1 2020 interim report

EBITDA

Net interest bearing debt

Q117

Q3 17

Q1 18 Q3 18 Q1 19

Q3 19

LTM

Q3 19

Q1 20

THE

Q1 20

USDm

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

USDm

2,000

1,500

1,000

500

0

-500

-1,000

Percent

12%

9%

6%

Q1 19 Q3 19 Q1 20

Q116 Q3 16 Q1 17

Q3 17 Q1 18

*) Cash flow generation = CFFO - Capex + dividends received from JV's and associates

CROIC

3%

0%

-3%

Q116 Q3 16

Q1 17

I

Q3 17

Hilli

Q3 18

Q1 18 Q3 18

Note: 2016-2017 IFRS16 adjustments have been simulated based on 2018 and is for reference purposes only. The 2016-2017 adjustment is not

audited. Free cash flow excludes disposals proceeds from Total S.A. shares. LTM = last twelve months.

USDm

LTM 5,000

3,750

2,500

1,250

Q1 19

Q3 19

0

Q1 20

-1,250

-2,500

MAERSKView entire presentation